Forex Happy Algorithm Pro Ea Review

The world of forex trading is constantly evolving, with new strategies and tools emerging regularly. One such tool that has gained popularity among traders is the Forex Happy Algorithm PRO EA.

This expert advisor (EA) is designed to automate forex trading, enabling traders to make trades 24/7 without constantly monitoring the market. The Forex Happy Algorithm PRO EA is built on advanced algorithms and uses price action analysis to identify profitable trades.

Download the best free forex trading tools.

It is compatible with MetaTrader 4 and can be used on any currency pair, making it a versatile tool for traders of all levels. This article will delve into the features and benefits of this and its performance over time.

We will also explore some of the drawbacks associated with using automated trading systems and provide tips for maximizing the potential of the Forex Happy Algorithm PRO EA.

Understanding The Happy Algorithm Pro Ea

The Happy Algorithm PRO EA is a forex robot or expert advisor designed to trade markets. Forex traders use it to automate trading strategies and execute trades automatically without human intervention.

The forex robot uses complex algorithms and mathematical models to analyze market trends, identify profitable trades, and execute them on behalf of the trader. The Happy Algorithm PRO EA works on the MetaTrader 4 (MT4) platforms, one of the most popular trading platforms in the forex industry.

It is easy to install and use, making it an ideal choice for novice and experienced traders. The forex ea can be installed on a Virtual Private Server (VPS), which ensures uninterrupted trading even when the trader’s computer is turned off.

The Happy Algorithm PRO EA has several features that make it stand out from other forex robots in the market. It uses a unique algorithm that accurately identifies profitable trades and executes them within milliseconds. The ea also has built-in risk management tools that help traders minimize losses and maximize profits.

Overall, the Happy Algorithm PRO EA is a powerful tool for forex traders who want to automate their trading strategies and save time. It is easy to use, reliable, and effective in identifying profitable trades. With its advanced features and compatibility with MT4, this forex robot can quickly help traders achieve their financial goals.

Advanced Algorithms For Happy Algorithm Pro Ea

Advanced algorithms have become increasingly popular in trading due to their ability to identify market trends and make quick decisions. The happy forex algorithm pro ea is no exception, as it utilizes complex algorithms to generate profitable trades in the foreign exchange market. These algorithms are designed to analyze market data and predict future price movements with high accuracy.

To optimize the performance of the forex happy algorithm pro ea, traders can incorporate several advanced algorithms. One such algorithm is the moving average convergence divergence (MACD) indicator, which helps identify momentum shifts in the market. Additionally, traders can use the relative strength index (RSI) indicator to determine overbought or oversold conditions in the market. This information can assist traders in making informed decisions about when to buy or sell assets.

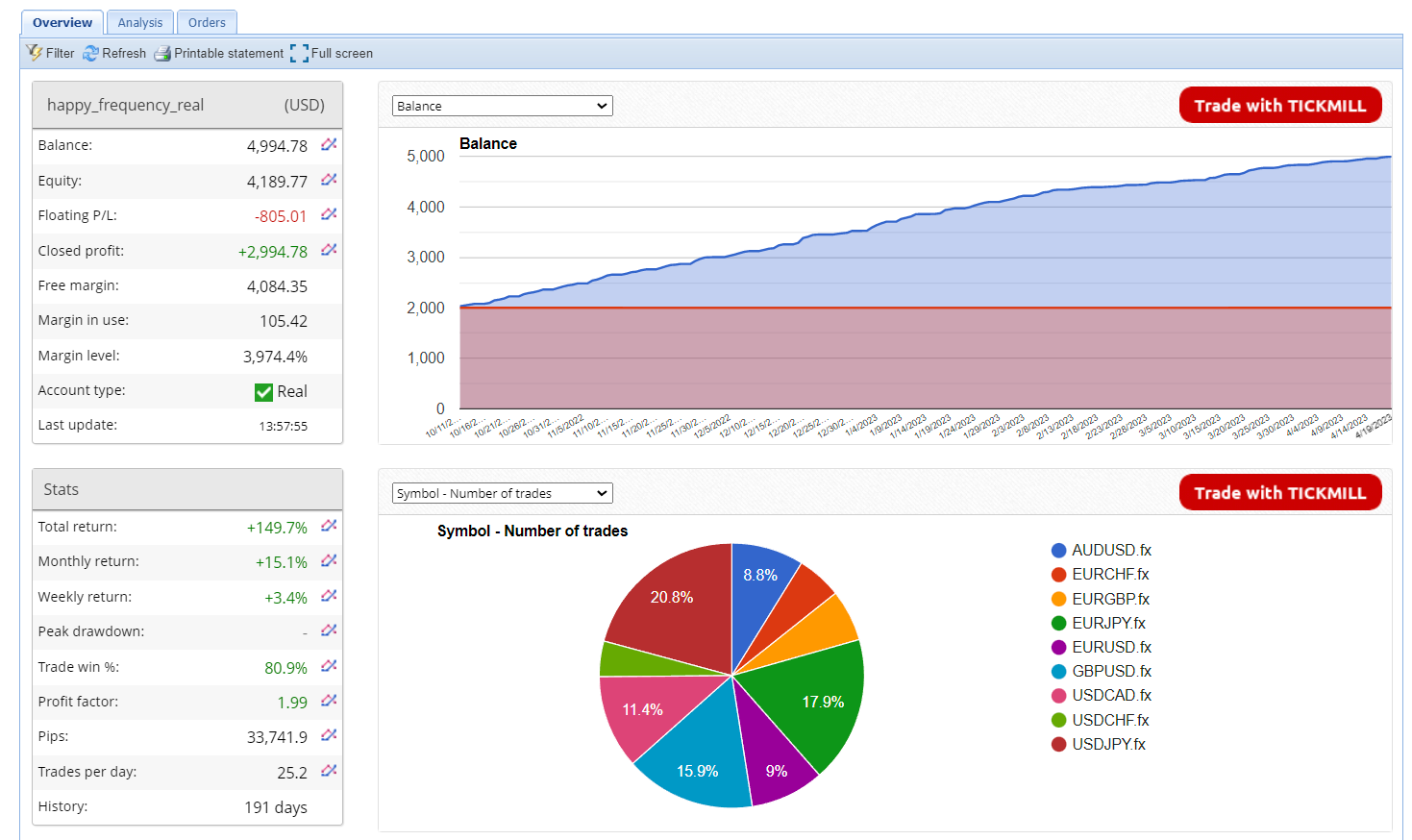

Another way to improve the performance of the forex happy algorithm pro ea is by utilizing myfxbook. This platform provides traders real-time statistics and historical data on their trading performance. By analyzing this data, traders can identify areas for improvement and adjust their strategies accordingly. Additionally, using a virtual private server (VPS) ensures that the forex happy algorithm pro ea runs smoothly without interruptions from external factors such as power outages or internet connectivity issues.

Finally, incorporating advanced risk management techniques into trading strategies can further enhance the effectiveness of the forex happy algorithm pro ea. Traders can limit their exposure to potential losses by setting stop-loss orders and taking profits at predetermined levels. Additionally, diversifying one’s portfolio by investing in multiple assets and markets reduces overall risk and increases profit opportunities.

In summary, optimizing the performance of the forex happy algorithm pro ea involves utilizing advanced algorithms such as MACD and RSI indicators, using platforms like myfxbook for analysis and a VPS for uninterrupted operation, and implementing effective risk management strategies. By incorporating these techniques into their trading strategies, traders can increase profitability and minimize risk in the foreign exchange market.

Customizable Settings For Happy Algorithm Pro Ea

- Trading strategies are the foundation on which successful forex traders build their strategies. Understanding the different trading strategies and how to use them effectively is essential.

- Money management is an important consideration when trading forex. It is essential to utilize a risk-reward ratio to ensure that losses are kept to a minim, um and profits are maximized.

- Risk management is a critical component of successful forex trading. It involves understanding the potential risks in a particular trial and making decisions based on the potential rewards and risks.

- Happy Algorithm PRO EA provides customizable settings for users to tailor their strategies to their risk and reward preferences.

- The customizable settings allow us to quickly adjust their strategies to the changing market conditions and manage their risk accordingly.

- With the customizable settings available in Happy Algorithm PRO EA, users can maximize their profits while managing risk, making it an ideal tool for forex traders.

Trading Strategies

Forex trading strategies are essential for every trader who wants to succeed in the market. It is important to understand that a strategy is not a one-size-fits-all approach but rather a personalized plan that considers an individual’s unique circumstances and goalsRegardingto Happy Algorithm PRO EA, customizable settings allow traders to tailor their strategies to fit their specific needs. One of the most important aspects of any trading strategy is risk management. The Happy Algorithm PRO EA has various customizable settings that help traders manage their risk effectively. For example, traders can adjust stop-loss levels and take-profit targets according to risk tolerance. This allows them to minimize potential losses and maximize profits.

Another crucial element of successful forex trading is timing. With Happy Algorithm PRO EA, traders can set specific time frames for trades or choose from preset periods depending on their preference. This customization helps ensure that trades are executed at optimal times, increasing the chances of success.

Finally, Happy Algorithm PRO EA allows traders to customize their technical indicators and charting tools. This level of customization enables traders to analyze the market from multiple angles and make informed decisions based on data-driven insights. Moreover, by using these tools efficiently, traders can identify market trends and patterns, which will help them make more accurate predictions about future price movements.

In conclusion, having a solid strategy is critical to success in forex trading. With customizable settings available in Happy Algorithm PRO EA, traders have greater control over their strategies, leading to better risk management and increased profitability potential. By taking advantage of these features and adapting them according to individual preferences, traders can create a personalized approach that works best for them in achieving their financial goals.

Money Management

In addition to the customizable settings discussed earlier, Happy Algorithm PRO EA also offers robust money management features.

As any experienced trader will tell you, effective money management is critical for long-term success in forex trading.

With this in mind, the Happy Algorithm PRO EA allows traders to set risk parameters and manage their capital effectively.

Traders can use money management tools in the Happy Algorithm PRO EA, including lot size adjustment and maximum drawdown limits. By setting an appropriate lot size based on individual account size and risk tolerance, traders can minimize losses while maximizing profits.

Additionally, setting maximum drawdown limits ensures traders do not lose more than a predetermined amount of their account balance.

The Happy Algorithm PRO EA also offers a unique feature called ‘Trade Time Contro,l’, which allows traders to set specific times for trading or disable trading during certain periods.

This function helps prevent overtrading during low liquidity periods when market conditions are unfavourable. This way, traders can avoid unnecessary losses and protect capital from excessive risks.

Another essential component of money management is monitoring and tracking trades. The Happy Algorithm PRO EA provides detailed trade analysis reports that help traders identify patterns and trends in their trading history.

These reports give critical insights into win/loss ratios, average profit/loss per trade, and overall performance metrics.

By analyzing these data points regularly, traders can make informed decisions about their trading strategies moving forward.

In conclusion, effective money management is vital for successful forex trading. The customizable settings within the Happy Algorithm PRO EA provide traders with powerful tools to achieve this goal.

By using these features to personalize their approach according to individual preferences and risk tolerance levels while monitoring trades regularly through detailed reports provided by the software – traders can optimize profitability while minimizing potential risks over time.

Download the best free forex trading tools

Risk Management

Another crucial aspect of forex trading is risk management, which involves minimizing potential losses and maximizing profits. The Happy Algorithm PRO EA offers customizable settings that enable traders to manage their risks effectively.

With this software, traders can set stop-loss and take-profit levels to ensure they exit trades at predetermined prices, reducing the likelihood of significant losses.

Moreover, the Happy Algorithm PRO EA provides a feature called ‘Trailing Stop,’ which allows traders to adjust their stop-loss levels dynamically based on market conditions. This function enables traders to clock in profits while minimizing potential losses as the trade progresses. By setting appropriate trailing stops based on individual preferences and risk tolerance levels, traders can optimize profitability while limiting potential risks.

The Happy Algorithm PRO EA also includes a ‘Breakeven’ function that enables traders to move their stop-loss level to their entry point once the trade has reached a specific profit level. This feature ensures that even if the trade reverses after reaching a certain level of profitability, the trader will not incur any losses, making it an effective tool for managing risks.

Finally, the Happy Algorithm PRO EA offers another unique feature called ‘News Filter.’ This function allows traders to avoid trading during high-impact news events by disabling trading during specific periods or setting minimum distance requirements from news releases. By doing so, traders can minimize potential risks associated with volatile market conditions resulting from unexpected news events that could lead to significant losses.

In conclusion, customizable settings within the Happy Algorithm PRO EA provide users with powerful tools for managing risks effectively. These features allow traders to personalize their approach according to individual preferences and risk tolerance levels while optimizing profitability.

Happy Algorithm Pro Ea Features

As a forex trading expert, it is essential to take note of the Happy Algorithm PRO EA’s features. This algorithmic trading system is designed to maximize profit through its integrated features catering to different market conditions.

One notable feature of this EA is its ability to handle high-volatility situations effectively by utilizing a unique hedging strategy that can withstand significant market risks.

Another impressive feature of the Happy Algorithm PRO EA is its customizable settings. Traderscano adjusts various parameters according to their preferences and risk appetite. These settings include lot sizes, stop loss, and take profit levels. Moreover, traders can also choose between different currency pairs and timeframes.

The Happy Algorithm PRO EA’s technical indicators are also worth mentioning as they provide valuable insights into market trends and potential trade opportunities. The algorithm uses Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) indicators to determine entry and exit points in the market. By analyzing these indicators’ signals, traders can decide when to enter or exit trades.

Lastly, the Happy Algorithm PRO EA has a user-friendly interface that makes it easy for traders of all levels to use. Whether you are a novice or an experienced trader, navigating the software is simpler. Additionally, customer support is available 24/7if you need any software assistance.

In summary, the Happy Algorithm PRO EA has several impressive features that stand out from other algorithmic trading systems in the forex market. Its customizable settings, technical indicators, hedging strategy, and user-friendly interface are some notable features that traders can benefit from when using this EA. As such, incorporating this system into your trading strategy may help increase your chances of success in forex trading.

Happy Algorithm Pro Ea Benefits

- Automated trading is an effective way to take advantage of market trends and manage trading transactions’ timings.

- When using automated trading, it is essential to ensure the system has robust risk management features to protect against downside risks.

- The Happy Algorithm PRO EA provides a comprehensive risk management system to protect against significant losses and optimize profitability.

- The system is designed to identify and capitalize on market trends, enabling traders to take advantage of short and long-term opportunities.

- The Happy Algorithm PRO EA has a high success rate, providing users the potential for high returns from their trading activities.

- By combining automated trading and risk management features, the Happy Algorithm PRO EA enables users to maximize their returns and minimize losses.

Automated Trading

Automated trading has become a popular trend in the forex market. It involves using computer algorithms to execute trades based on predetermined rules and strategies. This approach has gained popularity due to its speed, accuracy, and ability to quickly analyze vast amounts of data.

The Happy Algorithm PRO EA is an example of an automated trading system traders use to gain profits in the forex market. The Happy Algorithm PRO EAanalysese the forex market and identifies potential trades that fit specific criteria. The algorithm uses technical analysis tools such as moving averages, support and resistance levels, and candlestick patterns to determine entry and exit points for trades. The system can also consider fundamental factors such as economic news releases and political events influencing currency prices.

One significant advantage of an automated trading system like the Happy Algorithm PRO EA is its ability to remove human emotions from decision-making. Traders often make irrational decisions based on fear or greed, leading to trade losses. Automated systems don’t have emotions; they follow predetermined rules and strategies without deviation, ensuring consistency in executing trades.

In conclusion, automated trading systems offer traders significant benefits in speed, accuracy, consistency, and emotional detachment from decision-making processes. The Happy Algorithm PRO EA is one system traders can use to trade profitably in the forex market. However, it’s essential to note that these systems are not foolproof; they require constant monitoring and tweaking to ensure optimal performance. As with any investment strategy, risks are involved; traders should exercise caution when using automated trading systems like the Happy Algorithm PRO EA.

Risk Management

Moving forward, it is crucial to discuss another essential aspect of trading: risk management. While automated trading systems like the Happy Algorithm PRO EA offer traders significant benefits, it’s also essential to note that risks are involved. These risks include market volatility, technical glitches, and system failures that can lead to significant losses.

One way to manage risk using an automated trading system is by setting stop-loss orders. Stop-loss orders are predetermined price levels instructing the system to close a trade if the price reaches a specific level. This approach ensures that losses are limited and prevents traders from losing more money than they can afford.

Another way to manage risk is by diversifying your portfolio. Traders should not rely on a single automated trading system but instead use multiple systems with varying strategies and rules. Additionally, it’s advisable to spread your investments across different currency pairs or markets to reduce exposure to one particular market or asset.

Lastly, traders should regularly monitor their automated trading systems’ performance and adjust their strategies accordingly. The forex market is dynamic and constantly changing; hence traders must stay vigilant and adapt their strategies as the market conditions change.

In conclusion, while using an automated trading system like the Happy Algorithm PRO EA offers many benefits, traders must manage their risks effectively. By setting stop-loss orders, diversifying their portfolios, and monitoring their systems’ performance regularly, traders can minimize losses and maximize profits in the forex market.

High Profitability

Moving on to another essential aspect of the Happy Algorithm PRO EA, we will discuss its high profitability.

The Happy Algorithm PRO EA is designed to generate profits by analyzing market trends and making trades based on preset rules and algorithms. Its ability to monitor multiple currency pairs simultaneously allows it to identify profitable opportunities that manual traders may miss.

One of the key advantages of using an automated trading system like the Happy Algorithm PRO EA is its ability to execute trades with lightning-fast speed. This speed allows traders to exploit market fluctuations and capitalize on profitable opportunities before they disappear.

The system’s advanced algorithms also ensure that trades are executed at the best possible prices, maximizing profits for traders.

Another benefit of an automated trading system like the Happy Algorithm PRO EA is its ability to eliminate emotional biases from trading decisions. Manual traders are often influenced by emotions such as fear or greed, which can lead to poor decision-making and losses.

Automated systems operate purely based on objective criteria, ensuring that all trades are based on logical analysis rather than subjective feelings.

In conclusion, the Happy Algorithm PRO EA’s high profitability is a significant benefit for forex traders looking to maximize their returns in the market. Its ability to analyze multiple currency pairs simultaneously, execute trades quickly and accurately, and remove emotional biases from trading decisions makes it an attractive option for novice and experienced traders.

By utilizing this automated trading system effectively, traders can increase their profitability while minimizing risks in the forex market.

Download the best free forex trading tools

Happy Algorithm Pro Ea Disadvantages

Despite the impressive performance of the forex happy algorithm pro ea, it has disadvantages. Here are some of the challenges that traders may encounter when using this trading tool:

- Requires a Steep Learning Curve – The forex happy algorithm pro ea is designed to be used by experienced traders who deeply understand forex trading. For beginners, it can be challenging to understand how the tool works and how to optimize its settings for maximum profitability.

- Limited Customization – While the forex happy algorithm pro ea offers a range of customizable settings, it still has limitations. Users cannot create custom indicators or modify existing ones, limiting their ability to fine-tune the tool to their unique needs.

- Dependency on Market Conditions – The success of the forex happy algorithm pro ea largely relies on favourable market conditions, such as sufficient liquidity and low volatility. In adverse market conditions, the tool’s performance may suffer, leading to losses for traders.

Despite these drawbacks, many traders consider the forex happy algorithm pro ea a valuable addition to their trading toolkit. However, before using this tool in live trading sessions, it is crucial to thoroughly test it in a demo account and understand its limitations.

By doing so, traders can mitigate potential losses and optimize their profits using this powerful trading tool.

Ultimately, whether or not the forex happy algorithm pro ea is right for you depends on your expertise level and risk tolerance level in forex trading. Henceforth, implementing appropriate risk management strategies is critical when using any automated trading system like Happy Algorithm PRO EA to avoid significant losses in volatile markets or unfavourable market conditions.

Frequently Asked Questions

How Much Money Do I Need To Start Trading With Happy Algorithm Pro Ea?

When starting to trade forex, the amount of money needed varies depending on individual circumstances and trading strategies. As a general rule, it is recommended to start with a minimum deposit of $500 to $1000.

This allows for proper risk management and the ability to withstand market fluctuations. It is important to note that traders should not invest more than they can afford to lose and should always have a solid understanding of trading principles and techniques before entering the market.

Additionally, traders can use demo accounts or backtesting strategies to gain experience and confidence before investing real money.

Can I Use Happy Algorithm Pro Ea On Multiple Trading Accounts?

Using a single trading algorithm on multiple accounts can offer several benefits, including diversification of risk and increased trading volume. However, ensuring the software is licensed for use on multiple accounts is essential before attempting this strategy.

Many forex trading platforms have restrictions to prevent the unauthorized use of algorithms across multiple accounts. Additionally, users should consider the potential impact of varying account balances and leverage ratios when applying a single algorithm across multiple accounts.

While using an algorithm on multiple accounts may be possible, exercising caution and thoroughly researching platform restrictions and potential risks is crucial.

Is There A Free Trial Version Available For Happy Algorithm Pro Ea?

There is no free trial version available for the Happy Algorithm PRO EA.

This expert advisor is a commercial product that requires purchase before use.

The lack of a trial version may concern some traders who want to test the product before committing to its total cost.

However, it should be noted that the developer provides detailed information about the EA’s features and performance on their website, which can help traders make an informed decision.

Additionally, some brokers may offer demo accounts that allow traders to test the EA without risking real money.

What Kind Of Customer Support Is Available For Happy Algorithm Pro Ea Users?

For traders, having access to reliable customer support is essential. It ensures that any issues or queries can be resolved quickly and builds trust between the trader and the software provider.

When it comes to forex trading, where time is of the essence and market fluctuations can occur rapidly, having access to prompt assistance can make all the difference. Therefore, traders need to consider the level of customer support offered by their chosen forex trading software providers.

This may include options such as live chat, email support or telephone support, as well as resources such as user manuals or frequently asked questions (FAQs) sections on the company website.

Conclusion

Happy Algorithm PRO EA is a forex trading algorithm designed to help traders trade more efficiently and profitably. The software requires a minimum deposit of $500 to get started and can be used on multiple trading accounts. Additionally, the algorithm works with all types of currency pairs.

Unfortunately, no free trial version is available for Happy Algorithm PRO EA, but the company offers a 30-day money-back guarantee. Customer support is available via email and chat, and the team is highly knowledgeable about the product.

Overall, Happy Algorithm PRO EA offers a promising solution for traders looking to automate their trading strategies. However, as with any trading tool, it’s essential to use it wisely and carefully.

Traders should thoroughly research the product and its capabilities before deciding whether or not it’s right for them. With proper use and risk management techniques, Happy Algorithm PRO EA could potentially enhance a trader’s profitability in the forex market.