Channel Trader Pro EA – A Comprehensive Review

Channel Trader Pro EA is an expert advisor (EA) designed for automated trading on the MetaTrader 4 and 5 platforms. It trades the AUDCAD, AUDUSD, and EURJPY currency pairs using its own proprietary trading strategy. In this comprehensive review, we will take an in-depth look at this EA, including its features, performance, pros and cons, and suitability for traders.

Download Free Channel Trader Pro EA

Overview of Channel Trader Pro EA

Channel Trader Pro EA was created by Doug Price, who also developed other popular EAs like REV Trader Pro and Keltner Pro. It works by analyzing the market to determine the most likely short-term trend direction, usually for the next 2 days. Based on that analysis, it will automatically place trades following its strategy rules.

Some key features and characteristics of Channel Trader Pro EA include:

- Fully automated trading – requires no manual intervention once properly configured

- Trades the AUDCAD, AUDUSD and EURJPY currency pairs

- Can trade any timeframe, but performs best on H1 and H4

- Uses a combination of indicators and mathematical formulas in its analysis

- Opens between 2-10 trades per week on average

- Incorporates money management rules to limit risk

- Designed to capture short-term moves, profit target is usually less than 30 pips

- Does not use grid, martingale, or other risky trading techniques

- Easy to install and use on the MT4 and MT5 platforms

Now let’s take a more detailed look at how this expert advisor works.

How Channel Trader Pro EA Works

The core strategy behind Channel Trader Pro centers around identifying and trading breakouts from price channels or ranges. It does this through the use of a proprietary volatility indicator that works across two different time periods.

Specifically, the EA checks for situations where price breaks out of its recent trading range. It then looks for confirmation of that breakout using its volatility indicator. If everything lines up properly, Channel Trader Pro will automatically place a buy or sell trade in the direction of the anticipated breakout move.

Stops are placed just outside the opposite side of the channel, helping ensure a favorable risk to reward scenario on every trade. Profit targets are usually set to less than 30 pips, allowing the EA to capture short-term swings. Trailing stops may also be used to lock in profits as the market moves favorably.

The EA incorporates intelligent logic around trade management as well. For example, if a trade moves quickly into profit territory, it may close out only a partial position size and let the rest continue running with a trailing stop. This helps maximize profits on winning trades.

Overall, the strategy combines several common-sense trading principles like trading in the direction of the trend and managing profitable trades. While simple in concept, its execution requires advanced coding and optimization best left to the experts.

Performance and Backtests

According to the developer, Channel Trader Pro EA underwent rigorous backtesting across over 10 years of historical data before being released commercially. The posted backtests indicate impressive performance results:

- Average winning trade: 11 pips

- Average losing trade: -83.58 pips

- Win Rate: Over 90%

- Profit Factor: 1.92

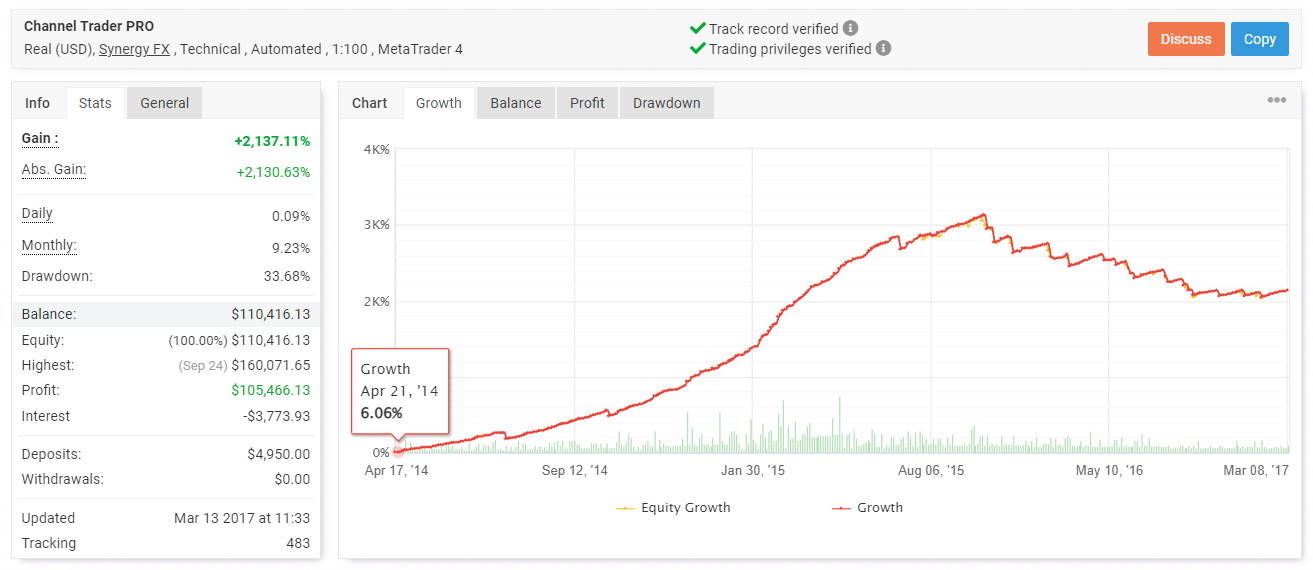

- Maximum Drawdown: 33.68%

Keep in mind drawdowns and win rates can vary across different time periods and market conditions. But in general, Channel Trader Pro has scored well in backtesting and optimizations.

In addition to backtests, myFXbook verified real account results are available for analysis. Over a nearly 1 year period, the posted account grew from $5,000 to over $100,000 for an incredible return exceeding 2000%.

While past performance is no guarantee of future results, these backtests and real account results provide credibility to the positive performance claims. Just remember automated trading results can differ significantly across software versions, brokers, account sizes, time frames, and market environments.

Pros and Cons

Pros

- Proprietary and intelligent trading strategy

- Strong backtesting and real account results

- Trades just 2-10 times per week on average

- Incorporates effective money management

- Easy to install and use

Cons

- Only trades 3 currency pairs

- Relatively large drawdown of 33%

- Expensive at $799 purchase price

- Requires MT4 or MT5 to run

While Channel Trader Pro has some limitations like any other EA, its overall performance across backtesting and real accounts appears competitive compared to alternatives.

Final Verdict

Channel Trader Pro is an impressively designed and optimized expert advisor for trading breakouts on the AUDCAD, AUDUSD, and EURJPY pairs.

For traders already using the MetaTrader platform who want the set-it-and-forget-it convenience of automated breakout trading, Channel Trader Pro is a compelling option. Just be sure to demo test first and manage position sizing and risk appropriately on a live account.

Overall, Channel Trader Pro earns high marks across the board in terms of strategy design, transparency, and performance. While costs are at the higher end, its quality and extensive backtesting suggests it may be worth the investment for serious traders interested in automation.