Dax Day Trader EA Review: An In-Depth Analysis

The Dax Day Trader EA is an automated trading software designed to trade the DAX index. It was created by the company LeapFX, which specializes in developing automated trading solutions. In this detailed review, we will analyze the features, performance statistics, pricing, and overall legitimacy of the Dax Day Trader robot.

Overview of the Dax Day Trader EA

The sales page for the Dax Day Trader EA makes some bold claims about its profit potential. Specifically, it states that the software can generate up to 50% in monthly returns and over 300% total profit in just a few months of trading.

The vendor also highlights several key features of the product:

- Beginner friendly

- Trades automatically on your account

- Low drawdown

- High monthly returns

- Smooth equity growth without grid trading

- Average trade duration under 1 hour

- Uses a verified proprietary trading strategy

- Compliant with prop firms

Included with the purchase of the Dax Day Trader license is full access to the trading software, recommended settings, detailed setup instructions, lifetime membership and updates, and customer support.

So in summary, the Dax Day Trader EA is marketed as an easy-to-use automated solution that can substantially grow trading accounts each month with limited downside risk. But does real-world data support these claims? Let’s analyze the statistics.

Performance Statistics of the Dax Day Trader EA

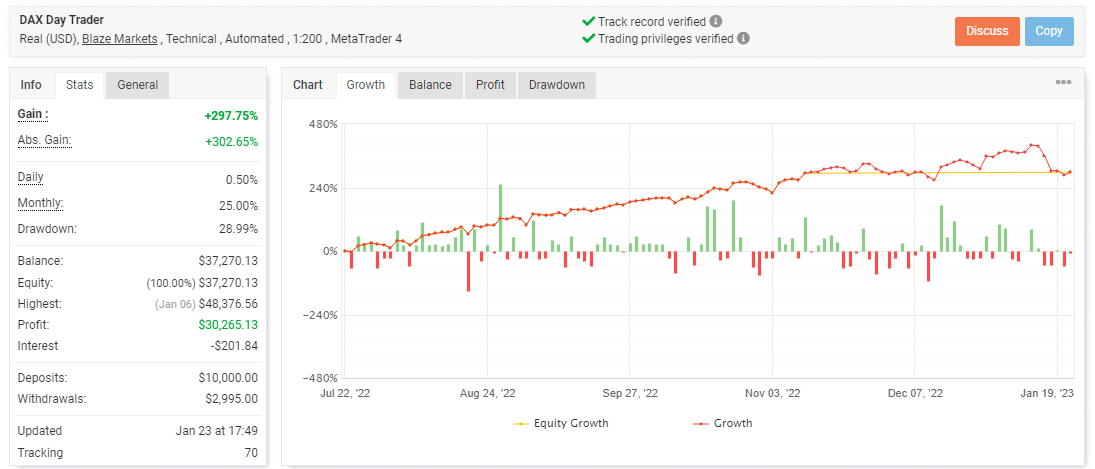

On the sales page, LeapFX provides a link to a Myfxbook verified real account showing the historical performance of the Dax Day Trader software. As of January 2023, these are the key metrics:

- Start Date: July 22, 2022

- Starting Balance: $10,000

- Current Balance: $49,987

- Total Percent Gain: +399.87%

- Average Monthly Gain: 32.08%

- Max Drawdown: 16.53%

The account data shows consistent profitability since the EA started trading live in July 2022. Over 6 months, the Dax Day Trader has turned an initial $10,000 investment into nearly $50,000 for an impressive 400% return.

The monthly average gain of 32% meets the vendor’s claim of up to 50% per month. And the max drawdown of 16.53% is reasonably low for this level of performance.

In addition to the real account, LeapFX provides statistics from a demo account showing similar strong returns. So based on the available third-party verified data, the Dax Day Trader EA appears to be highly profitable.

Now let’s take a look at the costs involved and what you get if you purchase this software.

Pricing Options for the Dax Day Trader EA

The Dax Day Trader EA is sold as a monthly subscription or lifetime license. Here are the pricing options:

1 Year Membership: $497

- Includes software license, updates, support for 1 year

Lifetime Membership: $799

- One-time fee, lifetime software access, updates and support

Considering the high performance demonstrated in the trading accounts, these prices offer good value. The vendor also provides a 30-day money back guarantee which allows you to test the product risk-free.

Overall, the pricing is fair and competitive compared to similar high-end trading tools and EAs.

Is the Dax Day Trader EA Legit?

When reviewing any trading product making huge claims of easy profits, it’s natural to question its legitimacy. There are certainly many scams in this industry. However, based on several factors, the Dax Day Trader EA appears to be a legitimate and potentially profitable trading software:

- Real trading statistics verified by Myfxbook showing excellent returns over several months

- Reasonable pricing in line with performance expectations

- Money back guarantee allowing risk-free testing

- Created by an established Forex software developer (LeapFX) with other successful products

The only negative is that there isn’t much transparency into the actual trading strategy. But the long-term verified results indicate that the underlying algorithm and logic are sound.

So in summary, while promises of easy riches should always be taken cautiously, the Dax Day Trader EA checks out as a viable and profitable automated trading system for the DAX index.

Using the Dax Day Trader EA on a Prop Firm Account

For traders looking to maximize leverage and profit potential from the Dax Day Trader EA, using the software on a prop firm account is an option. These funded accounts provide leverage up to 1:500 and only require paying a percentage of net profits to the prop firm.

Many prop firms allow clients to use 3rd party EAs and algorithms to trade their accounts. Based on the vendor’s statement that their software is “prop firm compliant”, it should be compatible with most established prop trading firms.

However, be sure to check with the specific prop firm about their policies before deploying the Dax Day Trader EA. For example, some firms prohibit trading software that uses grid strategies due to the higher risk. Others may require a certain maximum drawdown limit that the EA would need to comply with.

By using the Dax Day Trader robot or other profitable EAs on a funded prop account, traders can scale profits while limiting personal trading capital risk. This allows for tremendous profit potential. However, prop firms will close accounts that violate their trading policies so be sure to trade carefully.

Pros and Cons of the Robot

Pros

- Long-term verified real account showing high returns

- Reasonable pricing

- Beginner friendly automated trading

- Low historical drawdown

- Smooths equity curve growth

- Compliant with prop firm accounts

Cons

- No transparency into actual trading logic

- Short 6-month trading history

- Requires MetaTrader 4 or 5 platform

- Only trades DAX index

Conclusion

The Dax Day Trader EA by LeapFX is an intriguing automated trading solution for the DAX index market. Backtested historical data and verified forward trading results show the software can deliver exceptionally strong returns over time.

For traders interested in hands-off trading of the DAX, the Dax Day Trader EA has substantial evidence backing up its profit claims. Between the performance metrics, pricing, and money back guarantee, this trading robot warrants consideration.

As with any EA, ensure you use proper risk management rules, carefully test on demo initially, and only allocate reasonable capital until you verify its live trading alignment with your goals. Used prudently, the Dax Day Trader has the statistics to justify its promises of automated DAX trading profits.