AF Supply and Demand EA: A Comprehensive Review

In the world of Forex trading, automation has become a game-changer. One such tool that has been making waves is the AF Supply and Demand EA. This trading robot, designed to operate on the MetaTrader 4 platform, has been lauded for its ability to trade high probability institutional supply and demand zones with pinpoint accuracy.

Download AF SUPPLY AND DEMAND EA

What is AF Supply and Demand EA?

The AF Supply and Demand EA is a fully automated trading robot. It exploded onto the crypto scene, trading assets such as Bitcoin, Ethereum, and Litecoin, among others. The EA is designed to trade high probability institutional supply and demand zones with a high level of accuracy. It’s capable of trading 24/7, and it doesn’t require any additional expenses.

Key Features

The AF Supply and Demand EA comes with a host of features that make it stand out in the crowded field of trading robots.

- Fully Automated Trading: The EA trades fully automated, meaning it can operate 24/7 without any human intervention.

- High Win Rates: The EA boasts increased win rates of 90%+ and super low drawdown of 10-30 pips per trade.

- Multi-Asset Trading: It can trade a wide range of assets, including Forex, Crypto, Gold, Silver, Oil, Stocks, CFDs, and Indices.

- User-Friendly: The EA is easy to use and is suitable for both new and veteran traders.

- Risk Management: The EA uses stop loss and take profit with every trade, ensuring that your risk is managed effectively.

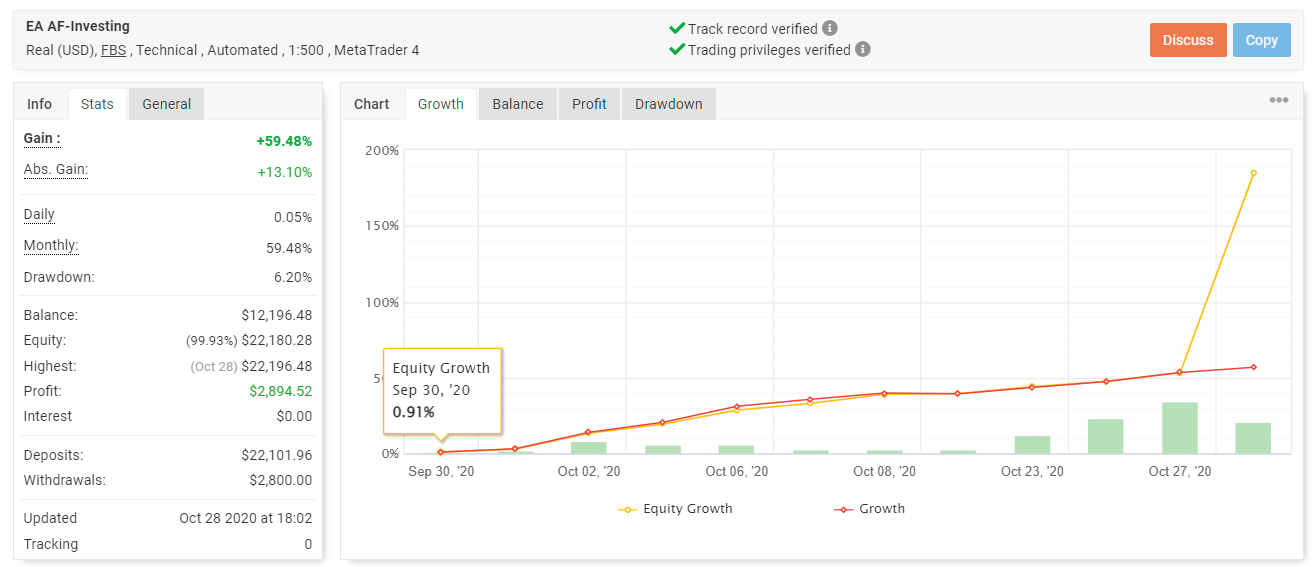

AF Supply And Demand EA Performance

The AF Supply and Demand EA has shown impressive performance. Users have reported significant profits using this EA. For instance, the EA’s official website showcases profits made with the AF Supply and Demand EA, demonstrating its potential to generate substantial returns.

Pricing

The AF Supply and Demand EA is priced at £497, down from its regular retail price of £997. This price includes future software updates and 24/7 trading support. The EA also comes with a 365-day money-back guarantee, providing peace of mind for those who are unsure about the purchase.

User Experience

Users of the AF Supply and Demand EA have reported positive experiences. The EA is praised for its ease of use, making it suitable for both new and veteran traders. Users have also reported that the EA has helped them complete FTMO and Prop Firm Challenges.

AF Supply And Demand EA Conclusion

In conclusion, the AF Supply and Demand EA is a powerful tool for any trader looking to automate their trading process. With its high win rates, fully automated trading, and ability to trade a wide range of assets, it offers a comprehensive solution for those looking to maximize their trading potential. Its user-friendly design and risk management features further enhance its appeal, making it a worthy investment for any trader.

Remember, while the AF Supply and Demand EA has shown impressive results, trading always comes with risks. It’s essential to understand these risks and manage them effectively to ensure successful trading.