Forex Scalping Project EA Review

The Forex market is one of the most volatile and unpredictable markets in the world, with trillions of dollars exchanging hands daily. Traders are constantly seeking ways to maximize their profits while minimizing their risks. One popular trading strategy is scalping, which involves making multiple trades over short periods to take advantage of small price movements. The Forex Scalping Project EA is an automated trading system designed specifically for this purpose.

The Forex Scalping Project EA utilizes advanced algorithms to analyze market conditions and make trades with minimal risk. This system has been designed to work with all major currency pairs and can be customized to suit individual trading preferences.

Download the best free forex trading tools.

It is ideal for novice and experienced traders looking for a reliable and efficient way to scalp the Forex market. With its user-friendly interface and powerful features, the Forex Scalping Project EA has become popular among traders worldwide.

Overview Of The Scalping Project Ea

The forex scalping project EA is a type of forex robot or expert advisor (EA) designed to execute trades automatically in the foreign exchange market. It is programmed to identify profitable trading opportunities and execute trades swiftly, usually within seconds or minutes.

The EA is created using a programming language called MQL4, compatible with the popular MetaTrader 4 (MT4) platform. The main objective of the forex scalping project EA is to generate profits for traders who use it.

Unlike traditional trading methods that require human intervention, the EA operates autonomously, removing emotions and other psychological factors from the decision-making process. It uses complex algorithms and technical indicators to analyze market conditions and predict future price movements.

The EA can also be customized to suit individual trading styles and preferences. Overall, the forex scalping project EA overview highlights its potential benefits for traders seeking an automated trading solution in the forex market. This expert advisor can help traders make more informed decisions while maximizing their profits over time by eliminating emotional biases and executing trades at lightning-fast speeds.

Its compatibility with MT4 and customizable settings offer a flexible approach to automated trading tailored to each trader’s unique needs and preferences without requiring direct human intervention.

Scalping Project Ea Trading Strategy

The Scalping Project EA is a forex trading software designed to generate profits through scalping. It is developed on the MetaTrader 4 platform and can be installed on a virtual private server (VPS) to ensure continuous operation.

The software uses advanced algorithms to identify profitable trades and execute them automatically. To achieve optimal performance, it is recommended that the Scalping Project EA be installed on a VPS.

A VPS allows traders to run their trading software 24/7 without interruptions caused by power outages or internet connectivity issues. This ensures that trades are executed promptly and accurately, which is crucial in scalping, where every second counts.

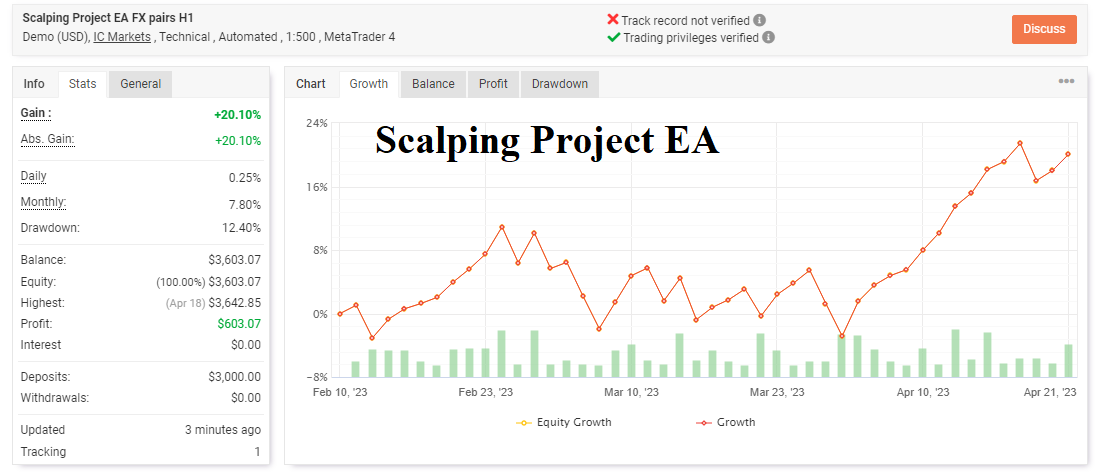

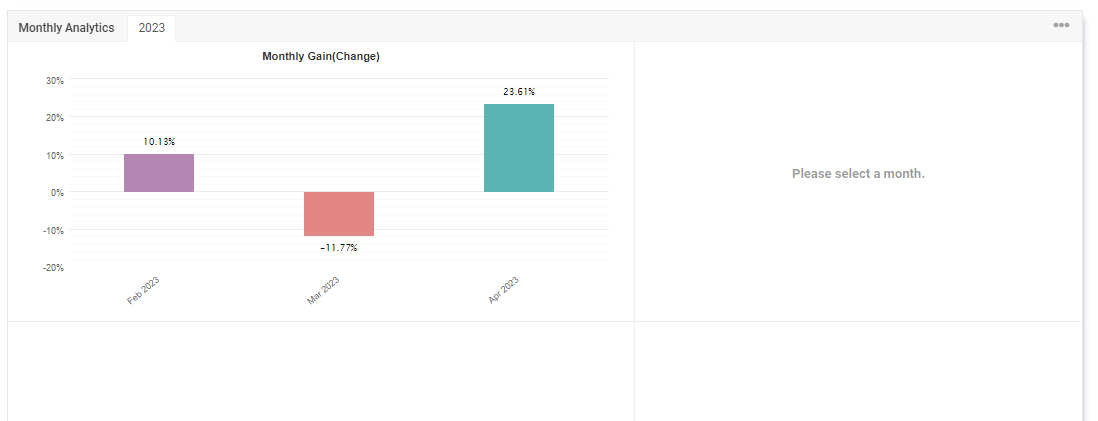

The performance of the Scalping Project EA can be monitored using Myfxbook, a third-party service that provides detailed statistics on the performance of forex trading systems. Myfxbook tracks various metrics such as profit, drawdown, and win rate, which can help traders evaluate the effectiveness of their trading strategy.

By analyzing these metrics, traders can make informed decisions on whether to continue using the Scalping Project EA or make adjustments to their strategy.

Scalping Project Ea Features

- Strategy optimization is a critical element of a successful Forex scalping project EA.

- Money management, such as setting stop-loss and take-profit levels, is essential to optimizing profits and minimizing losses.

- Indicator analysis is a crucial part of any scalping project EA and can be used to identify profitable trading opportunities.

- EA can yield higher returns by utilizing multiple strategies in a scalping project, as each strategy may offer different advantages in different market conditions.

- Proper money management is essential for a successful scalping project EA, as it can help to mitigate risk and increase profitability.

- Technical indicators can help identify profitable trading opportunities and should be included in any scalping project EA.

Strategy Optimization

Scalping Project EA features are designed to help traders maximize their profits in the foreign exchange market. One of the critical features is Strategy Optimization. This feature enables traders to fine-tune their trading strategies by testing different parameters and identifying the most profitable ones. By doing so, traders can significantly improve their success chances and minimize risks.

To optimize a strategy using the Scalping Project EA, traders must select a specific set of parameters they want to test. These could include stop-loss levels, take-profit targets, or entry and exit signals indicators. The EA will then backtest these parameters using historical data, generating a report that shows which combination yielded the best results.

Traders can use this information to adjust their strategy and improve profitability. The benefits of strategy optimization using Scalping Project EA cannot be overstated. It allows traders to avoid costly mistakes by identifying optimal settings before deploying funds into live trading. Additionally, it saves time by automating the backtesting process and providing accurate results quickly.

Overall, strategy optimization is an essential tool for any trader looking to succeed in forex scalping projects, and Scalping Project EA makes it easier than ever before.

Money Management

Another crucial feature of Scalping Project EA is money management. Effective money management is essential to ensure consistent profitability in forex trading.

Scalping Project EA provides traders various tools to manage their funds, including lot size adjustment, risk-reward ratio customization, and stop-loss placement. With these features, traders can control the amount of capital they risk per trade while maximizing their potential returns.

The lot size adjustment feature allows traders to specify the number of lots they want to trade per position. This feature ensures that traders do not over-leverage their accounts and risk losing all their funds quickly.

The risk-reward ratio customization feature enables traders to adjust the ratio between potential profits and losses. By setting this ratio, traders can ensure that their trades have a positive expected value, which increases the likelihood of long-term profitability.

Lastly, stop-loss placement is essential for managing risks in forex trading. It limits traders’ losses by automatically closing positions when the market moves against them. Scalping Project EA offers flexible stop-loss placement options that allow traders to place stops at predetermined levels or based on technical indicators such as moving averages or support and resistance levels.

Overall, Scalping Project EA’s money management features are designed to help traders minimize risks and maximize profits in forex trading. By effectively managing their funds, traders can reduce emotional biases and make objective decisions based on sound trading principles.

Indicator Analysis

In addition to effective money management, Scalping Project EA also provides traders with tools for indicator analysis.

Technical indicators are mathematical calculations based on price and volume data to help traders identify potential trading opportunities.

Using indicators in forex trading is a popular strategy among traders looking to gain an edge in the market.

Scalping Project EA offers a variety of technical indicators that traders can use to analyze market trends and make informed decisions.

These indicators include moving averages, Bollinger Bands, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and many others.

Each of these indicators has its own unique calculations and interpretation methods.

By analyzing these technical indicators, traders can gain insight into market trends and develop strategies accordingly.

For example, suppose a trader observes that the RSI indicates an overbought condition in a particular currency pair. In that case, they may choose to sell the pair or take other appropriate actions based on their strategy.

Overall, the indicator analysis features provided by Scalping Project EA allow traders to make more informed trading decisions based on objective data rather than subjective opinions or emotions.

Forex Scalping Project Ea Benefits

- Forex Scalping Project EA offers quick profits for investing in the foreign exchange market.

- Through automated trading, Forex Scalping Project EA can reduce the risk associated with manual trading.

- Forex Scalping Project EA provides access to high-leverage potential with the ability to place orders with minimal capital.

- The pForex Scalping Project EA increases profit potential as it can make decisions and execute trades faster than manual trading.

- With Forex Scalping Project EA, traders can use various strategies to capitalize on the market movement in a shorter period.

- Forex Scalping Project EA allows traders to capitalize on small price movements and short-term trends.

Quick Profits

Forex scalping project EA is a popular trading strategy aiming to capture small market price movements. One of its benefits is the ability to generate quick profits for traders. This is because scalpers open and close multiple positions within a short period, usually seconds or minutes, to take advantage of small price fluctuations.

Scalping can be an effective way to make quick profits in the forex market. Traders using this strategy can earn returns ranging from a few pips to several hundred pips per trade. However, it’s important to note that quick profits come with higher risks. The market can be volatile and unpredictable at times, and scalping requires traders to make fast decisions, which means they are more exposed to sudden price changes.

Overall, quick profits are one of the main benefits of forex scalping project EA. By capturing small price movements quickly, traders can increase their trading volume and generate higher returns.

However, it’s crucial for traders to understand the risks involved and have a solid risk management plan in place before implementing this strategy into their trading activities.

Reduced Risk

Another benefit of the forex scalping project EA is reduced risk. Scalpers aim to capture small price movements in the market, which means they tend to hold positions for a short period. This reduces their exposure to sudden and significant price changes that could result in substantial losses.

In addition, scalpers can use stop-loss orders to limit their potential losses further. Traders using this strategy can also benefit from reduced overnight risk. Scalping involves opening and closing multiple positions quickly, usually during the day session.

This means traders don’t have to hold positions overnight, exposed to various risks, such as unexpected news events or gaps in the market’s opening price. Overall, the forex scalping project EA can benefit traders looking for reduced risk in their trading activities.

By capturing small price movements within a short period and avoiding holding positions overnight, traders can limit their exposure to sudden and significant price changes that could result in substantial losses.

High Leverage Potential

Another benefit of using forex scalping project EA is the potential for high leverage. Scalpers aim to make small profits from multiple trades, so they must use high leverage to increase their trading volume.

With higher leverage, traders can open more prominent positions with smaller amounts of capital. This means that traders can potentially earn higher profits in a shorter period. However, it’s important to note that high leverage also increases risk.

Traders must be careful not to over-leverage themselves, which could lead to significant losses. Overall, forex scalping project EA can provide traders with the potential for high leverage, allowing them to open more prominent positions and earn higher profits. However, traders must manage their risk carefully and avoid over-leveraging themselves.

Scalping Project Ea Backtesting And Results

The forex scalping project EA is an automated trading system designed to execute rapid trades to generate quick profits. To evaluate the effectiveness of this EA, backtesting was conducted using historical data.

Backtesting involves simulating trades using past market data to determine how the EA would have performed if it had been used during that period. The results of the backtesting showed that the scalping project EA could generate consistent profits over several months.

However, it should be noted that past performance does not guarantee future success, and there are no guarantees for forex trading. Additionally, the backtesting results do not consider slippage or other factors that may impact actual trading results.

Despite these limitations, the backtesting results provide valuable insights into the potential effectiveness of this EA. Traders interested in using this system should conduct their testing and analysis before making investment decisions.

Overall, the scalping project EA shows promise as a tool for generating profits in forex trading. Still, it should be used with caution and careful consideration of individual risk tolerances and investment goals.

Forex Scalping Project Ea Disadvantages

Based on the backtesting results discussed in the previous section, it is evident that the forex scalping project EA has shown promising potential for generating profits quickly. However, like any trading strategy, it also comes with its own set of disadvantages.

One major disadvantage of using a scalping strategy is the need for constant monitoring and quick decision-making. Since scalping requires traders to enter and exit trades within seconds or minutes, there is little room for error. This can be stressful and overwhelming for some traders, especially those new to the forex market.

Another drawback of scalping is that it can lead to high transaction costs. Since scalpers make several trades throughout the day, they may incur more commissions and spread costs than other traders holding positions for extended periods. Additionally, since scalpers aim to profit from small price movements, they may need to use high leverage, which can also increase their risk exposure.

Overall, while forex scalping project EAs have shown potential for quickly generating profits through backtesting results, considering the potential drawbacks before implementing this strategy in live trading is essential.

It requires constant monitoring and quick decision-making, which can be stressful for some traders and potentially higher transaction costs due to frequent trading and high-leverage usage.

Scalping Project Ea Pricing

The pricing of a forex scalping project EA is essential for traders who want to use this technology to automate their trading strategies. To attract potential buyers, developers of these EAs typically price them competitively while still ensuring that they cover development and maintenance costs. However, it is crucial to remember that low-priced EAs may not always be the best option as they may lack essential features or have subpar performance.

One factor that can affect the pricing of a scalping project EA is its level of customization. Customizable EAs offer greater flexibility and can be tailored to specific trading requirements, making them more expensive than off-the-shelf alternatives.

Additionally, the reputation and track record of the developer can also impact pricing. Established developers with a proven track record of producing successful EAs may charge higher prices than new or untested developers.

Another significant aspect to consider when pricing a scalping project EA is the developer’s level of support and maintenance. Some developers offer free updates and customer support for a limited period after purchase, while others charge for these services separately or provide them only through paid subscriptions. Traders should carefully evaluate their needs before purchasing an EA based on the levels of support offered.

Finding the right balance between cost and functionality when purchasing a scalping project EA can be challenging. It is essential to weigh all factors carefully before deciding, including customization options, developer reputation, level of support provided, and overall performance. By doing so, traders can make informed decisions that maximize their chances for success in the highly competitive Forex market.

Low-priced EAs may lack key features or have subpar performance.

Download the best free forex trading tools.

Frequently Asked Questions

What Is The Recommended Account Balance To Use With The Forex Scalping Project Ea?

The recommended account balance for forex trading varies depending on several factors, such as the trader’s experience level, risk tolerance and trading strategy.

However, it is generally advised that traders should have a minimum account balance of $1,000 to manage their trades and avoid over-leveraging effectively.

This amount can increase depending on the leverage used and the size of the positions taken.

It is essential for traders also to consider the fees their broker charges and any potential slippage when deciding on an appropriate account balance.

A well-funded trading account can give traders more flexibility and opportunities to profit from the forex market.

Can The Forex Scalping Project Ea Be Used On Multiple Currency Pairs Simultaneously?

Whether a particular forex trading software can be used on multiple currency pairs simultaneously is an essential consideration for traders seeking to optimize their investment strategy.

While some trading tools are designed specifically for one or a limited number of currency pairs, others may be more versatile and capable of handling multiple pairs simultaneously.

However, the ability to trade across multiple currency pairs can present unique challenges, including increased complexity in managing risk and potential conflicts between different trading strategies.

Using a particular software program on multiple currency pairs will ultimately depend on the individual trader’s goals, experience, and comfort level with different trading techniques.

Does The Ea Use Any Specific Indicators Or Trading Algorithms?

The EA utilizes specific indicators and trading algorithms to execute trades in the foreign exchange market. These indicators and algorithms are designed to analyze market factors, such as price movements, trends, and volatility, to identify profitable entry and exit points.

The specific indicators used may vary depending on the strategy employed by the EA, but commonly used ones include moving averages, support and resistance levels, and oscillators. Additionally, the trading algorithms may incorporate techniques such as trend following, mean reversion, or scalping strategies to achieve profitability.

The effectiveness of these indicators and algorithms depends on various factors, including market conditions and trader preferences.

Is Any Support Or Training Provided For Using The Forex Scalping Project Ea?

Several automated trading systems provide support and training for traders to understand their products.

This assistance may include live chat, email or phone support, user guides, video tutorials, webinars, and other resources that help the trader navigate the platform and its features.

The quality and access to this support vary widely across products, and traders need to evaluate the level of assistance provided before making a purchase decision.

Adequate training can significantly improve a trader’s ability to use an EA effectively and maximize profits.

How Often Are Updates And Improvements Made To The Scalping Project Ea?

Various factors, such as market trends, technological advancements, and customer feedback, determine the frequency of updates and improvements to an electronic trading system.

A well-designed electronic trading system should be flexible enough to adapt to these changes without compromising stability or performance.

However, developing updates and improvements must be carefully managed to ensure they do not introduce bugs or errors into the system.

Moreover, updates and improvements must be tested rigorously before being released to customers to avoid negative impacts on their trading activities.

Therefore, developers of electronic trading systems need to strike a delicate balance between innovation and reliability to meet the ever-changing needs of their customers.

Conclusion

The Forex Scalping Project EA is designed to help traders execute scalping strategies in the forex market. The recommended account balance for using this EA is $500 or more, and it can be used on multiple currency pairs simultaneously.

The EA utilizes specific indicators and trading algorithms to identify potentially profitable trades. Support and training are provided for using the Forex Scalping Project EA, as well as regular updates and improvements.

Traders must understand the risks associated with scalping strategies before using this EA. Overall, the Forex Scalping Project EA can be valuable for experienced forex traders looking to implement scalping strategies in their trading approach.