Forex EA Project Review

The Forex market is a complex and dynamic environment where traders rely on a combination of analysis techniques and trading strategies to make profitable trades. However, analyzing the market and executing trades can be time-consuming and prone to human error.

This is where Forex EA Project comes in – an automated trading system that aims to simplify the process of trading in the Forex market. Forex EA Project is a cutting-edge software application that uses advanced algorithms to analyze market data, identify opportunities for profitable trades, and execute trades automatically.

Download the best free forex trading tools.

The system is designed to work seamlessly with popular Forex trading platforms such as MetaTrader 4 and MetaTrader 5, giving traders access to real-time market data and analysis tools that can help them make informed decisions about their trades. With its powerful features and user-friendly interface, Forex quickly became one of the most popular automated trading systems among Forex traders worldwide.

Overview Of The Ea Project

The forex market is a complex and constantly evolving environment, requiring traders to stay on top of the latest trends and developments to succeed. One tool that has become increasingly popular among traders is the forex robot or expert advisor (EA). These programs are designed to automate trading decisions based on pre-set rules and algorithms, allowing traders to take advantage of market opportunities even when they can’t monitor the markets themselves.

One of the most popular platforms for developing EAs is MetaTrader 4 (MT4), which provides various tools and resources for traders looking to create their automated trading strategies. Using MT4, traders can program their EAs to analyze market data, identify trading signals, and execute trades based on pre-set parameters. This allows traders to focus on other aspects of their trading so their EA handles the more routine tasks.

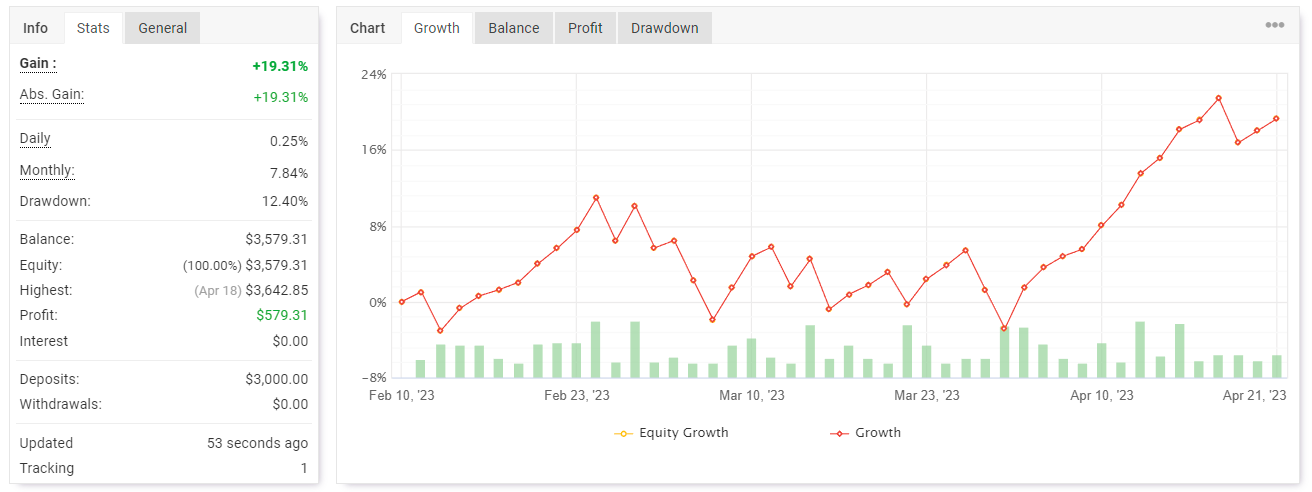

To evaluate the performance of an EA, many traders turn to services like Myfxbook, which provides detailed analytics and reporting tools for forex traders. Myfxbook allows users to track their trades in real-time, analyze performance metrics that can’t profit factors, and compare their results against other traders using similar strategies. By leveraging these tools, traders can gain essential insights into their trading performance and adjust as needed to improve their overall results.

Ea Project Trading Strategy

Any forex ea project’s success mainly depends on the trading strategy employed. A sound trading strategy should generate consistent profits in different market conditions.

In developing a trading strategy for our forex ea project, we have considered various factors such as market volatility, liquidity, and trends. We have settled on using the Metatrader 4 platform for our forex ea project. This platform offers several advantages, including real-time data feeds, advanced charting tools, and the ability to execute trades automatically. Furthermore, Metatrader 4 allows us to program our expert advisor (EA) using MQL4 language to make developing and testing our trading strategies easier.

We will use a virtual private server (VPS) to host our trading platform to ensure the optimal performance of our forex ea project. A VPS broth has several benefits, such as faster execution times and increased stability compared to running the EA on a local machine. Additionally, hosting our trading platform on a VPS eliminates the need for us to keep our computers running all day long.

Our trading strategy will incorporate technical analysis indicators such as moving averages and RSI. We will use a stop-loss mechanism to limit potential losses while maximizing profits. Our EA will trade multiple currency pairs simultaneously to diversify risk.

In summary, developing an effective trading strategy is critical in ensuring the success of any forex ea project. Utilizing the Metatrader users along with a VPS, we can optimize the performance of our EA. Incorporating technical analysis indicators and implementing sound risk management practices will further enhance the profitability of our forex ea project.

Ea Project Features

Backtesting is an essential feature of a forex ea pro computer that enables system developers to evaluate their strategies before they are implemented in trading.

Automated trading allows users to automate their trading with the help of a computer program and thus saves time and effort.

Both backtesting and automated trading are essential to ensure the success and reliability of any forex ea project.

By utilizing both features, developers can ensure that their strategies are efficient and reliable before they are implemented in actual trading.

Backtesting

The backtesting feature is a crucial component of any Forex EA project. It allows traders to test their strategies using historical data, providing insights into how the system would have performed under different market conditions. This information can be used to refine and optimize the system, increasing its effectiveness and profitability.

Backtesting involves running the EA on historical data, simulating trades and analyzing performance metrics such as profit/loss, drawdowns, and win rates. Traders can use this information to identify their strategy’s performance patterns and make necessary adjustments.

For instance, if the EA performs poorly during high volatility periods, traders can adjust the settings or add new rules to handle these conditions better. One key benefit of backtesting is that it allows traders to evaluate their systems objectively without risking natural capital.

By testing multiple strategy variations on historical data, traders can determine which offers the best potential for success in live trading. This reduces the risk of overfitting or optimizing too much based on a single set of results.

In summary, backtesting is essential for any Forex EA project, providing valuable insights into your system’s performance and optimizing it for maximum profit pattern ability.

Automated Trading

Another crucial feature of Forex EA projects is automated trading. Automated trading refers to using pre-programmed rules to handle these conditions better automatically without manual intervention.

This feature is handy for traders who want to take advantage of market strategy variations in the global forex market where trading never s.

In an automated trading system, traders can set specific entry and exit points, stop-loss levels, and profit targets based on their strategy’s rules. The system then executes trades automatically when these conditions are met. This eliminates human errors and emotions that can often lead to costly mistakes.

Moreover, automated trading systems can analyze multiple markets simultaneously, identifying profitable opportunities that may not be apparent to human traders. It also allows backtesting and optimizing strategies based on historical data, ensuring the system’s market conditions.

Iseizeomated trading is a critical feature for any Forex EA project. It offers numerous benefits, such as eliminating human errors and emotions in executing trades while enabling traders to take advantage of market opportunities round-the-clock. Furthermore, it provides room for testing and optimizing strategies based on historical data analysis.

Forex Ea Project Benefits

- Automation is a crucial benefit of a Forex EA Project, as it allows for trades to be executed quickly and efficiently without manual intervention.

- Forex EA Projects can also be programmed to use money management strategies to optimize losses.

- Risk management features such as stop orders and trailing stops can be automatically enacted to protect investments from sharp losses.

- Furthermore, Forex EA Projects also provide an opportunity to divers trading strategies to reduce risk exposure and maximize trading performance.

Automation

Automation is an essential feature of Forex EA projects that can benefit traders significantly. With automated trading strategies, traders can eliminate the need for manual intervention and execute trades more efficiently and timely. This can help reduce the risks associated with emotional trading decisions influenced by fear, agreement on d or other factors.

By using automated systems, traders can focus on developing their strategies without being distracted by market fluctuations. In addition to reducing the risks of emotional trading, automation also provides traders greater flexibility in managing their portfolios. With automated tools, traders can monitor multiple markets and currencies simultaneously and adjust their positions accordingly. This can benefit traders significantly and maximize their profits while minimizing potential losses.

Furthermore, automated systems allow for more excellent efficiency and time. They are based on predetermined rules and parameters. Finally, automation can potentially significantly increase efficiency and productivity in Forex trading. By automating repetitive tasks such as data analysis or order placement, traders can save time and focus on more critical aspects of their business. Additionally, automation allows for faster execution of trades, which is crucial in fast-moving markets where every second counts.

Overall, the benefits of automation are numerous and can significantly enhance the profitability and success of Forex EA projects.

Minimizing Losses

Another significant benefit of using automated systems in Forex EA projects is minimizing losses.

One of the biggest challenges traders face is managing risk while making profitable trades. Automated systems can help it to increase efficiency and productivity in Forex trading based on predetermined rules and parameters. This can help prevent emotional trading decisions from leading to more significant losses.

Automated tools can also provide traders with real-time market data, allowing them to make informed decisions and adjust their positions when necessary. By constantly monitoring market trends, traders can identify potential risks and take action before they become significant losses.

Additionally, automated systems can help diversify portfolios by spreading investment and currencies, reducing the impact of any single loss.

Overall, minimizing losses is a critical aspect of successful Forex trading. By using automated tools and strategies, traders can reduce the risks associated with emotional decision-making and make more informed trades based on objective data analysis. This helps protect against significant losses and increases overall profitability in Forex EA projects.

Ea Project Backtesting And Results

The backtesting phase of an EA project is a crucial step towards evaluating and improving the performance of the algorithmic trading strategy. Backtesting involves running the EA on historical market data to simulate its performance under different market conditions. The results obtained from backtesting are used to assess the EA’s profitability, risk management, and overall effectiveness.

During the backtesting process, traders can optimize their EAs by adjusting parameters such as stop loss, take profit, trade size, and entry/exit rules. The aim is to improve the EA’s pe by identifying potential weaknesses or tendencies in its design.

Backtesting also helps traders to validate their assumptions about market behaviour and refine their trading strategies based on empirical evidence. Once the backtesting phase is complete, traders can analyze the results to determine if the EA meets their expectations. They can compare the performance metrics of different versions of their EAs and select the one that offers optimal returns while minimizing risks.

By conducting thorough backtesting and its results, traders can gain confidence in their EAs’ abilities before deploying in live trading environments.

Forex Ea Project Disadvantages

While offering numerous advantages, the Forex EA project also comes with its fair share of disadvantages.

For starters, the development process can be pretty complex and time-consuming. This is because the project requires a lot of coding, testing, and debugging to ensure that the EA works as intended. Additionally, market conditions are constantly changing, which means that developers must be able to adapt and update their EAs regularly.

Another downside of Forex EA projects is that they can be very costly. Developing a high-quality EA can take several months, and during this time, developers must dedicate significant resources to ensure the project’s success. This includes hiring expert programmers and analysts to create a winning state Forex EA project strategy. Moreover, once an EA has been developed, it must be tested thoroughly before being released into the market.

Lastly, an EA is not guaranteed to succeed in the Forex market. Even with its sophisticated algorithms and advanced features, EA may still fail to generate consistent profits for traders. This could happen due to various factors, such as sudden market volatility or changes in trading regulations. Furthermore, some traders may not fully understand how to use an EA effectively for losses.

TherefoTherefore, crucial for traders considering implementing EAs into their trading strategies to do thorough research before making investment decisions. In summary, while Forex EAs offer many advantages such as automation and increased efficiency in trading activities, being come with several drawbacks, including EA is not guaranteed and costliness. Additionally, there is a need for an EA will succeed in generating consistent profits for traders due to changing market conditions or trader errors when using.

Pricing a forex expert advisor (EA) project is essential to ensure the developers and clients agree on the development cost. The pricing of an EA project depends on several factors, such as the strategy’s complexity, the completion timeframe, and software requirements. Developers must also consider their hourly rates and the hours required to complete the project.

One standard method for trading efficiency gets a fixed fee based on the scope of work. This approach allows both parties to agree on a price upfront and minimizes potential disputes regarding additional costs during development. However, this pricing model does not account for any challenges or changes in scope during development.

Another approach involves charging an hourly rate for development services. This approach allows development cost fees based on changes in scope or unexpected challenges, which may cause the strategy’s complexity and complete edition timeframe. That hourly rate can add up quickly if extensive changes or challenges are required.

In conclusion, determining the appropriate pricing strategy for an EA project is critical to ensure that developers and clients are satisfied with the final product and the fees charged. Developers must cover several factors when determining their fees, including their hourly rate, the complexity of the strategy, software requirements, and the timeline for completion. Clients must also understand how pricing will be determined upfront to ensure transparency throughout development.

Download the best free forex trading tools.

Frequently Asked Questions

What Programming Language Was Used To Develop The Forex Ea Project?

The programming language used in developing the forex EA project is crucial in determining its effectiveness and efficiency. The choice of programming language is often based on various factors such as ease of use, availability of rees, and compatibility with different platforms.

Several programming languages can be used to develop Forex EAs, including C++, Java, Python, and MQL4/MQL5. Each language age offers unique advantages and disadvantages depending g on the project’s specific requirements.

Therefore, selecting the appropriate programming language requires the careful conditions of emulators to ensure optimal performance and functionality of the forex EA project.

Can The Ea Project Be Run On Multiple Trading Platforms?

Developing a trading robot on multiple platforms is crucial for traders seeking flexibility and convenience. Given that different trading platforms often have unique features, it is essential that the EA project can function seamlessly across various platforms, such as MetaTrader 4, cTrader, NinjaTrader, and TradingView.

Therefore, developers of automated trading systems must ensure that their software is compatible with the most widely used trading platforms to cater to the diverse needs of traders. This compatibility can be achieved through coding in a language that supports multiple trading platforms or by creating separate versions of the EA for each platform.

How Many Currency Pairs Does The Ea Project Support?

The EA project is designed to support multiple currency pairs to provide a diversified trading portfolio.

The exact number of currency pairs that the EA project supports may vary depending on the specific implementation and customization of the software. However, t is generally recommended to include a range of major, minor, and exotic currency pairs to minimize risk and maximize potential profits.

The EA project can effectively analyze market trends and execute trades across multiple platforms using advanced algorithms and analytical tools with minimal human intervention.

The ultimate goal of the EA project is to provide traders with a reliable and automated solution for achieving consistent profits in the highly competitive Forex market.

Does The Ea Project Havetos Feature?

The stop loss feature, including forex expert advisors (EAs), is essential to any trading system. The stop-loss feature is used to limit the potential losses that may occur during trading. It sets a specific price level at which the trade will be automated if the market moves against it.

This feature The risk tolerance. The EA project includes a stop-loss feature that can be adjusted based on market conditions and others by utilizing advanced algorithms and analytical tools variables. By incorporating this feature, traders can minimize their potential losses and maximize their profits in the competitive world of forex trading.

Is There A Minimum Recommended Account Balance For Using The Ea Project?

The minimum recommended action for using an EA depends on the specific EA being ustop-losse. Some EAs may require a larger minimum balance due to their trading strategies; others may be suitable for smaller accounts.

It is essential to thoroughly research and test any EA before implementing it with real funds, as market conditions can significantly impact its performance.

Risk management techniques suchstop-lossr position sizing and stop-loss orders should always be utilized to mitigate potential losses.

Ultimately, it is up to the individual trader to determine their risk tolerance and account size when using an EA.

Conclusion

The Forex EA Project is a software program designed to automate forex trading for traders. The project was developed using the MetaQuotes Language 4 (MQL4), a high-level programming language used to develop trading strategies and custom indicators for the MetaTrader 4 platform.

This language is widely used by traders and developers worldwide, making it easy to find resources and support for the project. The EA Project can be run on multiple tradinRiskding MetaTrader 4 and 5.

The software supports over 20 currency pairs, allowing traders to diversify their portfolios and benefit from different market conditions. Additionally, the EA Project has a stop-loss feature that allows traders to limit their losses in case of adverse market movements.

Although no minimum recommended account balance exists for using the EA Project, traders should ensure they have funds to cover their trades’ margin requirements and potential losses. Overall, the Forex EA Project offers an automated solution for forex trading that can help traders save time and improve their profitability by executing trades based on pre-defined rules and algorithms.