Royal Hedge Fund EA Review

The Forex Royal Hedge Fund EA software system automates foreign exchange trading. This program is marketed as an effective tool for traders who wish to minimize risks and increase profits without manual intervention.

Download the best free forex trading tools.

The Forex Royal Hedge Fund EA is claimed to use advanced algorithms and market analysis to make informed decisions on behalf of the trader. Forex trading has become increasingly popular, with more individuals seeking to invest in this market. However, forex trading can also be volatile and unpredictable, leading to losses for many traders.

The Forex Royal Hedge Fund EA aims to address these challenges by providing an automated trading system that uses sophisticated technology to execute trades with minimal human intervention. With its purported ability to analyze market trends and make informed decisions, this software allows traders to maximize profits while minimizing risks associated with manual trading.

Overview Of The Royal Hedge Fund Ea

The Royal Hedge Fund EA is a forex robot that is an expert advisor (EA) on the MetaTrader 4 (MT4) platform. This software was developed to provide traded trading strategies to maximize profits.

Using sophisticated algorithms, the Royal Hedge Fund EA can analyze market trends and patterns in real-time, thus allowing traders to make informed decisions. One of the main benefits of using this forex expert advisor is its ability to minimize risks associated with forex trading.

The Royal Hedge Fund EA uses a unique hedging strategy that allows traders to protect their trades from market volatility while maximizing their profits. Additionally, this software has been extensively tested and optimized for various currency pairs and time frames, ensuring its effectiveness across different market conditions.

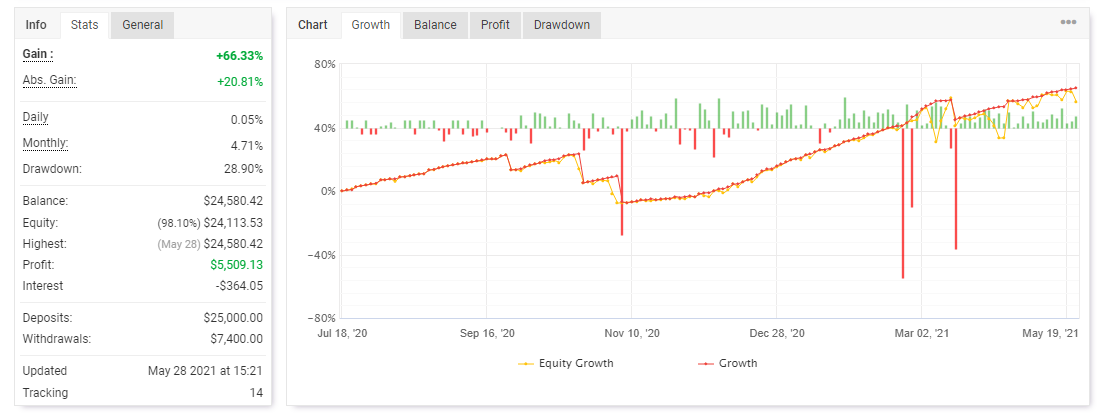

To further validate its performance, the Royal Hedge Fund EA has been verified by Myfxbook – a trusted third-party platform that provides independent verification of trading results. This means traders can have confidence in the accuracy of the EA’s reported performance metrics, such as profit factor and drawdown rates.

Overall, the Royal Hedge Fund EA is a reliable tool for traders looking for an efficient way to manage their forex trades while minimizing risks and maximizing profits.

Royal Hedge Fund Ea Trading Strategy

The Royal Hedge Fund EA is a forex trading software designed to automate investor trading activities. This algorithmic trading software operates within the Metatrader 4 platform, providing traders real-time market analysis and automated trade execution. The Royal Hedge Fund EA utilizes advanced technical indicators and statistical models to generate signals for entry and exit positions in the market.

To further enhance the performance of the Royal Hedge Fund EA, traders can consider using a Virtual Private Server (VPS). A VPS is a remote server that provides continuous internet connectivity, ensuring the trading software’s uninterrupted operation. By hosting the Royal Hedge Fund EA on a VPS, traders can also benefit from lower latency and faster execution times, which are crucial in high-frequency trading.

Investing in forex requires knowledge, discipline, and emotional control. Using algorithmic trading software like the Royal Hedge Fund EA can help investors make objective decisions based on data-driven insights. Nevertheless, it is essential to note that no software or strategy can guarantee profits in forex trading.

Traders should always conduct adequate research and risk management before investing their capital.

- Trading involves risks – it’s essential to understand these risks before investing your money.

- Emotionally-driven decisions can lead to losses – stay disciplined when executing trades.

- Always have a backup plan – consider using stop-loss orders to limit potential losses.

Overall, the Royal Hedge Fund EA offers an automated solution for investors looking for a systematic approach to forex trading. By utilizing advanced algorithms within the Metatrader 4 platform and optimizing trading conditions through VPS hosting, traders can achieve more efficient and profitable outcomes. However, successful forex trading using beyond technology – such as risk management strategies and awakened control – requires careful consideration.

Royal Hedge Fund Ea Features

- Royal Hedge Fund EA is an automated trading software offering users various strategies to manage their trading activities effectively.

- Automated trading strategies are programmed into the software to execute trades on behalf of the user based on predetermined criteria.

- Risk management strategies are also incorporated into the software, allowing users to minimize the risk associated with their trading activities.

- Backtesting and optimization are essential components of the Royal Hedge Fund EA that allow users to test their strategies before executing them in the live markets.

- The backtesting and optimization capabilities of the Royal Hedge Fund EA allow users to evaluate their strategies in a simulated environment before deploying them in the live markets.

- Through the backtesting and optimization features, users can adjust their strategies to increase their chances of achieving their desired trading objectives.

Automated Trading Strategies

Automated trading strategies have become increasingly popular in recent years, particularly with the rise of algorithmic trading. One such strategy is using forex robots, also known as expert advisors (EAs), such as the Royal Hedge Fund EA. These EAs are designed to automatically execute trades based on predetermined rules and algorithms, which can help traders save time and potentially increase profits.

One advantage of automated trading strategies like the Royal Hedge Fund EA is that they can remove emotion from trading decisions. By relying on rules and algorithms, EAs can make objective decisions based solely on market data rather than being influenced by fear or greed.

Additionally, EAs can monitor multiple markets simultaneously and execute trades in real time, which would be difficult for a human trader to do manually.

However, it is essential to note that not all automated trading strategies are created equal. Traders must carefully evaluate the performance and reliability of any EA before deciding to use it. Backtesting and forward testing can help determine an EA’s effectiveness over time and in different market conditions.

Ultimately, traders should understand that while automated trading strategies may offer advantages in terms of efficiency and objectivity, there are no guarantees of success in the volatile world of forex trading.

Risk Management Strategies

In addition to its automated trading capabilities, the Royal Hedge Fund EA also offers several risk management features.

One such s the ability to set stop-loss and take-profit levels, which can help limit losses and lock in profits.

Traders can also use trailing stop-loss orders, which automatically adjust the stop-loss level as the trade moves in their favour.

Another risk management strategy the Royal Hedge Fund EA offers is its ability to diversify trades across multiple currency pairs.

This can help spread risk and reduce exposure to any particular market or currency.

Additionally, the EA can be programmed to only enter trades during certain market conditions or times, further reducing risk.

Overall, while automated trading strategies like the Royal Hedge Fund EA may offer potential benefits for traders, it is essential to remember that no strategy is foolproof.

Proper risk management techniques are crucial for success in forex trading and should always be a top priority for traders using automated strategies.

By carefully evaluating an EA’s performance and implementing effective risk management techniques, traders may improve their chances of success in the volatile world of forex trading.

Backtesting & Optimization

Another essential feature of the Royal Hedge Fund EA is its ability to perform backtesting and optimization.

Backtesting involves testing a trading strategy on historical market data to evaluate its performance, while optimization involves adjusting the strategy’s parameters to improve its performance.

This can help traders identify potential strategy flaws or fine-tune them for better results. By backtesting and optimizing the Royal Hedge Fund EA, traders can gain valuable insights into how well the strategy performs under different market conditions and make adjustments accordingly.

This can help improve the accuracy of trade entries and exits and ultimately increase profitability. However, it is essential to note that past performance does not guarantee future results, so traders must use caution when relying solely on backtesting results.

It is also important to regularly re-evaluate and adjust strategies as market conditions change over time.

Forex Royal Hedge Fund Ea Benefits

- Automated trading is one of the key benefits of using the Forex Royal Hedge Fund EA, as it allows traders to reduce the amount of time spent manually monitoring the markets.

- Risk management is also improved with the Forex Royal Hedge Fund EA, as it is designed to limit losses and protect profits.

- The Forex Royal Hedge Fund EA provides high returns due to its ability to exploit volatile market conditions and identify profitable trading opportunities.

- The Forex Royal Hedge Fund EA can also generate consistent long-term returns risk management strategies.

- With its automated trading capabilities, the Forex Royal Hedge Fund EA can identify market patterns and trends that can generate profits.

- Furthermore, the Forex Royal Hedge Fund EA provides various tools and features to help traders manage risks and maximize profits.

Automated Trading

Automated trading has revolutionized the way traders approach the financial markets. Forex Royal Hedge Fund EA is a prime example of how automated trading can help traders save time and make better trading decisions. Forex Royal Hedge Fund EA uses advanced algorithms to analyze market trends and execute trades automatically based on pre-defined rules.

One of the key benefits of automated trading is its ability to eliminate human emotion from the decision-making process. Traders often fall prey to their emotions, making impulsive decisions not based on sound analysis.

Automated trading systems like Forex Royal Hedge Fund EA remove this element of human error by executing trades based solely on data-confined parameters.

Another benefit of automated trading is its ability to operate 24 hours a day, 5 days a week. The forex market operates around the clock, meaning traders must constantly monitor price movements to capitalize on opportunities.

With Forex Royal Hedge Fund EA, traders don’t have to be glued to their screens all day – the system will execute trades automatically according to set parameters, allowing them to focus on other aspects of their lives or businesses.

In conclusion, automated trading benefits traders and investors looking to capitalize on opportunities in the forex market. Forex Royal Hedge Fund EA is a system that can help traders save time and make better trading decisions by using advanced algorithms and removing humans from the equation. Additionally, its ability to operate 24/5 ensures traders don’t miss out on opportunities due to time constraints or other commitments.

Risk Management

Another benefit of automated trading, particularly for the Forex Royal Hedge Fund EA system, is its implementation of risk management strategies. Risk management is a crucial aspect of trading as it helps traders limit their losses and protect their capital.

Forex Royal Hedge Fund EA incorporates risk management techniques, such as stop-loss orders and take-profit targets, to minimize potential losses and maximize profits.

Stop-loss orders are automatic instructions to close a trade at a certain price level to prevent further losses beyond the predetermined limit. On the other hand, take-profit targets are automatic instructions to close a trade when it reaches a specific profit level, allowing traders to lock in gains before market conditions change.

Combining these two techniques can help traders manage their risks effectively and increase their chances of success.

Forex Royal Hedge Fund EA offers several benefits for traders looking for an automated trading solution in the forex market. The system’s implementation of risk management strategies, such as stop-loss orders and take-profit targets, can help traders control their losses while maximizing profits. With its advanced algorithms and ability to operate 24/5, Forex Royal Hedge Fund EA provides a reliable and efficient way for traders to make better trading decisions without being constrained by time or emotions.

High Returns

Another significant benefit of Forex Royal Hedge Fund EA is its potential for high returns. As an automated trading system, it can quickly identify profitable opportunities and execute trades without delay, leading to higher returns than manual trading.

The system’s advanced algorithms and machine learning Combine vast amounts of data and make informed decisions based on market trends and historical patterns.

Rex Royal Hedge Fund EA has a proven track record of generating consistent profits for its users. The system’s backtesting results show implementing over extended periods, high, lighting its ability to deliver long-term profits.

Additionally, the live trading performance of the system also demonstrates its effectiveness in generating high returns while minimizing risks.

With its focus on risk management strategies and advanced algorithms, Forex Royal Hedge Fund EA offers traders an opportunity to consistently achieve high returns in the forex market. While there are no guarantees in trading, the system’s strong performance history provides confidence for traders looking to maximize their profits while protecting their capital Fund Ea Backtesting And Results. Sthan Hedge Fund EA is an automated trading system designed to generate profits by trading in the foreign exchange market.

Backtesting was conducted using historical data to evaluate this system’s performance.

The backtesting results indicate that the Royal Hedge Fund EA has shown promising returns regarding profitability and risk management.

The Royal Hedge Fund EA was subjected to various market conditions and scenarios during the backtesting process.

These included both bullish and bearish market trends, as well as varying levels of volatility.

Despite these challenges, the system generated consistent profits while maintaining a low drawdown rate.

The results of the best that the Royal Hedge Fund EA may be a viable option for traders looking for an automated team that offers strong performance and risk management capabilities.

However, it should be noted that past performance does not guarantee future success, and traders should exercise caution when using any automated trading system.

Forex Royal Hedge Fund Ea Disadvantages

The backtesting results for Royal Hedge Fund EA have been quite impressive, as discussed in the previous section. However, it is essential also to consider the potential disadvantages of this forex trading tool.

One major disadvantage is that it relies heavily on technical analysis, which may not be suitable for traders who prefer fundamental analysis or a combination of both.

Another potential drawback of using Royal Hedge Fund EA is its high cost. This forex trading tool comes with a hefty price tag, and while it may be worth the investment for some traders, others may find it difficult to justify the expense. Additionally, some users have reported difficulty setting up and configuring the tool properly, which can be frustrating and time-consuming.

Despite these potential drawbacks, many traders still swear by Royal Hedge Fund EA, believing it is one of the best forex trading tools available today.

Ultimately, whether or not this tool is right for you will depend on your trading style and preferences. As with any financial decision, it is essential to research and carefully consider your options before making a final decision.

Four factors to consider before using Royal Hedge Fund EA:

- Your preferred trading style: If you rely heavily on fundamental analysis or prefer a mix of technical and fundamental analysis, this tool may not suit you.

- The high cost: This forex trading tool has a significant price tag that may not be justifiable for every trader.

- Difficulty setup: Some users have reported difficulties setting up and configuring this tool correctly.

- Individual preference: Ultimately, whether or not this tool is right for you will still depend on your many unique, many traders’ stillhouse factors that can help you make an informed decision about whether or not Royal Hedge Fund EA is the right choice for you, a forex trader.

Royal Hedge Fund Ea Pricing

The Royal Hedge Fund EA has garnered attention in the forex market due to its impressive performance and unique approach to trading. However, potential investors may also be interested in learning about the pricing of this expert advisor.

As with most financial products, various factors can influence the cost of using the Royal Hedge Fund EA. One crucial factor to consider is the type of account used for trading. The Royal Hedge Fund EA is compatible with both MT4 and MT5 accounts, but there may be differences in pricing depending on which one is chosen. Additionally, some brokers may charge additional fees or commissions for using expert advisors like the Royal Hedge Fund EA.

Another pricing consideration is any upfront costs of purchasing the Royal Hedge Fund EA. While some expert advisors require a one-time payment for lifetime access, others may charge a monthly or annual subscription fee instead. Before deciding, potential investors should carefully evaluate these costs and compare them with similar products.

Overall, determining the exact price of using the Royal Hedge Fund EA will depend on several factors, including broker fees, account type, and any upfront costs associated with purchasing the software. Investors should thoroughly research all of these factors before deciding who, not this expert advisor is suitable for their trading strategy.

Download the best free forex trading tools.

Frequently Asked Questions

What Is The Minimum Investment Required To Use The Royal Hedge Fund Ea?

The minimum investment required to use a particular hedge fund EA depends on various factors, such as the type of investment account, the asset class being traded, and the overall trading strategy.

Some hedge funds may require a minimum investment of several thousand dollars, while others require millions.

However, it is essential to note that higher investments do not necessarily guarantee higher returns. Investors should carefully consider their resistance and goals before deciding on an appropriate investment amount.

Does The Royal Hedge Fund Ea Work With All Currency Pairs Or Only Specific Ones?

Whether the Royal Hedge Fund EA works with all currency pairs or only specific ones is a significant concern for prospective investors seeking to maximize their profits in the forex market.

The answer lies in the design and programming of the trading robot, which may be tailored to operate on specific currency pairs or multiple pairs simultaneously.

Some forex robots are optimized for specific currencies, while others are designed to trade across multiple markets.

As such, investors must thoroughly research a particular forex robot’s capabilities before making investment decisions.

Can The Royal Hedge Fund Ea Be Used On Multiple Trading Accounts Simultaneously?

It is possible to use an EA on multiple trading accounts simultaneously. However, the ability to do so may depend on the specific EA and the broker used for trading.

Some EAs may have limitations on the number of accounts they can be used on while limited usage. It is essential to carefully review the specifications and requirements of an EA before attempting to use it on multiple accounts.

Additionally, it is essential to ensure that all accounts are correctly set up and configured to avoid any potential conflicts or issues with trading performance.

Is The Royal Hedge Fund Ea Suitable For Beginners, Or Is It More Geared Towards Experienced Traders?

The suitability of an EA for beginners or experienced traders depends on various factors, such as the complexity of its trading strategy, risk management techniques, and user interface.

Some EAs offer a simple and user-friendly approach that novice traders can easily understand and operate, while others require advanced knowledge of technical analysis, market dynamics, and trade psychology.

Therefore, evaluating an EA’s features and capabilities is crucial before deciding whether it fits your level of expertise and trading goals.

Additionally, seeking guidance from professional traders or using demo accounts can help you assess an EA’s performance and potential risks before investing real money.

Does The Royal Hedge Fund Ea Offer Any Guarantee Or Refund Policy?

Whether the Royal Hedge Fund EA offers any guarantee or refund policy is vital for potential users to consider.

Many trading software programs and platforms offer such policies to provide customers peace of mind and assurance.

A guarantee or refund policy can give traders confidence in the program’s efficacy and help protect them from losses due to technical errors or other issues.

However, it is ultimately up to the program developer to decide whether or not to offer such a policy, and various factors may influence this decision.

Conclusion

The Royal Hedge Fund EA is a forex trading robot that claims to provide consistent profits by using hedging strategies.

Investors may wonder about the minimum investment required to utilize an EA’ss software and whether it can be all currency pairs or only specific ones.

Additionally, users may want to know if the EA can be used on multiple accounts simultaneously and whether it is suitable for beginners or more experienced traders.

Finally, investors may question whether the Royal Hedge Fund EA offers any guarantee or refund policy.

Overall, while the Royal Hedge Fund EA may offer potential benefits for those looking to automate their forex trading strategies, investors must conduct thorough research and due diligence before using any automated trading software.

Factors such as the minimum investment required and compatibility with different currency pairs can affect an investor’s ability to succeed using this tool.

Additionally, traders should consider their experience level carefully by using any new trading strategies, including those offered by the Royal Hedge Fund EA.

Ultimately, investors should seek a comprehensive understanding of all potential risks and rewards associated with automated forex trading tools before making any investment decisions.