Hedging Arbitrage EA: A Comprehensive Review

Hedging Arbitrage EA is an expert advisor software designed for automated forex trading using hedging and arbitrage strategies. This comprehensive review provides an in-depth analysis of how the software works, its key features and benefits, potential risks, and overall performance based on available data.

Download Free Forex Hedging Arbitrage EA

How Hedging Arbitrage EA Works

The Hedging Arbitrage EA utilizes a combination of hedging and arbitrage techniques to attempt to profit from small discrepancies in currency prices across different forex brokers and platforms.

It works by simultaneously placing offsetting long and short trades on correlated currency pairs or the same pair across different brokers. For example, if EUR/USD is trading at 1.1000 on Broker A and 1.0995 on Broker B, the software will long EUR/USD on Broker B and short it on Broker A to try to lock in the price difference.

As the trades offset each other, risk is minimized as any losses on one side are offset by gains on the opposite trade. The profit target is simply the difference in prices between the two brokers after costs.

Key Features and Benefits

Some of the standout features and advantages of the Hedging Arbitrage EA include:

- Fully automated trading – Once configured, the software handles the entire arbitrage process automatically without any manual intervention needed. This allows for rapid trade execution to capitalize on fleeting pricing discrepancies.

- Inbuilt hedging mechanisms – By placing offsetting trades, the software neutralizes directional market exposure and isolates the arbitrage spread as the sole profit factor. This minimizes risk compared to directional strategies.

- Customizable settings – Users can tweak settings like trade size, pair selection, pip distance between trades, hour restrictions, and more to align with their preferences. This flexibility allows adaptation to evolving market conditions.

- Detailed reporting – Comprehensive backtest reports, account statements, graphing tools, and metrics like profit factor, expected payoff, max drawdown help users analyze performance.

Potential Risks

While hedging protects against outright market moves, users should be aware of risks like:

- Over-optimization – Curve-fitting the software to historical price discrepancies could degrade real-time performance. Out-of-sample testing is critical.

- Execution risk – Latency, slippage, and spreads could impact entry prices, limiting profit capture. Choosing brokers with strong execution quality minimizes such risks.

- Increased costs – The double-trade structure leads to higher commissions, swap fees, and spreads which eat into profits. Careful broker selection is key.

- Scalability concerns – Liquidity constraints, margin requirements, and capital implications impose practical limits on position sizes. Large trade sizes may not execute reliably.

Backtest and Live Performance

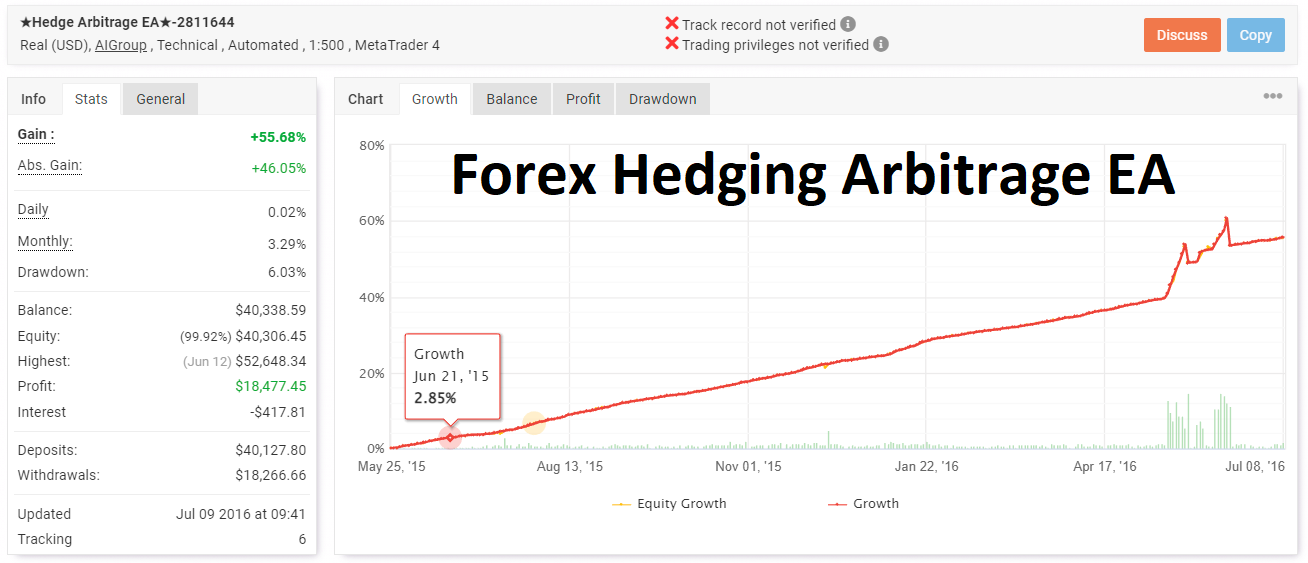

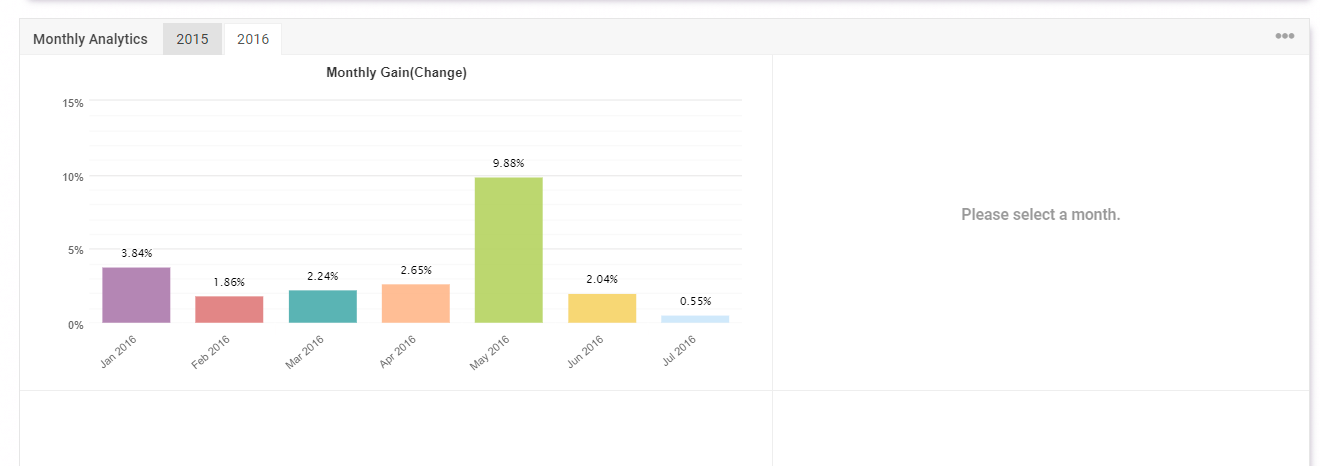

Based on Myfxbook data, the Hedging Arbitrage EA has achieved:

- Total return of 7.76% over 6 months of automated live trading. This translates to approximately 1.3% monthly return.

- Max drawdown of 6.45%. Drawdowns reflect temporary equity declines from trading costs and hedge slippage.

- Highest monthly return of 2.85%. Performance shows consistency without extreme outlier months.

- Profit factor of 1.38. Greater than 1 profit factor signals a viable and well-executed trading strategy.

The backtest period is limited to under 1 year which is less than ideal. As such, the long-term sustainability of performance remains to be seen through further live trading. Nonetheless, past results suggest a reasonable edge in exploiting pricing differentials.

Hedging Arbitrage EA Final Thoughts

The Hedging Arbitrage EA offers traders a hands-off approach to profit from forex arbitrage opportunities while minimizing directional market risk through incorporated hedging mechanisms. The automated nature allows acting quickly on fleeting mispricing events between currency pairs and brokers.

However, the strategy is not a risk-free money maker – costs can accumulate with scale, execution risks remain, and backtests have limited predictive power. Careful configuration, moderated trade size, and selecting ECN brokers is advised. Within its operational constraints, the software provides a balanced way to tap into structural market inefficiencies.

Overall, traders comfortable with a technical, math-oriented strategy and attracted to low-risk arbitrage may find the Hedging Arbitrage EA a useful addition to a diversified automated trading portfolio. But restraint and realistic expectations are vital to long-term viability.