Introduction to the GOLDIFY EA

The GOLDIFY EA is a forex trading robot that specializes in automated gold trading on the MetaTrader 4 platform. It was developed by the Maka Assistant team to trade the XAU/USD currency pair (gold) with the goal of generating monthly profits between 20-38% with an 84% win rate.

The GOLDIFY EA runs fully automated without any manual intervention needed. It uses an advanced algorithm to scan the gold charts for high-probability trading opportunities. When a trade is triggered, the EA will automatically place the order, set stop losses and take profit levels, and manage the position.

In this comprehensive review article, we will analyze how the GOLDIFY EA works, the trading strategy and logic behind it, key features, backtest results, real account trading performance, as well as pros and cons of using this gold trading robot.

GOLDIFY EA Trading Strategy Explained

The core strategy of the GOLDIFY EA revolves around identifying trend reversals and extreme overbought/oversold levels in the gold market. It combines analysis of multiple technical indicators and price action patterns to find high-probability setups to trade.

Specifically, the algorithm utilizes tools like Moving Averages, Bollinger Bands, RSI, and customized proprietary indicators to scan for trading signals. When the indicators align and confirm a potential trend change, the EA will automatically execute a trade.

Some of the entry techniques used include:

- Trading breakouts of key support and resistance levels

- Entering on pullbacks within the overall trend

- Identifying divergences between price and oscillator readings

Once in a trade, the GOLDIFY EA uses a trailing stop loss that dynamically moves to lock in profits as the market moves in the robot’s favor. Profit targets are based on recent price action volatility.

The EA does not use any martingale or grid trading concepts. Risk management seems to be based on a percentage of the account balance per trade.

Key Features and Tools of the GOLDIFY EA

Here are some of the standout features that come built-in to the GOLDIFY automated trading system:

Advanced Money Management – Auto-calculates optimal trade size based on account balance and risk parameters. Helps prevent overleveraging.

Forced Exit Function – Closes all open trades when user-defined drawdown limits are reached. Designed to stop out huge losing streaks.

News Filter – Halts trading around major economic news events to avoid volatile whipsaw price action.

No Martingale – Does not scale up lot sizes after losses, avoiding the high-risk martingale method.

Backtesting Capability – Allows traders to test the EA’s logic and settings on historical data before going live.

Multiple Timeframe Analysis – Scans the gold market on multiple timeframes (M5, M15, H1) seeking trade signals for a robust approach.

These integrated tools help manage trading risk and aim to ensure solid profitability over the long run.

GOLDIFY EA Backtest Results

The vendor shows a backtest for the GOLDIFY EA on their website spanning over 7 months of historical data. The results are as follows:

Total Net Profit – $9,790 Max Drawdown – 15.26% Profit Factor – 2.45 Win Rate – 71%

These backtest metrics indicate decent performance with good consistency judging by the smooth equity curve growth. However, backtests don’t always translate accurately to live trading environments. Real-money testing is still crucial.

It’s also worth noting the backtest does not provide information on the specific parameter settings, broker used, spread/commission costs, and other key details. More transparency on these inputs would allow better scrutiny of the backtest quality.

Live Trading Results

The best way to evaluate any EA is by analyzing the real account trading statements.

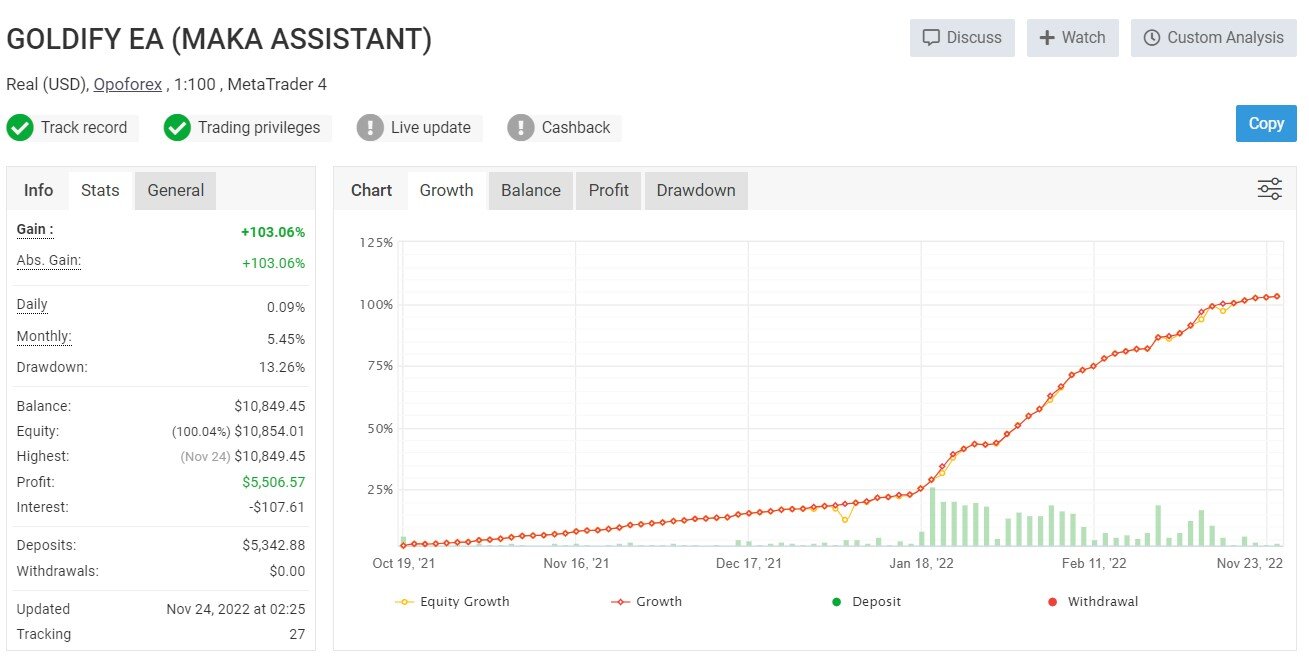

The GOLDIFY EA developer shows a MyFXBook verified account with over 1500 trades placed. The results are as follows:

Profit – +103.06% Drawdown – 13.26% Profit Factor – 2.45 Win Rate – 71%

These metrics indicate the GOLDIFY EA has been trading profitably in live market conditions. The growth curve shows consistent gains with relatively moderate drawdowns.

However, the amount of trading history shown is still quite limited at just over 1 year. More data would be needed to further verify the EA’s long-term consistency and reliability across different gold market regimes.

Using the GOLDIFY EA: Requirements and Broker Setup

Here are some key requirements and tips for getting set up with the GOLDIFY EA:

- Works on MetaTrader 4 platform only

- Recommended minimum account balance $500+

- XAU/USD symbol only

- Low spread ECN broker recommended

- Allow automated trading and EA use

- Use a reliable VPS service for uninterrupted trading

Since the GOLDIFY bot trades the volatile gold market, using a broker with tight spreads and fast execution is vital. This helps ensure trades get filled at optimal prices for the best chance of profitability.

Some top recommended brokers for running this gold EA include IC Markets, Pepperstone, and XM.com. These offer competitive spreads plus support algorithmic trading.

Pros and Cons of the GOLDIFY Trading Robot

Pros

- Specialized for potentially lucrative gold trading

- Fully automated hands-free approach

- Real account results showing solid profits

- Custom indicators to enhance trade signals

- Risk management features to preserve capital

Cons

- Still relatively new to the market

- Limited long-term track record

- Lacks transparency on parameter settings

- High drawdowns on backtest and live account

While the GOLDIFY EA shows promise, traders should be aware there are still unanswered questions regarding the longevity of performance and drawdown risks based on the information provided so far. Running further demo testing is advised.

Conclusion – A Solid Gold Trading Robot But Demo Test First

For traders interested in algorithmic gold trading, the GOLDIFY EA offers an intriguing option with its 20-38% monthly profit target and 84% win rate goal. Real trading accounts show it is capable of generating sizeable gains.

However, the limited transparency on backtest assumptions and lack of long-term verification means traders should still approach with caution and not rely solely on demo results or short-term live gains.

Extensive demo testing of your own, across different market conditions, is highly recommended to better gauge the EA’s logic and risk parameters. This allows configuring it to align with your personal risk-reward preferences.

Overall the GOLDIFY EA shows potential but needs further validation. Use demo trading as an initial trial before considering running it live with real capital.