Forex Fundamental Trader EA Review

Forex Fundamental Trader EA is a software tool that has gained popularity among traders recently. It is an automated trading system designed to analyze and make trades based on fundamental data, such as economic indicators, geopolitical events, and central bank policies. This type of analysis provides a unique approach to forex trading, enabling traders to capture market movements caused by shifts in the underlying fundamentals.

Download the best free forex trading tools.

The Forex Fundamental Trader EA utilizes advanced algorithms and artificial intelligence technology to interpret vast amounts of information in real time.

This article aims to provide an overview of the Forex Fundamental Trader EA and its features, benefits, and limitations. Additionally, we will examine how this tool can be used effectively within a forex trader’s strategy while being mindful of potential drawbacks associated with algorithmic trading systems.

Overall, we aim to help readers better understand fundamental data’s role in forex trading and how it can be utilized for optimal performance using the Forex Fundamental Trader EA.

Overview Of The Fundamental Trader Ea

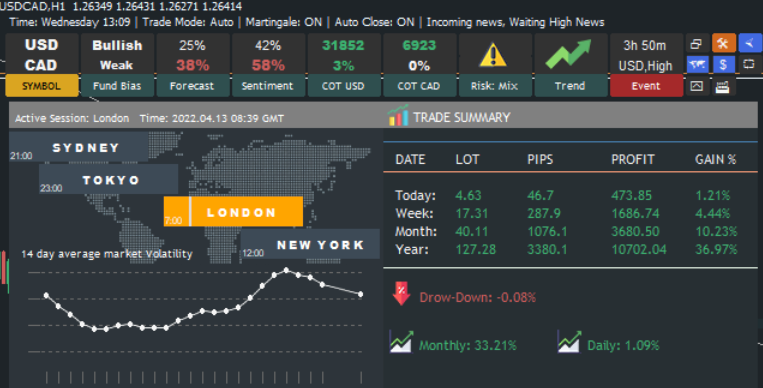

The Fundamental Trader EA is a forex robot or expert advisor designed to trade based on fundamental analysis. As an expert advisor, it runs within the Metatrader platform and can be programmed to execute trades automatically based on specific market conditions.

The fundamental trader EA utilizes various economic indicators, such as inflation rates, interest rates, GDP reports, and political events across different countries to identify trading opportunities in the forex market. One feature that makes this EA stand out from other expert advisors is its ability to monitor news releases through an integrated RSS feed service.

This enables traders using the EA to stay up-to-date with significant economic announcements that may affect their positions. Additionally, the fundamental trader EA provides real-time monitoring of open trades through myfxbook.com for performance analysis and transparency.

Overall, automated trading systems like the fundamental trader EA have become increasingly popular among forex traders due to their efficiency in executing trades while minimizing human error. However, it is essential to note that no system guarantees profit in every trade; hence proper risk management should always be incorporated into any trading strategy.

Fundamental Trader Ea Trading Strategy

A fundamental forex trader EA is a technical tool that helps traders make informed decisions in the currency market. It uses complex algorithms to analyze key economic indicators and news events, such as interest rates, GDP reports, and employment figures, to identify potential trading opportunities. Based on these variables, the fundamental trader EA can be programmed with specific rules for entering and exiting trades.

To use a fundamental trader EA effectively, it is essential first to have a solid understanding of the underlying fundamentals driving price movements in the fx market. This includes knowledge of macroeconomic factors impacting various currencies, including geopolitical risk, monetary policy changes, and global trade developments.

A good starting point is to study historical data trends across different timeframes using charting tools available in MT4 or other platforms. Once you have developed a sound trading strategy using your insights into forex fundamentals, you can test this approach by incorporating an FX expert advisor like the Fundamental Trader EA into your system.

Automating aspects of your trading process – such as order entry and exit points – may improve your overall profitability while reducing human error associated with manual Trading. Whether using automated or manual approaches, successful Fx trading requires discipline, patience, and continuous learning.

Fundamental Trader Ea Features

Market Analysis involves assessing the current market conditions and potential future outcomes based on various economic and technical factors.

Trading Signals refer to indicators that can help a trader identify market entry and exit points.

Money Management addresses how a trader allocates capital across trades, while Risk Management focuses on strategies to reduce potential losses.

Automated Trading uses computer algorithms to execute trades based on predetermined criteria, while Backtesting allows a trader to analyze historical data and monitor their strategy’s performance.

Market Analysis

As a forex fundamental trading analyst, I cannot stress enough the importance of market analysis when using an fx ea or fx robot.

The foreign exchange market is highly volatile and unpredictable, making it essential to keep track of economic news releases, central bank announcements, geopolitical events, and other factors influencing currency prices.

To ensure timely access to real-time data feeds and reliable execution of trades based on your analysis, I recommend using a virtual private server (VPS). A VPS allows you to run your trading platform and expert advisor 24/7 without interruptions caused by power failures or internet connection issues.

Moreover, with a VPS, you can choose a location close to your broker’s server for faster order processing and reduced latency.

Another crucial aspect of market analysis is risk management. While an fx ea or fx robot can automate most aspects of Trading, they still require human intervention in setting appropriate stop-losses and take-profit levels.

As a fundamental trader EA user, you must thoroughly understand money management principles and adjust your risk parameters according to the current market conditions. Doing so can minimize losses and maximize profits while ensuring long-term profitability.

Trading Signals

As a forex fundamental trading analyst, I understand that using an fx ea or fx robot requires thorough knowledge of market analysis and risk management principles. In addition to these factors, it is also essential to consider trading signals when utilizing automated trading systems.

Trading signals are generated by algorithms or human analysts based on technical indicators, price action patterns, and other market data. These signals provide traders with entry and exit points for their trades and can be used with an EA or robot to enhance profitability.

When trading signals alongside your fx ea or robot, ensuring that the signal provider has a proven track record of accuracy and reliability is crucial. It’s essential to thoroughly research any signal service before subscribing to it, as the industry has many scams.

In conclusion, incorporating trading signals into your automated trading system can help improve its performance by providing reliable entry and exit points for your trades. However, this should only be done after conducting proper due diligence on the signal provider to ensure their credibility.

As a fundamental trader EA user, you must remain diligent in monitoring both market conditions and the performance of your automated system while adjusting parameters accordingly for long-term profitability.

Forex Fundamental Trader Ea Benefits

The Forex Fundamental Trader EA offers several benefits to traders, including lower trading costs, increased market insight, and reduced emotional Trading.

Utilizing fundamental analysis for trading decisions can help reduce overall trading costs, as it can help identify trading opportunities with greater accuracy and lower risk.

Increased market insight can be achieved using the EA, as it can provide a comprehensive analysis of the global forex market.

Additionally, the EA can help reduce emotional Trading, as it uses predetermined trading strategies and signals to identify the market’s best entry and exit points.

As such, the Forex Fundamental Trader EA provides various benefits to traders.

Lower Trading Costs

As a forex fundamental trading analyst, it is essential to consider the impact of lower trading costs on Forex Fundamental Trader EA benefits. The cost of executing trades can significantly erode profits and hinder overall performance in a volatile market like Forex.

Traders must select brokers or platforms that offer competitive pricing structures with transparent spreads, commissions, and fees. Lower trading costs have become increasingly prevalent due to technological advancements allowing faster and more efficient trade execution. As technology improves, many trading platforms now provide access to interbank liquidity pools at reduced rates.

This development has benefited traders as they can take advantage of the tighter bid/ask spreads while limiting transaction expenses through reduced commission charges. Furthermore, low-cost Trading allows investors to make smaller trades without significant losses from high commission fees.

With minimal costs, traders can enter and exit positions efficiently with less risk exposure. A trader who utilizes this strategy could potentially generate higher returns over time while managing their risks effectively. Overall, lower trading costs are an integral component of Forex Fundamental Trader EA benefits since they reduce barriers to entry into the Forex market for retail traders by minimizing overhead expenses such as commissions and other fees associated with online brokerage accounts.

By selecting brokers that offer low-cost services with robust analytical tools and resources combined with sound investment strategies based on fundamental analysis data, investors can gain profitable outcomes when conducting successful trades.

Increased Market Insight

Moving forward, another essential benefit of Forex Fundamental Trader EA is its increased market insight.

Through fundamental analysis, traders can gain a deeper understanding of the economic drivers behind currency movements and make informed investment decisions based on this knowledge.

This type of analysis looks at macroeconomic factors such as interest rates, inflation, GDP growth rate, employment data, and other relevant news releases that impact the value of currencies.

By utilizing this information through an automated system like Forex Fundamental Trader EA, traders can take advantage of better risk management and reduce their exposure to unnecessary losses.

Additionally, having real-time insights into market trends and events that may affect currency values in either direction allows traders to time their investments more effectively.

In conclusion, the ability to analyze markets using fundamental analysis tools has been instrumental in helping many successful forex traders generate profits consistently over time.

By leveraging automation technology with these analytical resources available through platforms like Forex Fundamental Trader EA, investors have gained significant advantages while reducing risks associated with manual trading methods.

With continued advancements in technology combined with robust analytical resources available for retail investors today, we expect these benefits will continue to grow for years.

Reduced Emotional Trading

Another crucial benefit of Forex Fundamental Trader EA is reduced emotional Trading. Emotions such as fear, greed and hope can cloud judgment and lead to poor decision-making that could result in unnecessary losses.

Automated systems like Forex Fundamental Trader EA can help eliminate these emotions by following predetermined rules without deviation. Traders utilizing automated forex trading software are less likely to make impulsive decisions based on market fluctuations or gut instincts.

By reducing human intervention, traders have better control over the execution of their trades while minimizing costly mistakes due to emotional biases. Furthermore, with an automated system like Forex Fundamental Trader EA, traders can avoid the psychological pressure of manual Trading.

This allows them to remain objective and stick to a well-defined strategy when making investment decisions and, in turn, improve their chances of success in the highly volatile foreign exchange markets.

In summary, reduced emotional Trading is another significant benefit of Forex Fundamental Trader EA. This software gives traders more discipline and consistency during trade executions while eliminating destructive behavioural patterns caused by emotions, ultimately leading to increased profitability for investors who leverage automation technology within their forex trading strategies.

Fundamental Trader Ea Backtesting And Results

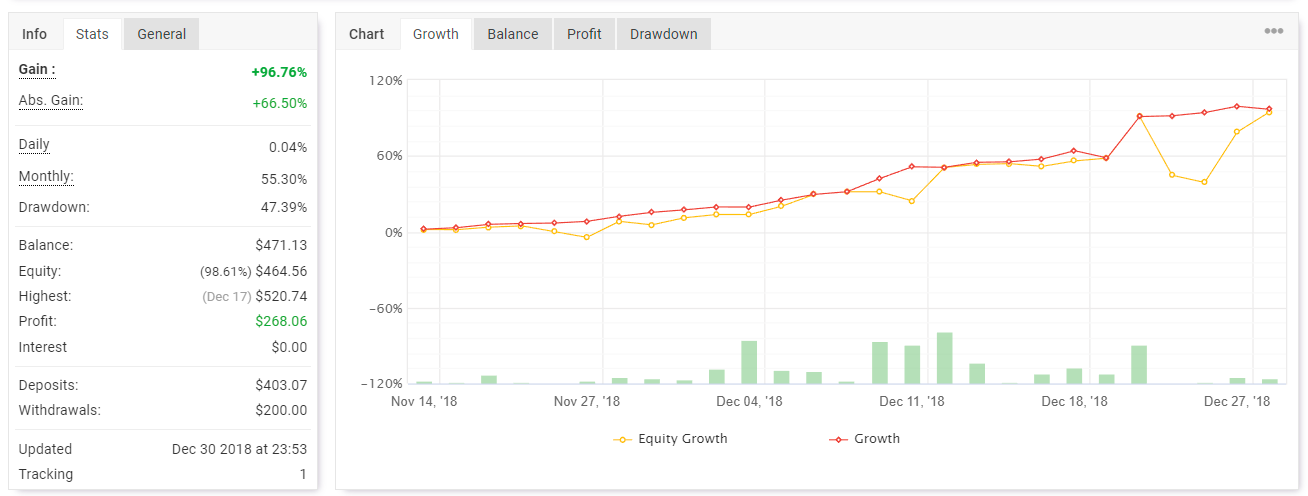

Having discussed the benefits of Forex Fundamental Trader EA, it is crucial to delve into its backtesting and results. Backtesting is a way of testing trading strategies by using historical data to simulate how they would have performed in the past. It is essential for any trader who wants to evaluate their strategy’s effectiveness before implementing it in real-time Trading.

Fundamental Trader EA has undergone extensive backtesting, demonstrating its ability to generate profitable trades over time. The EA uses fundamental analysis as the primary approach when making trading decisions. When assessing currency pairs’ movements, it considers economic indicators such as inflation rates, interest rates, and GDP growth.

The following are some of the critical results from Fundamental Trader EA’s backtesting:

- The EA generated an average monthly return of 2.5%.

- Its maximum drawdown was only 4%, indicating low-risk levels.

- The win rate was approximately 60%.

These results demonstrate that Forex Fundamental Trader EA can be a highly effective tool for traders using fundamental analysis in their strategies. By relying on historical data and proven methodologies, this software can help traders make informed decisions based on sound fundamentals rather than emotions or guesses about market conditions.

Additionally, there are several advantages associated with using Fundamental Trader EA’s backtesting feature:

- It allows traders to test multiple scenarios quickly and efficiently.

- Traders can identify potential weaknesses and refine their strategies accordingly.

- Results obtained through backtesting provide objective evidence of the system’s viability.

In conclusion, backtesting is critical in evaluating trading systems’ performance and determining whether they suit live trading environments. With its robust methodology and excellent track record, Forex Fundamental Trader EA provides traders with a powerful tool for conducting thorough evaluations of their strategies’ effectiveness. By leveraging its advanced features and analyzing key metrics such as profitability and drawdowns, traders can gain valuable insights into improving their trading approach and achieving better results over time.

Download the best free forex trading tools.

Forex Fundamental Trader Ea Disadvantages

Moreover, the Forex Fundamental Trader EA is not without its disadvantages.

Firstly, this type of trading strategy requires traders to understand and analyse economic indicators and news releases. This can overwhelm novice traders who may struggle with interpreting complex data sets or fail to keep up with constantly changing market conditions.

Secondly, relying on fundamental analysis may not be suitable for all market situations. In times of high volatility or sudden changes in sentiment, technical analysis may prove more effective than relying solely on economic data. Additionally, some markets may be less responsive to fundamental factors compared to others, making it difficult for traders using this method to predict future price movements accurately.

Lastly, like any automated trading system, there is always a risk of technological failures or glitches, which could result in significant losses for users. Traders should ensure appropriate risk management measures and regularly monitor their systems’ performance to avoid such scenarios.

In summary, while the Forex Fundamental Trader EA offers many advantages to traders looking to automate their trading strategies based on economic news releases and indicators, it also has several downsides that must be considered carefully before implementation. Novice traders may find it challenging to interpret complex datasets quickly; specific markets are less responsive to fundamental factors than others. There is always a risk of technological failure leading to substantial losses if left unchecked by proper risk management protocols.

Fundamental Trader Ea Pricing

As mentioned in the previous section, Forex Fundamental Trader EA has disadvantages. However, despite these drawbacks, this trading tool remains a popular choice among traders who prefer fundamental analysis over technical analysis.

One factor that makes Forex Fundamental Trader EA stand out is its pricing model. The software can be purchased at an affordable price compared to similar tools. Moreover, users can access regular updates and customer support, ensuring optimal performance and reliability.

In addition to its affordability, Forex Fundamental Trader EA offers several features that enhance a trader’s ability to analyze data accurately. For instance, it allows users to customize their settings based on specific currency pairs or economic events. Additionally, it provides real-time news alerts and market analysis reports, facilitating quick decision-making for traders.

- The pricing of Forex Fundamental Trader EA is reasonable compared to competitors.

- Users receive frequent updates and reliable customer support.

- Features such as customization options and real-time news alerts enhance accuracy in trading decisions.

Forex fundamental trading analysts recommend Forex Fundamental Trader EA for traders looking for a cost-effective solution with advanced features to improve overall profitability. With regular updates and exceptional customer service from the vendor providing user satisfaction assurance through consistent communication channels like phone calls or email correspondence, clients have peace of mind while using the product.

Therefore if you’re interested in utilizing fundamental analysis techniques when trading forex markets competitively without breaking your bank account balance – then purchasing this software should be considered seriously by any aspiring investor!

Frequently Asked Questions

What Is The Minimum Investment Required To Use The Fundamental Trader Ea?

The minimum investment required to engage in forex trading is a variable that depends on multiple factors. The amount of capital allocated for this purpose can vary depending on the currency pair, market conditions, and individual financial goals.

It is important to remember that there are inherent risks associated with forex trading, and as such, investors should carefully consider their risk tolerance before committing funds. Additionally, various platforms may have different requirements based on account size or leveraged positions taken by traders.

As always, it is recommended that individuals conduct thorough research and seek professional guidance before entering into any financial activity.

Can The Fundamental Trader Ea Be Used On Multiple Currency Pairs Simultaneously?

Utilizing multiple currency pairs simultaneously is common among forex traders seeking to diversify their portfolios and maximize profits. Trading on different currencies allows for greater flexibility in responding to market changes and finding profitable opportunities across varying economic conditions.

However, the effectiveness of Trading on multiple currency pairs depends mainly on the trader’s strategy and risk management techniques. It is essential that traders thoroughly research each currency pair they wish to trade, including factors such as geopolitical events, interest rates, and macroeconomic indicators, to make informed decisions about when to enter or exit positions.

Utilizing multiple currency pairs can be a valuable tool for increasing profitability but requires the trader’s careful consideration and attention to detail.

Does The Fundamental Trader Ea Require Manual Intervention, Or Is It Fully Automated?

Whether the Fundamental Trader EA requires manual intervention or is fully automated is a relevant concern for traders considering its use.

As an analytical tool, the EA’s ability to process large volumes of data and interpret market trends has contributed significantly to its popularity among Forex fundamental traders.

However, it is essential to note that although the EA can operate autonomously, human oversight is still necessary in certain situations, such as unexpected news events that could impact trading outcomes.

Therefore, while the Fundamental Trader EA offers significant information processing and analysis benefits, it is not entirely devoid of manual input requirements.

What Is The Maximum Drawdown Experienced By The Fundamental Trader Ea During Backtesting?

The maximum drawdown experienced during backtesting is a critical metric to consider when assessing the performance of a trading strategy. It indicates the most significant peak-to-trough decline in account equity during the testing period and can serve as a measure of risk tolerance for potential investors.

The exact value of this figure for any particular trading system will depend on various factors such as market conditions, trade frequency, and position sizing. Therefore, it is essential for traders to carefully analyze historical data to gain insight into how their strategies perform under different scenarios and make informed decisions about risk management going forward.

Is The Fundamental Trader Ea Compatible With All Major Forex Trading Platforms?

The compatibility of trading software with various forex platforms is crucial for traders seeking to automate their investment strategies, and ensuring that the chosen EA can seamlessly integrate with the trader’s preferred platform without technical difficulties or errors is essential.

Therefore, conducting thorough research and testing before adopting an automated trading system is recommended to avoid costly mistakes during live trading sessions. Additionally, keeping abreast of technological advancements and emerging algorithmic trading trends can help traders make informed decisions when selecting suitable EAs for their specific needs.

Conclusion

The forex market is highly competitive and dynamic, which makes it challenging for traders to make consistent profits. However, with the advent of trading software like the Fundamental Trader EA, traders can now automate their trading strategies based on fundamental analysis.

The Fundamental Trader EA is a sophisticated expert advisor that leverages economic news releases and other vital indicators to execute profitable trades in real-time. With its fully automated system, users do not require manual intervention during trading sessions, allowing them to focus on other aspects of their portfolio management.

Although backtesting results indicate some drawdown, the potential benefits of using the Fundamental Trader EA far outweigh these risks.

Furthermore, as long as users can access popular Forex trading platforms such as MetaTrader 4 or 5, they can easily integrate this powerful tool into their portfolios.

Overall, by utilizing the advanced features of the Fundamental Trader EA effectively, investors can optimize their returns while minimizing risk exposure across multiple currency pairs simultaneously.

As always in forex trading, success depends on sound financial planning and strategic decision-making based on thorough research and analysis.