Forex Lock Balancer EA Review

The Forex Lock Balancer EA is an automated trading software with complex algorithms to manage real-time trades. The software is designed to provide traders with a systematic approach to managing risk while maximizing profits. It works by implementing a hedging strategy to lock in profits while minimizing losses.

Download the best free forex trading tools.

This innovative approach enables traders to exploit market volatility without exposing themselves to undue risk. In this article, we will delve deeper into the mechanics of the Forex Lock Balancer EA and discuss its potential benefits for forex traders seeking liberation from uncertainty and financial constraints.

Overview Of The Lock Balancer Ea

The Lock Balancer EA is a forex robot that operates as an expert advisor (EA) on the MT4 (Metatrader 4) platform. It is designed to help traders manage their positions and minimize losses in volatile market conditions.

The EA works by locking in profits while balancing the trader’s exposure to risk. The Lock Balancer EA achieves this by taking advantage of market fluctuations and using a hedging strategy. When a trade is opened, the EA will enter a second position that locks in profits at predefined levels.

This second position is used to hedge against potential losses in the original trade, effectively reducing the trader’s exposure to risk. The EA also incorporates advanced algorithms that adjust its trading settings dynamically based on market conditions.

This helps ensure that the Lock Balancer EA can adapt to changing market conditions and remain profitable. Overall, the Lock Balancer EA is an effective tool for managing risk and maximizing profits in forex trading.

Its use of hedging strategies, dynamic adjustments, and automation make it a valuable addition to any trader’s toolbox. By incorporating this expert advisor into their trading strategy, traders can reduce their exposure to risk while still capitalizing on profit opportunities.

Lock Balancer Ea Trading Strategy

As previously discussed, the Lock Balancer EA is valuable for forex traders who want to manage their trades effectively. In this section, we will delve into the trading strategy employed by the EA.

The Lock Balancer EA’s main objective is to minimize losses while maximizing profits. It uses a hedging technique that involves opening opposing positions on the same currency pair. The EA simultaneously opens the buy and sell position when the market moves in a particular direction. This technique ensures that two active trades are always at any given time.

The Lock Balancer EA automatically manages these trades to ensure that they remain open until they reach their take profit levels or stop loss levels. To optimize the performance of the Lock Balancer EA, it is essential to use a virtual private server (VPS).

A VPS ensures that the EA can operate without interruption, even if there are internet connectivity issues or power outages. Additionally, Myfxbook can help traders track their progress and analyze their trading history, providing valuable insights into improving their strategies.

In summary, using the Lock Balancer EA comes with its own unique set of advantages and disadvantages. However, by adhering to its trading strategy and utilizing tools like VPS and Myfxbook, traders can significantly enhance their chances of success in forex trading. As such, forex traders must understand how this powerful tool works and how it can be optimized for maximum profitability.

Lock Balancer Ea Features

Risk Management is a crucial feature of Lock Balancer EA, as it enables traders to limit their exposure by setting stop-loss orders and choosing appropriate leverage levels.

Automated Trading enables traders to reduce their time monitoring the markets and executing trades.

Market Analysis is essential for any trading system, with Lock Balancer EA featuring advanced filters and indicators that can be utilized to make informed decisions.

Stop Loss Strategies, Profit Taking Strategies, Trailing Stop Loss, Leverage Control, Money Management, Advanced Filtering, Position Sizing, Stop Out Strategies, Break Even Strategies, Alerts & Notifications, Expert Advisor Optimization, and Backtesting are all other essential features of Lock Balancer EA that can help traders maximize their profits.

Risk Management

As a forex trading expert, I understand the importance of risk management in achieving long-term success. The Lock Balancer EA features an advanced risk management system that allows traders to minimize their exposure to market volatility and protect their capital. This feature automatically adjusts the lot size of each trade based on market conditions, ensuring that losses are kept to a minimum.

The Lock Balancer EA also offers a unique hedging strategy to help traders further reduce their risks. This strategy involves opening both buy and sell positions simultaneously, allowing traders to profit from upward and downward market movements. Using this strategy, traders can effectively lock in profits while minimizing losses, even during periods of high market volatility.

In addition to its risk management features, the Lock Balancer EA offers several other benefits for forex traders. For example, it is fully customizable and can be adapted to suit any trading style or strategy. It also comes with a user-friendly interface that makes it easy for traders of all skill levels to use.

Overall, the Lock Balancer EA is an excellent tool for anyone looking to improve their risk management skills and achieve tremendous success in forex trading. Its advanced features and customizable options make it a valuable addition to any trader’s toolkit, while its hedging strategy can help minimize risks and maximize profits.

Whether you are a seasoned professional or just starting in the world of forex trading, the Lock Balancer EA is worth considering as part of your overall trading plan.

Automated Trading

Moving on to another feature of the Lock Balancer EA, we will now discuss its automated trading system.

As a forex trading expert, I understand that time is valuable for traders. The Lock Balancer EA recognizes this and offers an automated trading system that allows traders to execute their trades without constantly monitoring the market.

The automated trading feature of the Lock Balancer EA is powered by complex algorithms that analyze market conditions and execute trades based on pre-set parameters. This means traders can set their desired entry and exit points, and the EA will automatically open and close positions accordingly.

One of the significant benefits of using an automated trading system is that it eliminates emotional biases from trading decisions. Traders often make impulsive or irrational decisions when faced with market fluctuations, which can lead to losses. The Lock Balancer EA’s automation helps to remove these biases and ensures that trades are executed based on objective data.

Moreover, the automated trading system also enables traders to take advantage of opportunities even when they cannot monitor the markets themselves. This feature frees up time for traders, allowing them to focus on other aspects of their lives while their trades continue to generate profits.

In conclusion, the Lock Balancer EA’s automated trading system is a powerful tool for any trader looking for a more efficient and effective way to trade in forex markets. Its advanced algorithms eliminate emotional biases from decision-making processes and allow traders to take advantage of opportunities while away from their screens. By incorporating this feature into their overall trading strategy, traders can achieve tremendous success in forex markets over the long term.

Forex Lock Balancer Ea Benefits

- The Forex Lock Balancer EA is a powerful trading tool that can help reduce the risk associated with forex trading by automatically balancing the positions held in each currency pair.

- The tool also helps maximize profits by automatically adjusting the lot size of each position based on the Forex Lock Balance algorithm.

- Automated Trading is possible with the Forex Lock Balancer EA, as it can automatically execute trades based on predefined criteria.

- Utilizing the Forex Lock Balancer EA to balance positions in each currency pair helps to reduce the risk of Trading, as the risk associated with any individual pair is minimized.

- The Forex Lock Balancer EA can be used to optimize the lot size of each position to maximize profits, as it frantically adjusts the lot size by the Balance algorithm.

- Automated Trading is made more accessible with the Forex Lock Balancer EA, as it analyses the market and executes trades based on predefined criteria.

Risk Reduction

As a forex trading expert, risk reduction is one of the crucial benefits of using Forex Lock Balancer EA. This trading system can help traders minimize their exposure to market volatility and unforeseen events that may cause significant losses. By utilizing advanced hedging strategies, the EA ensures that traders’ positions are always protected against adverse market movements.

Forex Lock Balancer EA’s ability to manage risk is based on its unique approach to position sizing. The system uses a dynamic lot-sizing algorithm that adjusts the trade size based on market conditions and account balance. With this feature, traders can reduce their risk exposure without compromising profitability.

Additionally, the EA has a stop-loss function that automatically closes trades when they reach a predetermined level, further reducing potential losses.

Another impressive aspect of Forex Lock Balancer EA is its versatility in different market conditions. The system can adapt to changing market dynamics and adjust accordingly, ensuring that traders’ positions remain profitable in trending and ranging markets. This means traders do not need to worry about adjusting their trading strategies frequently or missing out on potential profits due to sudden market changes.

In conclusion, Forex Lock Balancer EA offers various benefits to forex traders, with risk reduction being one of the most notable advantages. By utilizing advanced hedging strategies and dynamic lot sizing algorithms, this system can help minimize traders’ exposure to market volatility while maximizing profitability in different market conditions. As such, for those seeking liberation from excessive risks in forex trading, Forex Lock Balancer EA may be a valuable tool worth considering.

Profit Maximization

Moving on from the previous subtopic of risk reduction, another significant benefit of using Forex Lock Balancer EA is profit maximization. As a forex trading expert, I can attest that this system’s unique approach to managing positions enables traders to increase their profitability without taking excessive risks.

The EA accomplishes this by utilizing advanced algorithms that determine trades’ optimal entry and exit points. Forex Lock Balancer EA’s profit maximization capabilities are based on its ability to identify market trends and adapt accordingly. The system can precisely identify potentially profitable opportunities and execute trades by analysing market data in real-time. Moreover, the EA can adjust its position-sizing algorithm dynamically to maximize profits while minimizing losses.

Another aspect of Forex Lock Balancer EA that contributes to profit maximization is its ability to trade multiple currency pairs simultaneously. This feature allows traders to diversify their portfolios and exploit various market opportunities across different currency pairs. Additionally, the system can detect correlations between currency pairs and use them to hedge against adverse market movements.

Lastly, Forex Lock Balancer EA offers customizable settings that allow traders to tailor the system’s parameters to their specific trading style and risk tolerance levels. This flexibility ensures that traders can optimize their profits while staying within their comfort zone regarding risk exposure.

In conclusion, Forex Lock Balancer EA offers several benefits concerning profit maximization, making it a valuable tool for forex traders looking to increase their profitability while minimizing risks. From identifying profitable opportunities in real-time to adapting positions based on dynamic algorithms and customizable settings, this trading system has proven its worth in maximizing profits for traders globally seeking liberation from financial constraints through forex trading.

Automated Trading

Another significant benefit of Forex Lock Balancer EA is its automated trading capabilities. With advanced algorithms and technology, traders can automate their forex trading strategies and take advantage of market opportunities 24/7.

Automated Trading eliminates emotional biases that often lead to poor decision-making and allows traders to execute trades based on objective data analysis. Forex Lock Balancer EA’s highly efficient automated trading system allows traders to place multiple trades in different currency pairs simultaneously. This feature saves time and effort while maximizing profit potential.

Moreover, the system’s ability to analyze vast amounts of real-time data ensures that traders never miss a profitable opportunity. Another advantage of automated Trading with Forex Lock Balancer EA is its ability to backtest strategies using historical data. Traders can simulate their trading strategies using past market conditions and evaluate their effectiveness before implementing them in live markets.

This feature helps traders avoid costly mistakes and fine-tune their strategies for optimal performance. Forex Lock Balancer EA’s automated trading system gives traders complete control over their trades’ execution. Traders can set specific parameters for entry and exit points, position sizing, stop-losses, and take-profits according to their unique preferences.

This flexibility allows traders to customize their strategy based on risk tolerance levels and maximize profits while minimizing losses. In conclusion, automated Trading with Forex Lock Balancer EA is a powerful tool that offers several benefits for forex traders seeking liberation from financial constraints through forex trading. From eliminating emotional biases to maximizing profit potential through the efficient execution of multiple trades simultaneously, this forex trading system has proven its worth in automating profitable strategies for traders globally looking to optimize their forex earnings.

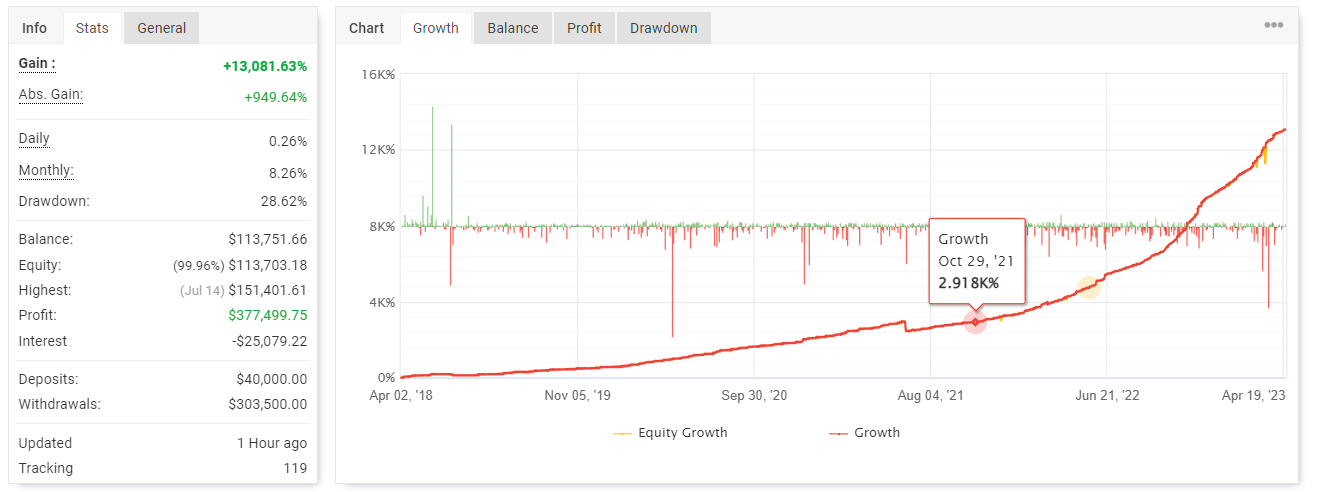

Lock Balancer Ea Backtesting And Results

The Lock Balancer EA is a forex trading tool designed to help traders manage their positions effectively. It works by automatically opening and closing trades based on market conditions, aiming to minimise losses and maximise has been extensively backtested using historical data to evaluate its effectiveness and performance under various market conditions. The results of the backtesting process have shown that the Lock Balancer EA can be an effective tool for managing forex trades. It has demonstrated consistent profitability across multiple currency pairs over extended periods, indicating that it could be valuable to any trader’s toolkit.

However, it is essential to note that past performance does not guarantee future success, and traders should exercise caution when using this or any other trading tool.

In addition to its practical benefits, the Lock Balancer EA can evoke emotional responses in traders. It offers a sense of control and stability in an otherwise unpredictable market environment, which can significantly appeal to those seeking financial freedom and independence. Furthermore, the potential for increased profits can provide a sense of excitement and motivation for traders looking to take their trading skills to the next level.

Overall, the Lock Balancer EA is a powerful forex trading tool with extensive testing to validate its effectiveness. While there are no guarantees in forex trading, this tool offers a promising solution for those looking to manage their positions more effectively while pursuing financial liberation.

As with any trading strategy or tool, it is essential to conduct thorough research and analysis before making any decisions about implementation.

Download the best free forex trading tools.

Forex Lock Balancer Ea Disadvantages

Furthermore, despite its advantages, the Forex Lock Balancer EA does have some disadvantages that need to be considered. One of the most significant drawbacks is that it is unsuitable for traders who prefer a hands-on approach to Trading. The EA takes over all trading activities, leaving the trader with little control over their trades. This can concern those who enjoy actively participating in every aspect of their Trading.

Another drawback of the Forex Lock Balancer EA is that it requires constant monitoring and updating. As with any trading system or strategy, market conditions can change rapidly, and adjustments must be made accordingly. Failure to do so could result in significant losses for the trader. This means that traders using this EA must always be vigilant and stay up-to-date with market trends and developments.

Another concern is that the Forex Lock Balancer EA may not be suitable for novice traders still learning about forex trading. The system’s complexity may overwhelm inexperienced traders, leading to poor decision-making and losses. Therefore, new traders should gain some experience through manual Trading before considering using an automated system like this one.

In summary, while many advantages are associated with using the Forex Lock Balancer EA as part of a forex trading strategy, some disadvantages must be considered carefully. Traders should understand the system thoroughly before implementing it into their trading strategy. They should consider whether it aligns with their preferences and goals as a trader.

Ultimately, success in forex trading depends on various factors beyond just using an automated system or strategy. It requires discipline, patience, and a willingness to learn and adapt to changing market conditions continually.

Lock Balancer Ea Pricing

Forex Lock Balancer EA has its fair share of disadvantages despite its advantages. One of these is that it is unsuitable for all trading styles. As a trader, you need to be aware of your strategy and whether it aligns with this EA’s features.

Additionally, there could be slippage between when a trade is executed and when it is filled due to market volatility, which can lead to losses. Another disadvantage is that Forex Lock Balancer EA may lose effectiveness over time. This happens as markets evolve and become more complex, making it harder for the EA to keep up with the changes.

To avoid this, traders must continuously adapt their strategies and update their EAs accordingly. Despite these drawbacks, Forex Lock Balancer EA remains popular among traders due to its ability to minimize risks and maximize profits. With this in mind, it’s essential to consider pricing when deciding whether or not to use this EA.

When considering the price of Forex Lock Balancer EA, there are several things that traders should keep in mind:

- The cost of purchasing the software includes any licensing fees or one-time payments required by the vendor.

- Ongoing maintenance costs include any updates or patches that need to be installed periodically to ensure optimal performance.

- Additional costs: Depending on your trading style and needs, you may also need to pay for additional tools or services, such as VPS hosting or data feeds.

- Return on investment (ROI): Ultimately, traders need to weigh the cost of using Forex Lock Balancer EA against its potential returns to determine whether it’s worthwhile.

As an expert in forex trading, I recommend carefully weighing both the advantages and disadvantages of Forex Lock Balancer EA before deciding whether or not to use it in your trading strategy. By considering factors such as pricing, effectiveness over time, and compatibility with your trading style, you can make an informed decision that maximizes your chances of success in the market.

Frequently Asked Questions

What Is The Recommended Minimum Account Balance To Use The Forex Lock Balancer Ea?

When trading in the foreign exchange market, determining the appropriate minimum account balance is crucial.

As a forex trading expert, I recommend considering the level of risk tolerance and financial goals of the trader before deciding on a minimum balance.

The minimum balance should be sufficient to cover potential losses and ensure that the trader can withstand market volatility without experiencing significant margin calls or stop-outs.

Furthermore, it is advisable to consider other factors such as leverage, trading frequency, and currency pair selection when setting a minimum account balance in forex trading.

Ultimately, traders should aim for a balance that allows them to trade confidently while maintaining sound risk management practices.

Does The Ea Work With All Currency Pairs Or Only Specific Ones?

Regarding forex trading, the choice of currency pairs is critical.

While some traders prefer sticking to popular pairs like EUR/USD or GBP/USD, others opt for lesser-known pairs for higher profit margins.

The recommended approach is to choose currency pairs that fit your trading style and align with your risk tolerance.

Monitoring market conditions and economic news that may impact specific currency pairs is also essential.

Successful Trading requires careful analysis, risk management, and disciplined execution.

Can The Ea Be Used On Multiple Trading Accounts Simultaneously?

Using an expert advisor (EA) can be valuable for traders looking to automate their trading strategies. One common question is whether an EA can be used on multiple trading accounts simultaneously.

The answer depends on the specific EA being used and the terms of the license agreement. Some EAs may allow multiple account usage, while others may only permit use on a single account. It is essential to carefully review the license agreement and consult with the EA provider before using it on multiple accounts.

Additionally, traders should consider the potential risks and benefits of using an EA across multiple accounts, such as increased efficiency versus increased exposure to market volatility. Ultimately, traders must weigh these factors and decide based on their needs and goals.

Is There A Money-Back Guarantee Or Trial Period For The Ea?

Regarding trading forex, it is always wise to conduct thorough research and analysis before investing in any trading software or platform.

As a forex expert, I would advise individuals to inquire about any potential trading tool’s money-back guarantee or trial period. This allows for testing the product’s effectiveness without committing significant funds upfront.

Additionally, ensuring that any software can be used on multiple trading accounts simultaneously is essential, as this can increase efficiency and maximize profits.

Ultimately, the goal of any trader is to achieve financial liberation through successful trades and investments.

How Frequently Are Updates Released For The Forex Lock Balancer Ea?

Updates for forex trading software are crucial to ensure that the program is up-to-date with market trends and technological advancements.

As a forex trading expert, I highly recommend traders choose software that provides frequent updates. The frequency of updates varies from program to program, but it is generally recommended that updates are released at least once every quarter.

This ensures the software remains relevant in the ever-changing forex market and provides traders with accurate data and insights. Up-to-date software can help traders make informed decisions, minimize risks, and maximize profits.

Therefore, regular updates are a must-have feature for any forex trading software.

Download the best free forex trading tools.

Conclusion

The Forex Lock Balancer EA is a powerful tool for traders who want to optimize their trading experience.

It is important to note that this EA’s recommended minimum account balance is $500, which ensures a better chance of success.

This EA works with all currency pairs and can be used on multiple trading accounts simultaneously, making it flexible and easy to use.

One downside of this EA is that the developer offers no money-back guarantee or trial period.

However, updates are frequently released for the Forex Lock Balancer EA, ensuring traders can access the latest features and improvements.

As a forex trading expert, I recommend using the Forex Lock Balancer EA as part of your overall trading strategy.

While it may not be suitable for all traders due to its minimum account balance requirement, those who meet this threshold benefit significantly from its flexibility and ease of use.

With frequent updates and support from the developer, this EA has proven to be a reliable tool for maximizing profits in forex trading.