The Firestorm Odin EA: A Unique Automated Trading Solution

The Firestorm Odin EA is an automated trading robot designed for the popular MetaTrader 4 (MT4) forex trading platform. Developed by the team at Firestorm Academy, this expert advisor (EA) utilizes a unique blend of price action analysis and support and resistance strategies to identify potential trading opportunities.

Download the best free forex trading tools.

Overview of the Firestorm Odin EA

Unlike many other forex robots that rely on risky high-frequency trading or grid trading methods, the Firestorm Odin EA takes a more measured approach based on key levels in the market. As described by Firestorm Academy, it is a “Support & Resistance, Price Action Bot”.

Specifically, the EA analyzes price action and volatility to determine possible support and resistance levels. It then watches these levels closely for breakouts and rejections to trigger buy and sell trades automatically.

The Firestorm team emphasizes that Odin is not a “magic wand” that will make traders instantly profitable. Instead, it is a sophisticated trading tool that can aid manual traders or complement other trading strategies. Mastering the EA takes dedication through demo testing, understanding the various inputs, and managing risk appropriately.

Main Features and Benefits

The Firestorm Odin EA comes packed with features that accommodate different trading needs:

- Flexibility: The EA can run seamlessly 24 hours a day, 5 days a week on major forex pairs (EURUSD, GBPUSD etc) as well as indices like NAS100. This allows traders to capitalize on opportunities whenever they arise.

- Customization: Users can tweak a range of input settings to control elements like trade sizes, entry rules, time filters, and more. The EA also supports using custom set files for greater optimization.

- Beginner friendly: With the ability to run on a $100 live account using small 0.01 EURUSD lot sizes, Firestorm Odin can appeal to traders still getting started.

- Advanced technology: Seasoned traders can enable the machine learning-powered “Firestorm AI” module for boosted performance and accuracy between 86-100%, depending on market conditions.

In terms of brokers and accounts, Firestorm Academy recommends using an ECN broker with tight spreads. Running the EA on a Virtual Private Server (VPS) ensures the best results, but it can still work effectively on a personal computer.

Performance and Results

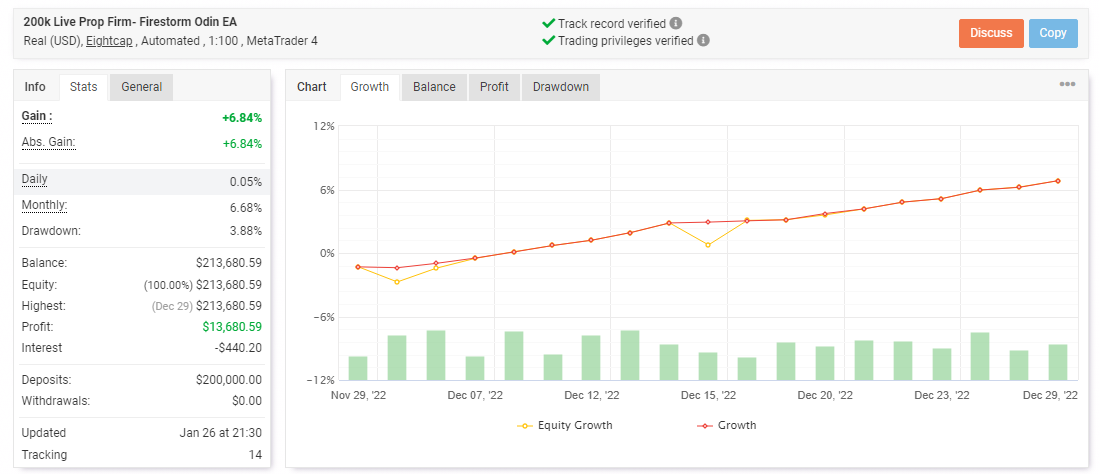

One of the most impressive aspects of the Firestorm Odin EA is its real-world track record using live trading accounts.

As documented on Myfxbook, Odin has achieved consistent profits over multiple months on a $200,000 prop firm account, with 835 pips gained and a relatively small 3.78% drawdown. The EA has also shown positive results across various pairs when demo traded with $100,000 virtual funds.

These stellar results showcase Odin’s capabilities and give traders more confidence in the EA before committing real capital. However, as with any trading system, past performance does not guarantee future outcomes.

Using the Firestorm Odin EA

The Firestorm team provides detailed instructions on using Odin effectively:

- Choose assets wisely: The EA performs best on major pairs like EURUSD and GBPUSD as well as indices like NAS100. Consider testing different assets in demo mode first.

- Optimize settings: Take time to understand all the input settings for trade management, risk control, etc. The set files can guide you, but further optimization may improve performance.

- Use proper position sizing: For EURUSD, use just 0.01 lots per $100 capital as a baseline. For indices, allow $1500 per 0.01 lots.

- Monitor regularly: Actively check on open trades and the EA’s activity. Disable trading if issues arise and contact Firestorm support if needed.

Following these tips helps avoid common mistakes like overleveraging and ensures Odin trades successfully.

Download the best free forex trading tools

Purchase Costs and Licensing

As a premium software product with extensive development behind it, the Firestorm Odin EA does come at a cost. Traders can purchase an unlimited use license of Odin V3 for $997 directly from the Firestorm Academy website.

However, at the time of writing, discounted pricing is also available through approved Firestorm vendors:

- MQLShop offers a license for $697

- Forex EA Store sells Odin V3 for only $14

These vendors may also bundle additional resources like set files, video tutorials, or access to trading communities with the EA license. So shopping around can net substantial savings for traders.

Do note that while discounts on technology products can provide great value, traders should still research the vendor carefully and ensure proper after-sales support is available from the Firestorm team directly.

The Verdict?

In conclusion, the Firestorm Odin EA stands out as an exceptional trading software that leverages some of the latest advancements in the field. The combination of price action analysis, flexible customization, and machine learning gives it an edge over the competition.

For traders willing to invest the time and effort to learn this advanced EA properly, it can become an indispensable ally in their trading journey. The proven track record on a live prop firm account also demonstrates this robot’s immense potential.

Overall, if managed well, the Firestorm Odin EA offers a unique automated solution for beating the markets consistently.