Wallstreet Gold Trader Ea Review

If you’re looking for an automated trading system that can help you make a profit in the world of forex trading, then WallStreet GOLD Trader EA could be the solution.

This expert advisor (EA) is designed to work with MetaTrader 4 and 5 platforms, making it accessible to traders around the globe.

WallStreet GOLD Trader EA uses advanced algorithms and strategies to analyze market data and generate buy/sell signals automatically.

It’s easy to use, even if you have no experience with forex trading or coding.

Download the best free forex trading tools.

With its user-friendly interface and customizable settings, this EA is suitable for both novice and experienced traders who want to optimize their profitability while minimizing risk.

Whether you’re looking for a reliable tool to automate your trades or an additional income stream, WallStreet GOLD Trader EA might just be what you need.

Automated Trading Systems

Automated trading systems have become increasingly popular in recent years, especially among traders who want to take advantage of the benefits they offer. These systems use algorithms and computer programs to execute trades automatically based on predefined rules and conditions.

One of the main advantages of automated trading is that it eliminates human emotions from the decision-making process. Traders can be influenced by fear, greed, or other emotions when deciding to buy or sell assets. Automated systems remove this factor entirely, ensuring that trades are executed objectively and without bias.

Another benefit of automated trading is its ability to operate continuously 24/7 without breaks. This means that traders can always take advantage of market opportunities, regardless of their physical location or time zone.

Additionally, automated systems can monitor multiple markets simultaneously, which would be impossible for a human trader to do manually.

Metatrader 4 And 5 Platforms

MetaTrader 4 and 5 are the two most popular platforms traders use worldwide. These platforms provide a powerful tool for trading in multiple financial markets, including forex, stocks, commodities, and cryptocurrencies.

The MetaTrader platform is user-friendly and easy to navigate. It allows users to customize their charts and indicators according to their preferences. Moreover, it has built-in tools such as Expert Advisors (EAs) to automate trading strategies based on pre-set rules.

MetaTrader’s popularity stems from its flexibility and versatility in terms of customization. Here are some key features available on both MT4 and MT5:

- Multiple order types

- Advanced charting capabilities

- Customizable indicators

- Support for algorithmic trading through EAs

- A large community of developers offering add-ons and plugins

Overall, MetaTrader 4 and 5 are excellent choices for traders looking to implement automated strategies or conduct technical analysis with ease. With these platforms’ extensive features, one can take advantage of market opportunities quickly and efficiently without hassle.

Traders can also access various educational resources online to learn more about using the MetaTrader platforms effectively. By mastering this software’s functionality, traders have an edge when executing trades profitably in today’s fast-paced financial markets.

Wallstreet Gold Trader Advanced Algorithms And Strategies

Traders are always looking for new and innovative ways to maximize their profits. One popular method is using advanced algorithms and strategies in trading. These algorithms can help traders make decisions based on complex data analysis, ultimately leading to greater returns.

One example of an advanced algorithm is machine learning, which involves teaching a computer program to identify patterns in market behaviour. The program can then use these patterns to predict future trends with a higher degree of accuracy than traditional methods.

Another strategy that has gained popularity in recent years is high-frequency trading, which uses powerful computers and lightning-fast internet connections to execute trades faster than humanly possible.

While these techniques may seem daunting to those unfamiliar with them, they have become increasingly accessible as technology continues to advance. Many software programs now offer pre-built algorithms that can be easily integrated into a trader’s existing platform.

In addition, online communities of traders often share their custom algorithms and strategies, creating a collaborative environment where everyone benefits from shared knowledge.

By utilizing advanced algorithms and strategies, traders can gain an edge over the competition and increase their chances of success in the volatile world of Wall Street. While it may take some time to master these techniques, the potential rewards are well worth the effort.

As long as traders remain vigilant and adaptable in an ever-changing market, there will always be opportunities for profit through innovative approaches like these.

User-Friendly Interface And Customizable Settings

As a user, you want an interface that is easy to navigate and understand. The WallStreet Gold Trader EA delivers just that with its simple yet intuitive platform. You will not need to be a tech-savvy trader to operate this software.

In addition to the user-friendly interface, the customizable settings of the WallStreet Gold Trader EA allow you to tailor your trading experience according to your preferences. This feature enables traders to optimize their strategies for better results in the market.

With numerous customization options, you can control how you trade gold. With a few clicks on your mouse or taps on your mobile device screen, you can access all these features and start trading like a pro.

Whether you are new to trading or experienced in the industry, the WallStreet Gold Trader EA offers unparalleled convenience and flexibility in its design.

Optimizing Profitability And Minimizing Risk

Now that we’ve discussed the user-friendly interface and customizable settings let’s delve into optimizing profitability and minimizing risk with the Wallstreet Gold Trader EA.

First and foremost, it’s essential to understand your trading goals and set realistic expectations for profit margins. The EA allows you to customize various parameters such as stop loss levels, take profit targets, and trade volumes which can significantly impact your overall returns.

Secondly, monitoring market conditions is crucial in maximizing profits while reducing risk exposure. With the Wallstreet Gold Trader EA, you can access real-time data feeds, including charting tools and technical indicators that aid in making informed decisions on when to enter or exit a position.

Now that we’ve covered some key strategies for optimizing profitability and minimizing risk remember that successful trading also requires discipline and patience. It mMakingulsive trades based on emotions or rumours, but it may be tempting; sticking to predefined rules can lead to consistent profits over time.

Key Points:

- Set realistic profit goals

- Customize parameters like stop-loss levels & volume

- Monitor market conditions through real-time data feeds

- Stick to a well-defined trading strategy and avoid impulsive decisions

Frequently Asked Questions

What Is The Minimum Investment Required To Use ‘Wallstreet Gold Trader Ea’?

One may wonder about the minimum investment required to use the Wall Street GOLD Trader ea.

The answer to this question can vary depending on factors such as the broker being used, the desired risk level, and account type.

However, typically a minimum deposit of $500-$1000 is recommended to start trading with most brokers.

It’s essential to remember that investing always carries risks, so it’s important only to invest what you can afford to lose and do thorough research before making any decisions.

Can Wallstreet Gold Trader ea Be Used On Multiple Trading Accounts?

Yes, the ea can be used on multiple trading accounts. This is an excellent feature for those with multiple accounts who want to utilize the same strategies without manually entering trades on each account.

It also allows for easier tracking of overall performance across all accounts. However, it’s important to note that some brokers may have restrictions or fees for using an ea on multiple accounts, so it’s always best to check with your broker before making any changes.

Download the best free forex trading tools

Does The Ea Have Any Features For Managing Drawdowns?

Yes, the EA has several features for managing drawdowns.

It includes a stop loss and trailing stop feature to minimize losses during unfavourable market conditions.

Additionally, it offers a risk management tool that allows traders to set their preferred risk level and adjust position sizing accordingly.

The EA also provides real-time monitoring of account balance and equity levels to help identify potential drawdown risks early on.

These features can be especially useful in volatile markets where sudden price movements can quickly lead to significant losses.

How Often Are Updates Released For The Ea?

Updates for the ea are released regularly, and users can expect to receive new features and improvements consistently.

While the frequency of updates may vary depending on the developer’s schedule and priorities, most reputable trading software companies commit to keeping their products up-to-date with the latest market trends and user feedback.

Whether adding new algorithms for better performance or tweaking existing parameters to improve drawdown management, traders can rest assured that they will always have access to the latest tools and technology when using this powerful automated trading system.

Is There Any Customer Support Available For Technical Difficulties With The Ea?

If you are experiencing technical difficulties with an EA, knowing customer support is essential.

Many companies offer various levels of support for their products, from online forums and knowledge bases to direct contact with a representative.

Understanding what kind of assistance you can expect before purchasing or using the product is crucial.

Knowing someone is available to help troubleshoot any issues can give you peace of mind and confidence in your investment.

Wallstreet Gold Trader EA Conclusion

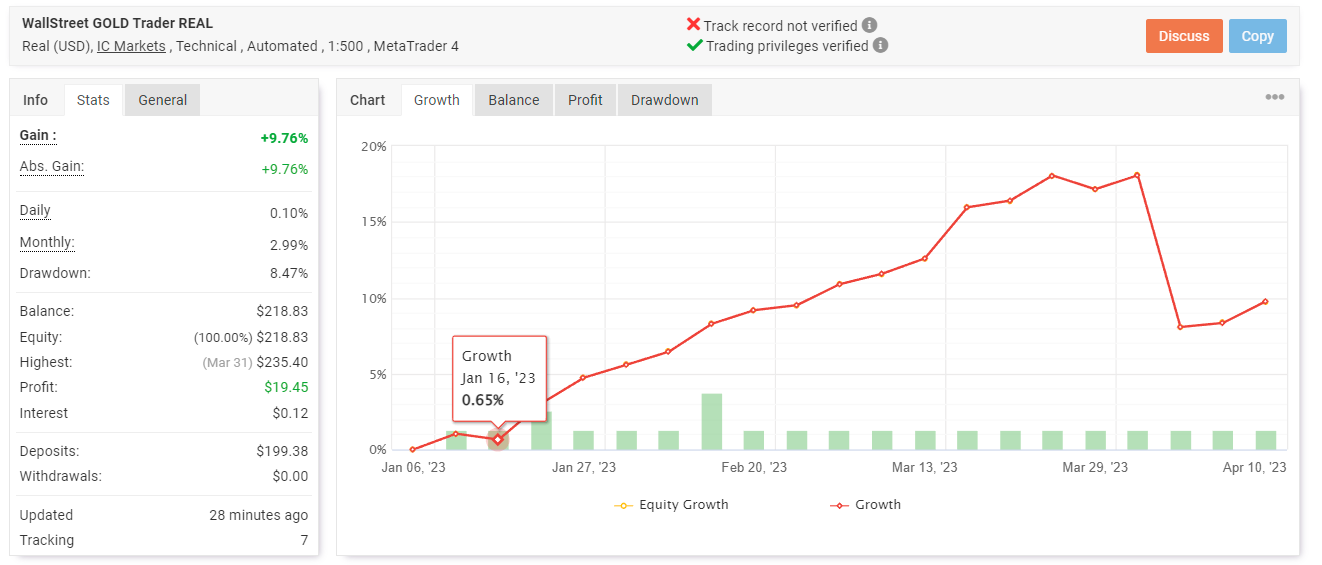

Overall, the Wall Street GOLD Trader ea is an excellent option for those investing in gold trading. The minimum investment required to use this ea may vary depending on your broker, but having at least $5000 in your account is generally recommended.

One of the best things about this ea is that it can be used on multiple trading accounts, which makes it easier to diversify your portfolio.

Additionally, the ea has features for managing drawdowns and minimizing losses, which can help protect your investments.

If you encounter any technical difficulties with the ea, customer support can assist you.

Overall, the Wall Street GOLD Trader ea is worth considering if you’re looking for an effective way to invest in gold trading.