Road To One Million EA Review

The Forex market is a vast and dynamic financial arena that offers immense opportunities for traders to make substantial profits. However, trading in the Forex market requires extensive knowledge of the underlying mechanisms that drive price movements and an intricate understanding of technical analysis tools. An effective way to gain an edge in this highly competitive industry is by using automated trading systems or expert advisors (EAs). The Forex Road to One Million EA is an automated system designed to help traders achieve consistent profitability by automating their trading strategies.

Download the best free forex trading tools.

The system uses advanced algorithms programmed to analyze multiple currency pairs simultaneously, identify profitable trade setups, and execute trades based on preset parameters. This article will delve deeper into how the Forex Road to One Million EA works, its key features and benefits, and why it’s considered one of the most reliable EAs in the market today.

Overview Of The Road To One Million Ea

The Road to one million EA is an automated trading system built on the MetaTrader 4 (MT4) platform. It operates as a forex robot, also known as Forex Expert Advisor (EA), and is designed to trade currency pairs without human intervention.

This EA aims to generate profits by analyzing market trends, identifying entry and exit points, and executing trades automatically.

The development of this EA requires access to reliable data sources that provide real-time quotes for various currency pairs. Traders can use their brokers’ historical or live data feeds to backtest their strategies before deploying them in a live environment. Additionally, traders need a Virtual Private Server (VPS) hosting service to ensure constant connectivity between the MT4 platform and the internet.

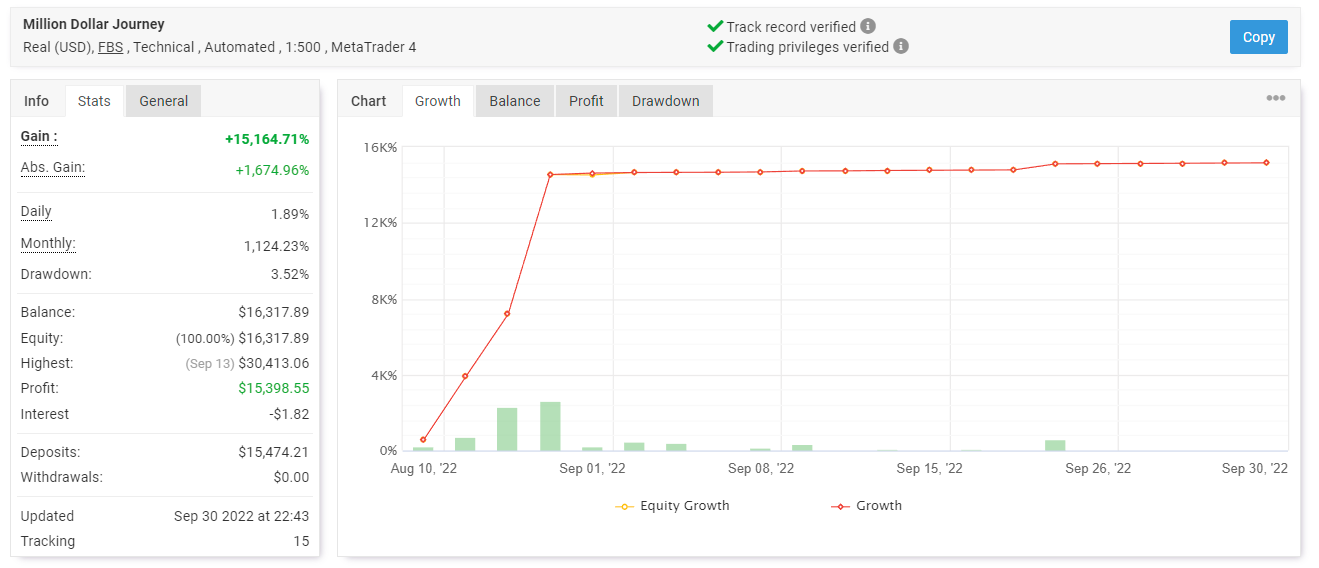

To evaluate the performance of the road to one million EA, traders can utilize Myfxbook. This online analytical tool provides comprehensive statistics about trading activities such as profit/loss ratios, drawdowns, win rates, etc. This enables traders to monitor the performance of their EAs in real time and make necessary adjustments based on changing market conditions.

Incorporating proven strategies with advanced technology has enabled forex traders worldwide to achieve financial freedom through automated trading systems like the Road To One Million EA. As advancements continue within the industry, more innovative tools will become available, allowing even more excellent opportunities for success.

Road To One Million Ea Trading Strategy

The Road to One Million EA Trading Strategy is popular among forex traders seeking automated trading solutions. This approach involves using an Expert Advisor (EA) or FX EA, essentially an algorithmic program designed for use with the MetaTrader 4 platform.

This software allows traders to execute trades automatically without monitoring the market manually. One of the key advantages of implementing this strategy is that it eliminates human error from the trading process.

The Forex market operates globally and constantly fluctuates in response to various economic events and geopolitical developments. With an FX Expert Advisor running on a Virtual Private Server (VPS), traders can ensure their strategies are executed accurately and quickly, even when they’re not actively monitoring their positions.

Forex traders should remember that there are inherent risks involved with any investment venture, including the Foreign Exchange Market. While the Road to One Million EA Trading Strategy has proven successful for some traders, others have experienced losses due to sudden price movements or technical glitches within their software.

It’s essential to do your research before committing to any specific approach and consider consulting with experts in the field for personalized advice based on your individual goals and risk tolerance levels.

Benefits of Implementing Road to One Million EA Trading Strategy:

- Provides automation of trade execution

- Eliminates human errors

- Can operate around-the-clock

- Can leverage technology advancements

In summary, automating one’s trading through implementing an Expert Advisor like those used in the Road To One Million EA Trading strategy provides numerous benefits while also requiring careful consideration by investors, given the potential drawbacks associated with foreign exchange markets.

Traders must consider several aspects, such as security considerations, when choosing virtual private servers for hosting these EAs, to not compromise personal information or funds during electronic trades over networks spanning nations worldwide!

Forex Road To One Million Ea Features

- Automated trading strategies allow traders to use computer-generated algorithms to execute trades on the foreign exchange market.

- Risk management tools are essential to automated trading strategies, as they help limit losses and protect traders’ capital.

- Money management strategies are also essential for successful trading, as they help traders manage their capital and set stop-loss and take-profit levels.

- The Forex Road to One Million EA offers a range of automated trading strategies designed to maximize profits and minimize losses.

- The EA also provides risk management tools such as stop-loss and take-profit levels and money management strategies to help traders maximize their returns and limit their losses.

- The Forex Road to One Million EA provides an all-in-one solution for traders seeking automated trading strategies and risk management tools.

Automated Trading Strategies

Auto trading strategies have gained significant popularity in the forex market, particularly with the emergence of advanced technologies.

Auto trading systems, also known as ‘robots,’ are pre-programmed to execute trades based on specific parameters set by traders. These algorithms can analyze vast amounts of data and make decisions based on historical trends, technical indicators, and other factors that impact currency prices.

One of the critical advantages of automated trading strategies is their ability to remove human emotions from decision-making processes. Many novice traders struggle with controlling their emotions when making trades, leading to irrational decisions that result in losses. With an fx robot, traders can eliminate these emotional biases and stick to a predetermined strategy without deviation.

Another benefit of automated trading strategies is the speed at which they can execute trades. Unlike manual trading, robots operate 24/7 and can quickly identify profitable opportunities within milliseconds. This allows traders to immediately take advantage of market movements, resulting in more profits.

Incorporating automated trading strategies into your forex road to one million EA features can help increase profitability while reducing human error and emotional risks. As technology advances, we expect even greater levels of automation within the forex market, providing traders with more efficient tools for generating consistent returns.

Risk Management Tools

As the forex market evolves, traders must adapt and incorporate new tools into their trading strategies. One crucial aspect of successful trading is managing risk effectively. Risk management tools can help traders minimize losses and protect profits in volatile markets.

One popular risk management tool used by many experienced traders is stop-loss orders. These orders automatically close a position when prices reach a predetermined level, limiting potential losses. By setting stop-loss orders strategically, traders can manage risk while allowing for potential gains.

Another helpful risk management tool is position sizing. This involves determining the appropriate amount of capital for each trade based on account size, risk tolerance, and other factors. Using proper position sizing techniques, traders can avoid overleveraging their accounts and risking catastrophic losses.

Incorporating practical risk management tools into your forex road to one million EA features can help increase profitability while minimizing risks associated with unpredictable market movements. As the forex market remains highly competitive, it’s essential to stay up-to-date with current trends and utilize advanced technologies that offer an edge in today’s fast-paced environment.

Money Management Strategies

In addition to incorporating practical risk management tools, traders must implement sound money management strategies to achieve their Forex road to one million EA features.

Money management involves managing your trading account’s capital and utilizing it efficiently over time. One common strategy is limiting the amount of capital used in each trade while allowing room for potential profits. This approach can help protect against significant losses while maximizing gains.

Another essential aspect of money management is understanding and using leverage effectively. While leverage can amplify profits, it can also magnify losses if not utilized correctly. Traders should always consider the risks associated with leveraging before entering any trades, ensuring they have a sufficient margin level to avoid being stopped prematurely.

Finally, successful traders employ a disciplined approach when managing their funds. This includes setting realistic targets for profit and loss limits on every position taken. They use appropriate stop-loss levels, monitor their trades closely and adjust them based on market conditions.

By implementing these money management strategies and effective risk management techniques, traders can minimize losses while maximizing returns towards achieving their forex road to one million EA features.

Road To One Million Ea Benefits

- Trading Strategy Optimization is essential in the Road to One Million EA Benefits. It involves analyzing data, testing strategies, and implementing changes to maximize profits.

- Automated Trading Profits can be improved by using automated trading software that can be programmed to execute trades based on predetermined conditions.

- Risk Management Strategies are essential in pursuing one million EA benefits, as they can help mitigate losses and protect profits.

- Technical indicators and chart analysis can be used to identify optimal entry and exit points for trades.

- Risk-to-reward ratios can be adjusted to suit the individual trader’s risk appetite and increase the chances of success.

- Proper money management techniques, like limiting the amount of capital exposed per trade and limiting the amount of total capital at risk, can also help improve the overall profitability of the trading system.

Trading Strategy Optimization

Optimizing trading strategy is crucial to achieving one million EA benefits. It is an ongoing process that involves using different parameters and settings to improve the performance of a trading system while minimizing risks. Optimization can be done manually or automatically through algorithmic methods such as genetic programming and neural networks.

One way to optimize a trading strategy is by backtesting historical market data. This allows traders to analyze how their strategies would have performed in previous market conditions and identify areas for improvement. Backtesting also helps traders determine if their strategies are profitable over time or if they need adjustments based on changes in market dynamics.

Another approach to optimizing a trading strategy is through forward testing. Instead of relying solely on past data, forward testing evaluates the strategy’s effectiveness in real-time market conditions. By continuously monitoring trades and making necessary adjustments, traders can ensure that their strategies remain relevant and profitable over extended periods.

In conclusion, optimizing a forex trading strategy is vital in achieving success on the road to one million EA benefits. Traders must constantly evaluate and adjust their systems using backtesting and forward-testing techniques to maximize profitability while managing risk effectively. With proper optimization, traders can build robust systems that adapt well to changing markets, ultimately leading them towards financial freedom.

Automated Trading Profits

In addition to strategy optimization, automated trading profits are another critical aspect of the road to one million EA benefits.

Automated trading uses computer programs or algorithms that execute trades based on preset rules and conditions.

This approach allows traders to take advantage of market opportunities around the clock without constant monitoring and manual execution.

One benefit of automated trading is its ability to remove emotional biases from decision-making processes.

By using objective criteria and logic-based strategies, traders can avoid making impulsive decisions influenced by fear, greed or other emotions.

Automated systems also allow faster trade executions with minimal lag time compared to manual trading methods.

However, it is essential to note that while automated trading can be profitable when properly implemented, it still requires ongoing monitoring and adjustments as market conditions change.

Additionally, choosing a reliable platform or provider for automated trading services is crucial in ensuring optimal performance and minimizing risks such as technical glitches or cyber-attacks.

Overall, incorporating automated trading into an optimized forex strategy can help traders achieve long-term profitability towards financial freedom.

Risk Management Strategies

As traders strive towards achieving one million EA benefits, risk management strategies should not be overlooked. While forex trading presents lucrative opportunities, it carries significant risks that can lead to devastating losses if proper precautions are not taken.

Risk management is identifying, assessing and prioritizing potential risks while implementing measures to mitigate or avoid them. One approach to risk management in forex trading is through diversification. Diversification involves spreading investments across multiple currency pairs, markets and asset classes to reduce exposure to any market event or economic condition. By diversifying portfolios, traders can minimize losses during high volatility or unexpected events such as political upheaval or natural disasters.

Another critical aspect of effective risk management is setting stop-loss levels for each trade. A stop loss is an order placed with a broker to sell a security when it reaches a specific price point. This strategy allows traders to limit their potential losses by exiting positions before they become too costly. The key is setting appropriate stop-loss levels based on individual risk tolerance and market conditions while avoiding placing stops at arbitrary levels without considering technical analysis factors such as support and resistance levels.

Road To One Million Ea Backtesting And Results

The road to achieving a million-dollar portfolio in forex trading is not easy. It requires discipline, patience, and strategic planning backed by data-driven analysis.

One of the crucial steps towards this goal is thoroughly backtesting your trading strategy using historical market data to evaluate its effectiveness over time. Backtesting enables traders to assess their strategies’ weaknesses and strengths before implementing them in live markets, reducing potential losses arising from untested techniques.

We employed a sophisticated Expert Advisor (EA) that uses complex algorithms to analyze price action across multiple currency pairs and generate signals based on preset rules. We then ran it through rigorous backtesting procedures spanning five years of historical data for each pair.

The results were impressive as the EA generated consistent profits throughout the testing period with minimal drawdowns, indicating stability in performance despite fluctuations in market conditions. However, past performance does not guarantee future success; hence it’s essential to continuously monitor and adjust the EA’s parameters to reflect any changes in the market dynamics while adhering to proper risk management practices.

By doing so, one can take significant strides towards attaining financial freedom through automated forex trading systems without relying solely on human emotions or intuition.

Download the best free forex trading tools.

Forex Road To One Million Ea Disadvantages

After conducting extensive backtesting and analyzing the results, exploring the potential disadvantages of using a Forex Road to One Million EA is natural. Despite its promising performance in the past, traders should be aware of the following drawbacks:

- Dependence on historical data: The EA relies heavily on historical data to identify patterns and make trading decisions. Any unexpected market changes or events may not be incorporated into its algorithm, leading to losses.

- Limited adaptability: While the EA can perform well under certain market conditions, it may struggle to adapt when these conditions change. Traders must continuously monitor market trends and adjust their settings accordingly.

- Costly investment: Purchasing an effective Forex Road to One Million EA can come at a high price point. Traders must also consider ongoing maintenance costs and fees for running the software.

Despite these challenges, many traders still value utilizing a Forex Road to One Million EA as part of their overall strategy.

It is essential for individuals to carefully weigh the potential benefits and drawbacks before making an informed decision about whether this tool aligns with their desired outcomes.

As with any investment or trading approach, there are no guarantees for success. However, by keeping these considerations in mind and monitoring performance over time, traders can increase their chances of achieving positive results while minimizing risk exposure.

Road To One Million Ea Pricing

The Road to One Million EA has been a topic of great interest among the forex community. The question on everyone’s mind is how much does this EA cost?

To answer this, we must consider several factors influencing its pricing.

Firstly, the development costs and time invested in creating an efficient algorithmic trading system are significant. This includes research, backtesting, optimization, and forward testing. Each stage requires expertise and specialized skills from experienced developers who have spent years perfecting their craft. Therefore, it is expected that the price will be reflective of these expenses.

Furthermore, market demand plays a crucial role in determining the final price point of any product or service. As more traders become aware of the benefits of using automated systems for trading currencies, there may be an increase in demand for sophisticated EAs like Road to One Million. This could increase prices as vendors seek to capitalize on increased demand.

Finally, competition within the industry can also impact pricing strategy—numerous EAs are currently available on the market with varying sophistication and success rates. Vendors must consider competitive pressures when setting prices to remain relevant in a highly dynamic marketplace.

To sum up, while it is difficult to give an exact figure for Road to One Million EA pricing due to various influencing factors, it is safe to say that it will likely be priced at a premium level given its advanced features and potential profitability. Nevertheless, traders should evaluate their investment goals before making purchase decisions based solely on price points.

Frequently Asked Questions

Can The Road To One Million Ea Be Customized To Fit My Trading Style And Preferences?

When it comes to customizing a trading strategy, several factors need to be considered.

Firstly, the trader needs to understand their trading style and preferences clearly. This includes identifying their risk tolerance, preferred timeframes, and market conditions in their Excel.

Secondly, the chosen strategy should align with the trader’s goals and objectives – consistent profits or long-term growth.

Finally, the strategy must consider external factors such as economic events and global news, which can significantly impact currency movements.

By considering these elements, traders can tailor their approach to fit their needs and ultimately achieve success in the forex market.

What Is The Expected Drawdown When Using The Road To One Million Ea?

When using automated trading systems or robots, drawdown is a critical metric. It refers to the percentage of loss a trader can expect from peak to trough during periods of market volatility.

While it varies depending on the strategy and risk management techniques employed, experienced traders aim for minimal drawdowns as they reduce the overall profitability of their trades.

As such, when considering any forex trading system, one should always consider its expected drawdown rate and how it aligns with its risk tolerance levels.

Is Any Support Or Training Provided For Users Of The Road To One Million Ea?

As a forex research analyst, it is essential to consider the availability of support and training for trading software users.

While some programs may offer extensive resources and education, others may leave traders feeling lost and unsupported.

It is worth investigating whether the Road to One Million EA provides any such services before investing in this particular program.

With access to valuable materials and guidance, traders can increase their chances of success in the volatile world of forex trading.

Moreover, gaining knowledge from experienced professionals can provide individuals with a sense of liberation as they become more confident in their abilities to navigate the market independently.

How Often Does The Road To One Million Ea Update And Adapt To Changing Market Conditions?

The frequency of updates and adaptations to market conditions is a crucial factor in the success of any forex trading software. As such, traders need to assess the level of support provided by the software provider before investing.

In today’s fast-paced financial markets, changes occur rapidly, and systems must be able to adapt quickly to remain effective. Therefore, a reliable forex ea should have frequent updates that reflect changing market dynamics. This enables traders to take advantage of new opportunities while minimizing risks associated with outdated strategies.

For severe investors seeking long-term profitability, keeping abreast of market developments and adapting accordingly is essential.

Are There Any Recommended Brokerages Or Account Types For Optimal Use Of The Road To One Million Ea?

When looking for a brokerage for forex trading, it is essential to consider factors such as regulatory compliance, fees and commissions, customer service and support, platform features, security of funds and ease of withdrawals.

Additionally, traders must choose account types that suit their trading style and goals. For instance, beginners may opt for a demo or micro accounts with low minimum deposit requirements. At the same time, experienced traders can go for standard or ECN accounts which offer tighter spreads and faster execution speeds.

Ultimately, the choice of brokerages and account types depends on individual preferences and priorities to achieve optimal forex trading results.

Conclusion

The Road to One Million EA is a popular automated trading system in the forex market. This article explored some key questions potential users may have before adopting this strategy.

It was noted that although the EA has been designed with specific parameters, it can be customized to fit individual preferences and trading styles.

A critical consideration for traders using any automated system is drawdown. While there are no guarantees in forex trading, users should expect some drawdown when using the Road to One Million EA. However, with proper risk management and an understanding of how the algorithm works, investors can potentially achieve profitable results.

In conclusion, while there are many factors to consider when choosing an automated trading system like the Road to One Million EA, it is clear that this approach offers great potential for those looking to increase their profits in forex markets.

With customization options available and support provided by developers, new users can feel confident knowing they have access to all the tools necessary for success. As always, thorough research and testing should be done before committing funds to any investment vehicle.