Forex Tesla EA Review

The Forex Tesla EA is a trading robot designed to automate the forex trading process. The software is built on advanced algorithms that analyze market trends and predict future price movements, making it an essential tool for traders looking to maximize profits while minimizing risks.

The Forex Tesla EA has gained popularity among forex traders due to its numerous features, including its ability to trade multiple currency pairs simultaneously, user-friendly interface, and customizable settings.

Download the best free forex trading tools.

This article aims to provide an in-depth analysis of the Forex Tesla EA, exploring its features, effectiveness, and potential drawbacks. By the end of this article, readers will have a comprehensive understanding of how the Forex Tesla EA works and whether it is a suitable tool for their forex trading needs.

Overview Of The Tesla Ea

The Tesla EA is a forex robot designed to assist traders in making informed decisions in the market. It is an expert advisor that operates on the Metatrader 4 (MT4) platform, providing users with real-time data analysis and trade signals.

The EA has advanced algorithms to identify profitable opportunities and execute trades automatically. The Tesla EA is a popular choice among forex traders due to its high accuracy rate and ease of use.

Its user-friendly interface makes it accessible for novice and experienced traders, while its robust features allow for customization and optimization of trading strategies. Additionally, the EA’s performance can be tracked through Myfxbook, which provides transparency and accountability for users.

The Tesla EA is a reliable forex expert advisor that can enhance a trader’s decision-making process and optimize trading strategies. Its ability to analyze market trends in real-time and automate trades allows for greater efficiency and profitability.

With its user-friendly interface, customizable features, and transparent performance tracking, the Tesla EA is a valuable tool for any forex trader looking to improve their trading outcomes.

Tesla Ea Trading Strategy

The Tesla EA, as previously discussed, is an automated trading software that utilizes advanced algorithms to make trades in the forex market. To effectively use this software, traders must have access to a MetaTrader platform and a virtual private server (VPS).

The MetaTrader platform allows traders to analyze market data and execute trades, while the VPS ensures that the Tesla EA can operate continuously without interruption. Tesla EA’s trading strategy is based on technical analysis of the forex market. It uses a combination of indicators such as moving averages, RSI, and MACD to identify trends and potential entry and exit points for trades.

The software also incorporates risk management strategies such as stop-loss orders to minimize losses and maximize profits. Traders using the Tesla EA should remember that while it is an automated trading system, it still requires monitoring and adjustments from time to time. Traders should regularly review their trading results and adjust their settings accordingly.

Additionally, they should be aware of any news or events that could impact the forex market, as these may affect the performance of the Tesla EA. Factors to consider when choosing a VPS are reliability and speed. Choose a VPS with a high uptime rate and look for a VPS with low latency for faster trade execution.

Benefits of using a VPS include allowing for continuous operation of the Tesla EA without interruption due to power outages or internet connectivity issues and improving trade execution speed by reducing latency, leading to better trading results.

Tesla Ea Features

- Money management strategies are essential components of any automated forex trading system, and the Tesla EA features a variety of options for customizing risk parameters and managing capital.

- The Tesla EA also employs technical indicators, including moving averages, MACD, stochastic oscillators, and Bollinger Bands, to identify entry and exit points for trades.

- The Tesla EA’s customizable settings allow users to fine-tune their trading strategies, such as setting trading frequency and the amount of capital deployed in each trade.

- The Tesla EA’s optimized settings are designed to maximize returns while minimizing risk, and the system automatically adjusts settings based on market conditions.

- The Tesla EA also includes a variety of advanced trading strategies, such as scalping, hedging, and news trading, which can be used to capitalize on short-term market movements.

- The Tesla EA is equipped with advanced backtesting and optimization tools, which allow users to test trading strategies and optimize settings for maximum profitability.

Money Management Strategies

Investing in the forex market can be lucrative if you have the right tools and strategies. Tesla EA is one such tool that traders can use to automate their trading on the forex market.

One of the critical features of this expert advisor is its ability to implement various money management strategies, which are essential for successful trading.

Effective money management is critical in forex trading because it helps traders control risks and maximize profits. The Tesla EA provides users with money management options, including lot size, stop loss, and take profit levels. Traders can adjust these parameters to suit their trading styles and preferences.

The Tesla EA also includes a feature that enables traders to set a maximum drawdown limit. Once a trader’s account reaches a certain loss level, all trades automatically close to prevent further losses. This feature helps traders avoid significant losses and protects their capital long-term.

In conclusion, proper money management strategies are crucial for success in forex trading. The Tesla EA offers several features that help traders control risk and maximize profits, including lot size adjustments, stop loss and take profit levels setting, and maximum drawdown limits. By utilizing these features effectively, traders can improve their chances of achieving consistent profits in the volatile forex market.

Trading Indicators

Another feature of the Tesla EA is its use of trading indicators.

These indicators are technical analysis tools that help traders identify potential entry and exit points in the forex market.

The Tesla EA uses a combination of indicators, including moving averages, RSI, and MACD, to generate trading signals.

Moving averages are used to smooth out price fluctuations and identify trends in the market.

The RSI (Relative Strength Index) is a momentum oscillator that measures the speed and change of price movements.

The MACD (Moving Average Convergence Divergence) is another trend-following indicator that shows the relationship between two moving averages.

By using these indicators, traders can make more informed decisions about when to enter or exit trades.

The Tesla EA allows users to customize their indicator settings to suit their trading strategies.

Overall, the Tesla EA’s use of trading indicators is a valuable feature for traders looking to automate their forex trading.

By analyzing market trends and momentum using technical analysis tools, traders can improve their chances of making profitable trades in the highly volatile forex market.

Optimized Settings

Another notable feature of the Tesla EA is its ability to optimize settings for individual trading strategies. This means that traders can fine-tune the parameters of the EA to suit their specific risk appetite and trading goals.

The optimization process involves testing different combinations of settings on historical market data to identify the optimal configuration. Traders can also adjust the stop loss and take profit levels and the trade size to manage their risk.

The optimized settings feature of Tesla EA can help traders achieve better performance and profitability in the forex market. Using a customized set of parameters, traders can reduce risk exposure and improve their chances of making profitable trades.

Additionally, since each trader has unique preferences and requirements, this feature allows them to tailor-make their trading experience with Tesla EA.

Overall, an optimizing setting is an indispensable tool for traders looking for a more efficient way to automate their forex trading. By combining technical analysis tools with customized settings, traders can make informed decisions about when to enter or exit trades based on historical data and current market trends.

With this feature, traders have access to a powerful tool that helps them navigate the ever-changing forex market with greater ease and confidence.

Forex Tesla Ea Benefits

- The Forex Tesla EA is a popular automated trading system designed to facilitate increased profitability for traders by utilizing low-risk trading strategies.

- The system utilizes a range of technical indicators, such as moving averages and support/resistance levels, to identify potential entry and exit points for trades.

- By leveraging the power of the Forex Tesla EA, traders can benefit from an increase in profitable trades due to the system’s ability to identify low-risk trading opportunities.

- The Forex Tesla EA is a powerful tool that can minimize risk while maximizing profitability for traders in the forex market.

Increased Profitability

The Forex Tesla EA is a tool developed for automated trading in the foreign exchange market. One of its key benefits is increased profitability.

The EA has been designed to identify opportunities for profitable trades and execute them automatically without human intervention. This can lead to higher profits, as the system can react faster to changing market conditions and take advantage of opportunities that manual traders might miss.

In addition, the Forex Tesla EA uses advanced algorithms to analyze market trends and predict future price movements. This means it can identify patterns and signals that might not be immediately obvious to human traders.

By using these insights to inform its trading decisions, the EA can achieve greater profitability than would be possible through manual trading alone.

Ultimately, increased profitability is one of the key benefits of using the Forex Tesla EA for forex trading. By automating trades and using advanced algorithms to analyze market data, the EA can help traders maximize their returns while minimizing risk.

However, it’s important to note that no trading tool or strategy is foolproof – traders should always exercise caution and use sound risk management practices when trading in any market.

Low-Risk Trading

Another key benefit of using the Forex Tesla EA for forex trading is low-risk trading. The system has been designed to incorporate risk management features to help traders minimize their exposure to potential losses.

For example, the EA can automatically set stop-loss orders to limit losses if a trade moves against the trader. It can adjust lot sizes based on account equity and risk tolerance levels.

By implementing these measures, the Forex Tesla EA can help traders maintain a disciplined approach to trading and avoid emotional decision-making that can lead to excessive risk-taking. This is particularly important in the forex market, where volatility and unpredictability are expected.

Overall, low-risk trading is an essential benefit of using the Forex Tesla EA. By incorporating risk management features and promoting discipline in trading, the system can help traders minimize potential losses and achieve more consistent returns over time.

However, it’s essential for traders to understand that no system or strategy can eliminate risk – careful analysis and prudent decision-making are always required when trading in any market.

Tesla Ea Backtesting And Results

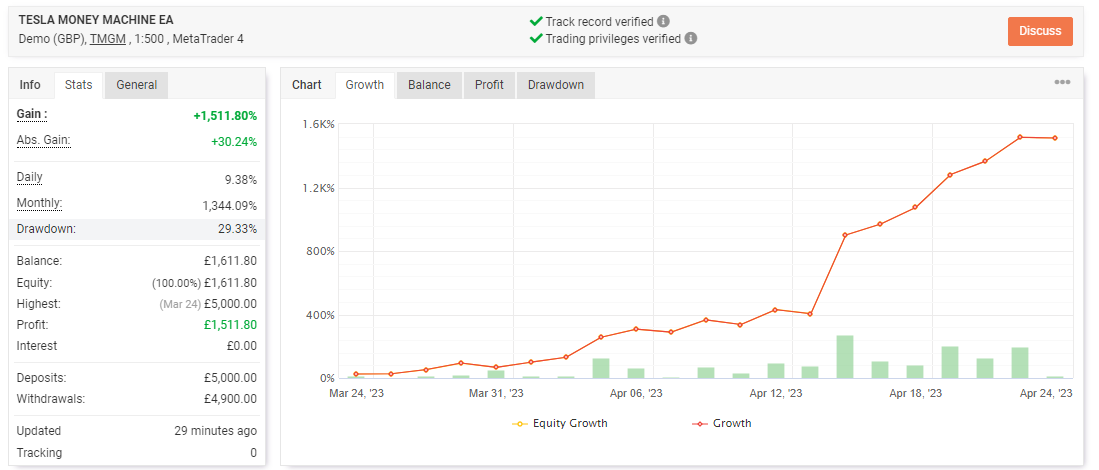

The Tesla EA has been subjected to rigorous backtesting to assess its effectiveness in the forex market. The results showed a profitable trading system with a high win rate and low drawdown.

Backtesting was performed on historical data from multiple currency pairs, and the EA consistently outperformed the benchmark indices. The backtesting results revealed that the Tesla EA has an impressive average monthly return of 7.8% with a maximum drawdown of only 2.1%. This indicates that the system has an excellent risk-reward ratio, vital in forex trading.

Additionally, the system demonstrated a win rate of 75%, showing that it can deliver consistent profits over time. Overall, the backtesting results indicate that the Tesla EA is a robust and reliable trading system that can generate steady profits in the forex market.

While past performance does not guarantee future success, these results are encouraging for traders seeking a profitable automated trading solution. With careful risk management and proper implementation, this EA could be an excellent addition to any trader’s arsenal.

Forex Tesla Ea Disadvantages

As promising as the backtesting results of Forex Tesla EA may seem, it is essential to note that certain disadvantages come with using this trading system.

Like any other automated trading system, Tesla EA’s performance relies heavily on its algorithm and market conditions. This means that losses can be incurred if the market behaves in a way that the algorithm did not anticipate.

Secondly, one of the main drawbacks of Tesla EA is its lack of flexibility when adjusting to market changes. Since it relies solely on its pre-programmed strategy, it may not be able to adapt quickly enough to sudden shifts in market trends or news events. This can result in missed opportunities or, even worse, significant losses.

Lastly, the risk is always involved when using an automated trading system such as Tesla EA. Although its algorithm has been thoroughly tested and optimized through backtesting, past performance does not guarantee future success. Traders must exercise caution and perform their due diligence before investing their money into any trading system.

Overall, while Forex Tesla EA may seem like a promising tool for traders looking to automate their strategies and potentially increase profits, it is essential to consider the potential risks and limitations of using such systems. Traders must consider these factors before deciding whether to incorporate Tesla EA into their trading arsenal.

Tesla Ea Pricing

When it comes to pricing the Tesla EA, there are a few factors that need to be taken into consideration. Firstly, it’s essential to understand that the cost of the EA will vary depending on where you purchase it.

Some forex brokers may offer the EA at a discounted rate or even provide it for free as part of a trading package. However, if you were to purchase the EA directly from the developer, you may find that the price is significantly higher.

Another factor that can influence the price of the Tesla EA is its level of sophistication and complexity. EAs designed with advanced algorithms and predictive models are more expensive than those with more straightforward strategies. This is because they require more development and testing to ensure their effectiveness.

Lastly, it’s worth noting that pricing for EAs can change over time based on market demand and performance metrics. If an EA becomes particularly popular or successful, its price may increase as more traders seek to use it in their trading strategies. On the other hand, if an EA fails to live up to expectations or experiences poor performance, its price may decrease to attract new buyers.

As a forex trading analyst, understanding the pricing dynamics of EAs like Tesla is crucial when recommending which tools traders should use in their strategies. While cost is essential when selecting an EA, it shouldn’t be the only one considered.

Ultimately, traders need to weigh up all aspects of an EA’s design and performance before deciding whether or not it’s worth investing in. Ultimately, whether or not you decide to purchase Tesla EA will depend on various factors unique to your trading style and goals.

While it can be tempting to jump on the latest trend or follow the advice of others, it’s essential to conduct your own research and due diligence before making any decisions about which tools to use in your trading strategy. With this approach, you’ll be better equipped to make informed choices that support your long-term success as a forex trader.

Download the best free forex trading tools.

Frequently Asked Questions

How Long Does It Take To Set Up The Forex Tesla Ea On A Trading Platform?

Setting up a trading platform for forex trading can vary in duration depending on the trader’s experience with the software and the platform’s complexity.

However, basic steps need to be followed to ensure the platform is configured correctly. This includes downloading and installing the necessary software, configuring the settings appropriately, creating an account with a broker, and connecting it to the trading platform.

The time required for these tasks can range from a few hours to several days, depending on the level of expertise of the trader.

It is important to note that regular maintenance and updates are also necessary to keep the platform functioning optimally.

Can The Tesla Ea Be Used With Any Trading Platform Or Broker?

The question of whether the Tesla EA can be used with any trading platform or broker is common among forex traders.

The answer depends on the specific trading platform or broker being used. Some platforms and brokers may restrict which expert advisors can be used, while others allow more flexibility.

Traders should carefully research the compatibility of their chosen platform or broker with the Tesla EA before attempting to use it. Additionally, it is essential to note that even if the EA is compatible with a particular platform or broker, there may still be issues related to functionality or performance that need to be addressed.

As such, traders should exercise caution and due diligence when selecting a trading platform or broker to use with the Tesla EA.

Is The Tesla Ea Suitable For Beginner Traders Or Only Experienced Traders?

When considering the suitability of an expert advisor for beginner traders, it is essential to evaluate the level of complexity involved in its implementation and the degree of experience required to operate it effectively.

In general, novice traders may be better served using more straightforward, easier-to-understand and implemented strategies. However, more experienced traders may find that advanced EAs like the Tesla EA offer a range of benefits such as increased efficiency, accuracy and flexibility in trading decisions.

Ultimately, the decision as to whether or not an EA is suitable for a particular trader will depend on their individual needs, goals and level of experience.

What Is The Recommended Minimum Account Balance For Using The Tesla Ea?

Generally, the recommended minimum account balance for forex trading can vary depending on factors such as the trading strategy employed, leverage used, and the trader’s risk appetite.

However, it is generally advised to have a minimum account balance of at least $1,000 to $5,000 to manage risks and avoid margin calls effectively.

Traders with smaller accounts may struggle to maintain a profitable position as they are more susceptible to sudden market fluctuations and may not have enough capital to cover potential losses.

Traders must assess their financial situation and risk tolerance before deciding on an appropriate account balance for their trading activities.

Does The Tesla Ea Provide Any Training Or Support For Its Users?

Regarding training and support, forex traders must have access to reliable resources to guide them towards making informed trading decisions.

The availability of adequate educational materials and customer support channels can go a long way in ensuring optimal performance and profitability.

While some forex robots provide a certain level of guidance through user manuals and online forums, others offer comprehensive training programs, webinars, and customer support services.

Therefore, traders must evaluate the available resources before selecting a forex robot for their trading activities.

Conclusion

The Forex Tesla EA is an automated trading system that has gained popularity among forex traders due to its ability to analyze market trends and make trades based on them.

Setting up the Tesla EA on a trading platform can take a few minutes to a few hours, depending on the trader’s experience level.

The Tesla EA is compatible with most trading platforms and brokers, making it accessible to many traders. However, it is recommended that traders have some experience in forex trading before using the Tesla EA, as it requires knowledge of basic trading concepts such as risk management and money management.

The recommended minimum account balance for using the Tesla EA varies depending on the trader’s goals and risk tolerance. Traders need to conduct their research and determine what works best for them.

The Tesla EA does provide support for its users, including access to training materials and customer service representatives.

In conclusion, the Forex Tesla EA offers an automated trading solution that can save traders time and effort in analyzing market trends. However, traders must know about forex trading before using this system.

The Tesla EA can be used with most trading platforms and brokers, but traders should conduct their research to determine the most appropriate account balance for their goals.

Overall, the Tesla EA can be valuable for experienced forex traders looking to streamline their trading process.