Forex Scalp EA Review

Forex Scalp EA is a trading robot developed to automate the process of currency trading. It allows traders to benefit from short-term market movements on their terms and without manual intervention.

This article will provide an overview of how this automated system works, its advantages over manual trading strategies, and its potential drawbacks.

The main advantage of using Forex Scalp EA is that it eliminates the need for continuous monitoring of the markets as well as tedious technical analysis activities. The software uses sophisticated algorithms to analyze price patterns and identify appropriate entry points for profitable trades.

Download the best free forex trading tools

Furthermore, it can be used in any time frame ranging from one minute to daily charts, making it highly versatile compared to traditional scalping strategies.

Users have complete control over the risk involved through stop-loss orders and take profit levels set by default. Still, they can also be adjusted according to personal preference or strategy requirements.

How Does Forex Scalp Ea Work?

Forex Scalp EA is an automated trading system designed to trade the forex market precisely and accurately. The software uses advanced algorithms to analyze price action, identify potential trades and execute them automatically on behalf of the trader.

By employing cutting-edge technology, it can quickly scan hundreds of currency pairs in seconds to find profitable trading opportunities. Once Forex Scalp EA detects a suitable opportunity, it will place a buy or sell order depending upon the conditions present in the market at that time.

It also uses trailing stops and takes profit orders which help maximize profits while minimizing losses incurred during volatile times. Additionally, this scalping robot offers customizable settings such as lot size, stop loss and take profit levels so traders can tailor their strategies according to their risk appetite and goals.

The main advantage of using Forex Scalp EA is its ability to detect and capitalize on small movements within the more significant trend for potentially higher returns than those achieved through traditional long-term trends alone. This feature gives traders access to potentially lucrative but risky trades without spending hours monitoring multiple charts manually.

Moreover, due to its automated nature, this scalper does not require constant intervention from users, allowing them more time for other activities, such as research or leisure.

Advantages Of Forex Scalp Ea

Forex Scalp EA for metatrader 4, a popular trading platform among traders, is designed to offer scalpers an automated approach to the forex market. Utilizing sophisticated algorithms and analysis techniques, it provides the user with reliable and accurate signals that can be used for profitable trades.

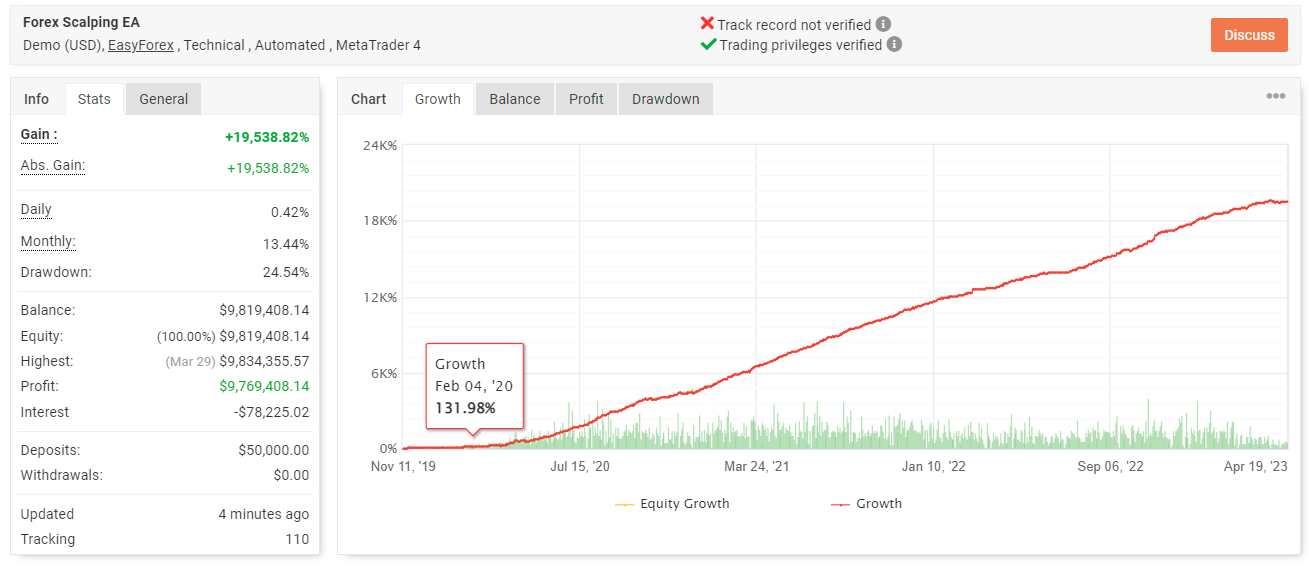

The system also includes trailing stops, take profit targets and time frames. The main advantage of Forex Scalp EA is its ability to produce consistent results even in volatile markets. This makes it ideal for those looking to capitalize on short-term trading opportunities without worrying about significant losses due to unforeseen events or sudden price movements.

Additionally, this type of software offers traders access to an array of custom indicators, allowing them to analyze trends more effectively and make better decisions when entering positions. Moreover, Forex Scalp EA is relatively easy to use and does not require prior knowledge of technical analysis or currency trading; hence making it accessible for novice and experienced forex traders.

This tool helps users stay ahead of the competition by providing timely trade suggestions that help identify potential entry points before they become available on the stock market. It also allows users to set up their parameters to maximize profits while minimizing risks associated with each trade.

Potential Drawbacks Of Forex Scalp Ea

Forex Scalp EA can be subject to execution delays in certain market conditions, which can cause traders to miss out on profitable opportunities.

High spreads can also significantly reduce the profitability of scalping strategies by reducing the number of pips gained per trade.

Poor risk management is also a significant concern when using Forex Scalp EA, particularly in volatile markets, as it can lead to significant losses.

It is essential to understand the underlying risks of Forex Scalp EA to ensure that a trading strategy is successful.

Execution Delays

Execution delays can be a significant drawback of forex scalp EA. This is because for an order to be filled and executed, which must occur promptly, or else profits be lost as prices move quickly on short-term trades.

A failure in execution speed may lead to slippage, whereby a trader’s orders are filled at worse prices than expected, thus resulting in reduced profitability.

To minimize these risks associated with trading technology malfunctioning, traders should ensure they choose an appropriate broker with fast execution speeds and low latency rates via their platforms.

In addition, adequate testing should be done before live trading with natural capital so that potential issues related to system lags can be identified before investing any money into the market.

Finally, traders should continually monitor their positions and keep track of current market conditions when scalping currency pairs using robots for maximum returns.

High Spreads

High spreads can also be a significant issue when trading with forex scalp EA since the more significant the spread, the more difficult it is to profit.

For instance, if there is a wide spread between buying and selling prices on a currency pair, the cost of executing trades will increase significantly. This means that scalpers may be unable to take advantage of short-term price fluctuations to generate profits.

Furthermore, wider spreads mean more considerable losses due to increased transaction costs incurred from entering and exiting positions within tight time frames.

As such, traders should thoroughly research which brokers offer better spreads across different currency pairs before commencing any trading activities. They should also consider using Forex brokers offering commission-based pricing models, as these have proven to provide tighter spreads than traditional market makers or dealing desk brokers.

Therefore, by ensuring tight spreads are always available through their chosen broker’s platform, scalpers can reduce potential risks and improve overall profitability associated with this high-frequency trading approach.

Poor Risk Management

Poor risk management is an essential factor that should not be overlooked when using Forex Scalp EA.

If traders fail to manage their risks properly, they may be exposed to significant losses due to the fast-paced nature of this type of trading strategy.

To reduce potential losses and maximize profits, scalpers must set strict money management rules aligned with their overall investment objectives.

This includes setting a maximum stop loss level and limiting the amount invested in any single trade according to available capital and account size.

Additionally, traders must consider diversifying across multiple currency pairs to reduce volatility exposure and lower the likelihood of significant losses from adverse market movements.

By utilizing sound risk management principles, scalpers can ensure that their investments remain safe while still having the opportunity to take advantage of short-term price fluctuations to generate profits over time.

Customizable Risk Management Settings

The risk management settings of a Forex scalping EA can be one of the most critical factors for success. Properly managing risks is essential to maximize profits and limit potential losses when trading in the forex market. Understanding how different settings affect your strategies is essential for successful scalping:

- Leverage size – higher leverage sizes increase profit opportunities but also add more risk;

- Stop-loss orders – setting these too tight may cause you to exit positions prematurely, while setting them too loose could result in more considerable losses;

- Take Profit levels – setting take profit points too far away from the entry price will reduce profitability;

- Trailing stops – this allows you to lock in gains as trends move up or down, allowing traders to ride out winning trades;

- Risk/Reward ratio – determining an appropriate balance between risk and reward that fits your strategy helps determine overall profitability.

Choosing a suitable combination of these customizable settings makes it possible to lower the inherent risk of any trade while still keeping enough flexibility to capture market movements and benefits from profitable trades.

This makes scalping significantly safer than other types of investing strategies novice traders use.

Versatility Across Different Time Frames

The versatility of Forex scalping strategies across different time frames is an essential factor in successful trading. Utilizing the correct strategy to match a trader’s individual timeframe preferences can significantly increase profitability, allowing for more consistent and efficient trades. To understand this concept, it is helpful to analyze how various timeframes interact and what techniques are used when engaging in short-term scalping activities.

| Timeframe | Trading Activity | Scalping Techniques |

|---|---|---|

| Intraday | Fast-paced | News & Momentum |

| Day | Medium speed | Support/Resistance |

| Swing | Slow | Trend Following |

The shortest timeframe typically considered for scalping is intraday, which involves fast-paced market activity over intervals of as few as minutes or seconds. This type of trading requires keen attention to news events and momentum shifts that may lead to opportunities for quick profits. As the timeframe extends further into day trading, there is less frantic movement and enough volatility to capitalize on support/resistance levels throughout the session. Finally, swing traders who prefer a slower pace can take advantage of longer-term trends using trend-following methods such as moving averages or Fibonacci retracements.

Overall, each time frame carries unique characteristics that must be considered when choosing a suitable forex scalp EA strategy. Traders should evaluate their personal risk tolerance level alongside their desired timeframe before selecting a technique to maximize potential profit while minimizing risks associated with excessive leverage or inadequate stop-loss placement. With proper analysis and preparation, any trader can successfully utilise these versatile strategies regardless of their trade timeframe.

Download the best free forex trading tools

Frequently Asked Questions

What Is The Cost Of Forex Scalp Ea?

The cost of a forex scalp EA can vary significantly depending on the developer and features offered.

Features like automated trading, myfxbook backtesting capabilities, and stop-loss triggers all affect the price of a scalping EA.

Generally speaking, prices range from free to hundreds or thousands of dollars depending on the complexity of the software and its accompanying support services.

Ultimately, it is up to traders to decide which product best meets their budget, functionality, and risk management strategy needs.

Does Forex Scalp Ea Require A Minimum Deposit To Use?

When it comes to trading, using automated software such as a ‘forex scalp ea’ can benefit traders. These programs are designed to automatically recognize tradeable patterns and open positions, which may provide an edge in the market.

However, due to their increased complexity and risk, most Forex scalping robots require a minimum deposit before use. It is, therefore, essential to consider whether or not you have sufficient funds available before using this type of program.

Is Forex Scalp Ea Compatible With All Trading Platforms?

Forex scalping is a trading technique that involves entering and exiting the market multiple times in short periods.

To use this strategy effectively, it is essential to ensure that the software used is compatible with all platforms available for trading.

Scalp EA has been designed to work on any platform, making it easy for traders who utilize this particular trading method to find success regardless of their chosen platform or broker.

How User-Friendly Is Forex Scalp Ea?

Forex Scalp EA is a user-friendly trading system that offers traders an efficient and stress-free way to scalp the markets.

The program features intuitive visual indicators, automated signals, and unique algorithms to provide real-time information on entry/exit points and risk management strategies.

It also includes a comprehensive manual mode for experienced traders who wish to review all their open trades before executing them.

In addition, Forex Scalp EA provides proper backtesting and simulation capabilities so users can assess the performance of their strategies without risking actual capital.

Is Forex Scalp Ea Suitable For Beginner Traders?

Whether Forex scalping suits beginner traders has been debated in the trading community.

While this approach has potential benefits, such as short-term profits from small movements in exchange rates, it comes with a high degree of risk. It entails an understanding of technical analysis and financial markets.

Beginner traders should educate themselves on the risks associated with Forex scalping before deciding if this approach is advisable.

Conclusion

Forex Scalp EA is a cost-effective solution for those who wish to capitalize on the lucrative forex market. It requires no minimum deposit and is compatible with all trading platforms, making it an ideal choice for seasoned traders and beginners.

The user interface of Forex Scalp EA provides an intuitive experience that makes mastering the software quickly. This scalping tool offers a reliable way to take advantage of short-term currency fluctuations to maximize profits from such movements.

Forex Scalp EA stands out as a viable option for any trader looking to make money off the dynamic forex market.