Forex Ftmo & Co EA Review

EA that has gained popularity in the forex trading community is the Forex FTMO & Co EA. The Forex FTMO & Co EA is a fully automated forex trading system that promises consistent profits while minimizing risk. This EA uses advanced algorithms to analyze market conditions and make informed trading decisions based on technical indicators, price action analysis, and other market factors.

Download the best free forex trading tools

It also features a built-in risk management system to protect traders’ accounts from significant losses. With its proven track record of success, the Forex FTMO & Co EA is becoming an increasingly popular choice among forex traders looking for an automated solution to their trading needs.

Understanding Automated Trading

Automated trading is a popular and efficient way of executing trades in the foreign exchange market. With forex robots, also known as expert advisors (EAs), traders can automate their trading strategies and take advantage of market opportunities 24/7.

These EAs operate within the MetaTrader 4 (MT4) platform, a widely used trading software in the forex industry. EAs have become increasingly popular due to their ability to analyze market data and make trades automatically. This means traders no longer need to monitor charts for long periods but instead set up their preferred parameters on the EA and let it do the work for them.

Furthermore, with the integration of virtual private servers (VPS) with MT4, traders can ensure that their EAs run uninterrupted even when their computers are turned off or disconnected from the internet. However, it is essential to note that not all EAs are created equal.

Some may perform well in specific market conditions but fail in others, while some may be outright scams. Therefore, traders must conduct thorough research before purchasing any EA or subscribing to any service that offers automated trading solutions.

It is also recommended to backtest EAs on historical data and conduct forward testing on demo accounts before deploying them on live accounts. In summary, automated trading using forex EAs has become integral to many traders’ strategies in today’s fast-paced financial markets.

With its ability to operate around the clock and eliminate emotional biases from decision-making processes, automated trading has proven to be a valuable tool for traders seeking consistent profits. However, traders must exercise caution when selecting and using EAs by conducting proper due diligence and testing procedures before committing real funds into live accounts.

Benefits Of Using The Forex Ftmo & Co Ea

- Automated trading with Forex FTMO & Co EA reduces the time and human effort required to analyze and execute trades, allowing traders to focus more on their overall trading strategy.

- Forex FTMO & Co EA also reduces risk by adhering to predetermined rules and parameters, thereby minimizing the possibility of emotional trading decisions.

- Forex FTMO & Co EA increases the potential for profits by taking advantage of minor price movements and ensuring that all trades are executed precisely and quickly.

- Forex FTMO & Co EA also allows traders to diversify their portfolios and use various strategies more efficiently.

- The ability to backtest and optimize strategies with the Forex FTMO & Co EA provides an additional layer of risk management.

- Finally, the Forex FTMO & Co EA’s scalability allows traders to increase their profits without worrying about additional resources or capital.

Automated Trading

Automated trading has become increasingly popular in the forex market due to its ability to remove emotions from decision-making and execute trades more efficiently. The Forex FTMO & Co EA is a prime example of an automated trading system gaining traction among traders.

This EA utilizes advanced algorithms and real-time market analysis to identify and execute profitable trades. By using this EA, traders can benefit from increased efficiency, accuracy, and profitability.

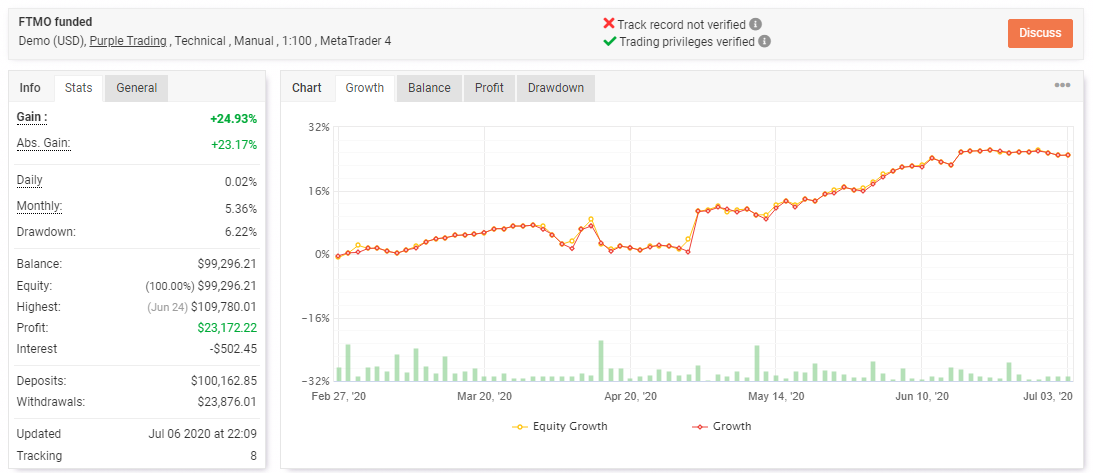

One of the key advantages of using the Forex FTMO & Co EA is its ability to track performance through my book. This platform allows traders to monitor their trades in real-time and assess their overall performance. Through my book, traders can analyze various metrics such as profit factor, drawdown, and win rate to determine the effectiveness of their trading strategy. This level of transparency gives traders valuable insights into their trading strategy and helps them make informed decisions.

Another benefit of the Forex FTMO & Co EA is its compatibility with virtual private servers (VPS). A VPS enables traders to run their EA 24/7 without interruption, ensuring that all trades are executed promptly even when they are not actively monitoring the markets. This eliminates any potential downtime or connectivity issues that could negatively impact profitability. Additionally, a VPS provides an added layer of security by keeping sensitive trading data off local devices.

In conclusion, automated trading has revolutionized how traders approach forex trading by removing emotions from decision-making processes and increasing efficiency. The Forex FTMO & Co EA is an excellent tool for traders looking to automate their trading strategy while benefiting from increased accuracy and profitability. Features such as myfxbook tracking and VPS compatibility make this EA an appealing choice for novice and experienced traders.

Reduced Risk

Another benefit of using the Forex FTMO & Co EA is its ability to reduce risk. As an automated trading system, it eliminates emotional trading decisions that often lead to impulsive trades and losses. By removing human error from the equation, the EA can execute trades based on data-driven analysis and algorithms, significantly reducing the overall risk associated with forex trading.

The Forex FTMO & Co EA also has built-in risk management features that help traders minimize potential losses. For instance, a stop-loss feature automatically closes a trade when it reaches a predetermined loss level. This ensures that traders do not lose more than they can afford and helps them stay disciplined in their trading approach.

Moreover, the EA employs advanced money management techniques such as position sizing and trailing stops to reduce risk further. Position sizing allows traders to determine how much capital to risk per trade based on their account size and risk tolerance levels. Trailing stops allow traders to lock in profits by adjusting stop-loss levels as the trade moves in their favour.

In conclusion, using the Forex FTMO & Co EA reduces overall forex trading risks by eliminating emotional decision-making and implementing robust risk management strategies. Its advanced features, such as stop-loss orders, position sizing, and trailing stops, provide additional protection for traders’ capital while maximizing profitability. The result is a more disciplined approach to forex trading that enhances profitability while minimizing risks.

Increased Profits

Another benefit of utilizing the Forex FTMO & Co EA is its potential to increase profits. The EA’s algorithmic trading approach can identify profitable trades and execute them quickly, giving traders an edge in the market.

Additionally, the automated system can analyze vast amounts of data and make real-time adjustments to trading strategies based on market conditions, which can lead to higher returns.

The Forex FTMO & Co EA’s advanced features also increase profitability. For instance, its position sizing feature allows traders to maximize their gains by allocating a percentage of their account balance to each trade based on their risk tolerance levels. This ensures traders do not over-leverage or under-leverage their capital, leading to better returns.

Moreover, the EA employs a trailing stop feature that enables traders to lock in profits as a trade moves in their favour. This innovative feature automatically adjusts stop-loss orders as the currency pair’s price rises, ensuring that traders capture as much profit as possible while minimizing losses.

In conclusion, using the Forex FTMO & Co EA has numerous benefits for forex traders, including increased profitability through algorithmic trading and advanced money management techniques such as position sizing and trailing stops. These features help traders make more informed decisions and reduce emotional biases while maximizing returns.

An automated trading system like the Forex FTMO & Co EA can significantly improve profitability and enhance overall trading performance.

Advanced Algorithms And Technical Indicators

The world of forex trading is constantly evolving, with new technologies and strategies being developed daily. As a trader, it is essential to stay ahead of the curve by utilizing advanced algorithms and technical indicators to help you make more informed decisions about your trades. These tools can provide valuable insights into market trends and patterns, allowing you to identify profitable opportunities and manage risk more effectively.

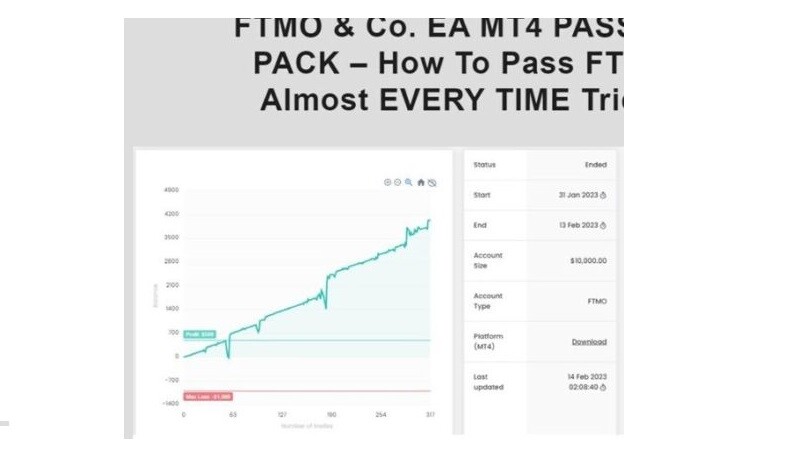

An expert advisor (EA), essentially a piece of software that automates trading decisions based on pre-set rules and parameters, is one of the most powerful tools in a trader’s arsenal. FTMO & Co EA is one such tool that has gained popularity among traders for its ability to generate consistent profits over time. Using sophisticated algorithms and technical indicators, this EA can analyze market data in real-time and make trades on your behalf, freeing up your time to focus on other aspects of your trading strategy.

Another critical aspect of advanced algorithms and technical indicators is their ability to identify market trends and patterns that may not be immediately apparent to the naked eye. For example, moving averages are a popular indicator many traders use to smooth out price fluctuations over time and identify long-term trends. Similarly, oscillators like the Relative Strength Index (RSI) can help you identify overbought or oversold conditions in the market, which can help you make short-term trades.

In conclusion, advanced algorithms and technical indicators are essential tools for any serious forex trader looking to improve their profitability and manage risk more effectively. Whether using an EA like FTMO & Co or analyzing charts manually using various indicators, these tools can provide valuable insights into market trends and patterns that would otherwise be difficult to spot.

By incorporating these tools into your trading strategy, you can make more informed decisions about when to enter or exit trades, ultimately increasing your chances of success in the competitive world of forex trading.

Navigating The Forex Market

Navigating the Forex market can be a complex and challenging experience, even for seasoned traders. To succeed in this arena, one must deeply understand market dynamics, economic indicators, and technical analysis. Additionally, traders must develop an acute sense of risk management to minimize their exposure to potential losses.

When navigating the Forex market, one key factor is staying informed about global economic events. The release of economic data such as GDP growth rates, interest rate decisions, and unemployment figures can significantly impact currency markets.

Traders who stay on top of these developments are better equipped to make informed trading decisions based on current economic conditions. Another critical aspect of navigating the Forex market is technical analysis. This involves studying price charts and using various indicators to identify trends and patterns in price movements.

Technical analysis can help traders anticipate potential price changes and adjust their strategies accordingly. Finally, traders must implement effective risk management strategies when navigating the Forex market. This might include setting stop-loss orders or taking partial profits at predefined levels to limit potential losses while maximizing gains.

By focusing on risk management techniques such as these, traders can reduce their overall exposure to risk and increase their chances of long-term success in the Forex market. In summary, navigating the Forex market requires a combination of knowledge about global economic events, technical analysis skills, and effective risk management strategies.

By staying informed about current events that could affect currency prices, analyzing price charts for patterns and trends, and implementing sound risk management techniques, traders can increase their chances of success in this exciting but challenging arena.

Increasing Your Chances Of Success

Having a clear understanding of the forex market is essential for any trader. Navigating the volatile market, where currencies constantly fluctuate, requires skill and knowledge. The forex market is an ever-evolving landscape that can be challenging, but traders can increase their chances of success with the right tools and strategy.

Tool traders often use to gain an edge in the forex market is an Expert ad expert (EA). An EA program is designed to analyze market data and execute trades automatically based on specific criteria. FTMO & Co EA is a program that has gained popularity among traders. This EA uses advanced algorithms to identify trends and patterns in the market, allowing it to make informed trading decisions.

However, it’s important to note that relying solely on an EA may not guarantee profits. While these programs can help automate trades, they are not foolproof and still require careful monitoring by a human trader.

Additionally, traders should have a solid understanding of trading strategies and risk management principles before incorporating an EA into their trading plan.

In conclusion, while navigating the forex market can be challenging, using tools like EAs can help increase your chances of success. However, it’s important to remember that these programs should not be relied upon as a sole trading strategy and should constantly be monitored by a human trader. By combining expertise with technology, traders can navigate the forex market more efficiently and confidently.

Customizing The Ea To Your Needs

As a forex trader, you understand that no two traders are alike. Each trader has a unique strategy and approach to trading the markets. Therefore, it is essential to customize your expert advisor (EA) to match your specific needs and preferences. This ensures that the EA aligns with your trading style and increases the likelihood of achieving profitable trades.

One way to customize your EA is by adjusting its parameters. These parameters can include things such as stop loss, take profit targets, and trailing stops. Changing these settings allows you to tailor the EA to match your risk tolerance and trading objectives. Remembering that each parameter should be adjusted with care as each change may impact overall performance.

Another way to customize your EA is by incorporating additional indicators or strategies into its algorithm. For example, if you prefer using a particular technical indicator in your trading strategy, you can add it as an input variable into the EA’s programming code. This allows the EA to analyze market data using multiple indicators and make trades based on a more comprehensive analysis.

Furthermore, some EAs allow for backtesting, providing historical data on how the EA would have performed in previous market conditions. This feature enables traders to test various customizations before implementing them in live trading. It is recommended that traders conduct extensive myfxbook backtesting before deploying their customized EAs in live markets.

In conclusion, they are customizing expert expertise crucial to successful forex trading. By adjusting parameters and incorporating additional indicators or strategies into its algorithm, traders can create an EA that aligns with their unique trading style and objectives. Additionally, thorough backtesting helps ensure the customized EA performs well under different market conditions. Ultimately, customizing an expert ad expert can improve profitability and success in forex trading.

Realizing Your Trading Goals

Achieving your trading goals is essential to becoming a successful forex trader. To do so, you must clearly understand what you want to accomplish and how you plan to get there. Setting achievable objectives and establishing a well-defined plan to reach them is essential.

This section will discuss some tips for realizing your trading goals.

Firstly, it’s crucial to have a solid trading strategy in place. Your strategy should be tailored to your needs and preferences, including risk tolerance, time constraints, and investment goals. A well-designed strategy will help you make informed decisions about when and where to enter or exit trades and manage your positions effectively.

Secondly, developing discipline is critical to achieving your trading goals. This means sticking to your strategy even when market conditions or emotions are challenging. Discipline can be developed through regular practice, realistic expectations, and a positive attitude towards setbacks.

Thirdly, leveraging the power of technology can help you realize your trading goals. There are many tools available that can help automate parts of the trading process or provide real-time data analysis for better decision-making. For example, an expert advisor like Forex FTMO & Co EA can help execute trades automatically based on pre-set rules while minimizing risks.

In summary, achieving your trading goals requires careful planning, disciplined execution of strategies and leveraging technology where possible. By following these tips and staying committed over time with patience and persistence – success will come eventually!

Download the best free forex trading tools

Frequently Asked Questions

What Is The Cost Of The Forex Ftmo & Co Ea?

The cost of a forex trading system is essential for traders seeking to optimize their profitability.

The price of a trading system will vary depending on various factors, such as the level of automation, the complexity of the algorithms, and the quality of backtesting.

High-quality forex trading systems can range from a few hundred to several thousand dollars.

However, it’s important to note that the cost of a trading system should not be the only factor considered when selecting a forex trading strategy.

Other factors, such as risk management, market analysis, and trade execution, should also be considered when making investment decisions.

Can The Forex Ftmo & Co Ea Be Used On Multiple Trading Platforms?

Traders need to be able to use their preferred trading strategies and tools across multiple platforms. This can provide greater flexibility and help traders to manage their portfolios better.

However, not all trading robots or expert advisors are compatible with every platform. Traders should check the compatibility of an EA with the platforms they use before making a purchase. By doing so, traders can ensure they have access to the tools they need, regardless of where they trade.

As such, it is worth considering whether the Forex FTMO & Co EA can be used on multiple trading platforms before investing in it.

Is It Possible To Backtest The Forex Ftmo & Co Ea Before Using It In Live Trading?

To ensure trading success and minimize risk, it is crucial for traders to thoroughly test their strategies before implementing them in the live market.

Backtesting is a valuable tool that allows traders to evaluate the performance of their strategies using historical data. Through this process, traders can identify potential flaws and make necessary adjustments to optimize their strategies for real-time trading conditions.

While backtesting has limitations, such as the inability to account for unforeseen events or changes in market conditions, it remains an essential step in developing any successful trading strategy.

What Is The Minimum Account Balance Required To Use The Forex Ftmo & Co Ea?

The minimum account balance required to use any forex trading strategy varies depending on the trader’s approach and risk management principles.

Generally, a recommended minimum balance for a forex trading account is at least $1,000, though some traders may opt for higher amounts to facilitate their risk management strategies.

The decision on the minimum account balance should be based on various factors, such as the amount of capital available for trading, the level of leverage used, and the expected return on investment.

Traders should also consider potential losses and drawdowns as part of their risk management plan, including predefined stop-loss orders and position sizing rules.

Ultimately, traders must ensure they have adequate funds to cover margin requirements and maintain sufficient account equity to withstand market fluctuations while executing their forex trading strategies.

Does The Forex Ftmo & Co Ea Come With Any Guarantees Or Refunds If It Does Not Perform As Expected?

When investing in forex trading, it is common to seek out strategies with guarantees or refunds if they do not perform as expected. However, it is essential to note that the forex market is highly volatile and unpredictable, and no strategy can guarantee a consistent profit.

As a result, it is essential for traders to thoroughly research and test any strategies before committing funds. Additionally, traders should carefully review the terms and conditions of any guarantees or refunds offered by EA providers to ensure they understand the limitations and requirements for eligibility.

Successful trading requires discipline, patience, and ongoing education rather than relying solely on guarantees or refunds from a single strategy or EA provider.

Conclusion

The Forex FTMO & Co EA is a popular trading tool that has gained significant attention in the forex trading community. This automated software is designed to help traders make profitable trades by analyzing the market and executing trades based on predetermined criteria. The cost of this software varies depending on the package selected, with prices ranging from $299 to $499.

One advantage of the Forex FTMO & Co EA is its compatibility with multiple trading platforms. This feature allows traders to use their preferred platform while benefiting from this software’s advanced capabilities.

Additionally, traders interested in using this EA can backtest it before using it for live trading, which helps to determine its effectiveness and suitability for their trading style.

In conclusion, the Forex FTMO & Co EA offers a range of benefits for traders, including compatibility with multiple trading platforms, backtesting capabilities, and flexible pricing options. However, it is essential to note that there is no guarantee of profitability when using any automated trading software.

Traders should exercise caution and conduct thorough research before investing in any forex trading tool or strategy.