Forex Fondex Hft V3.0 EA Review

The Forex market is a highly competitive and dynamic environment where traders constantly seek new ways to gain an edge. One popular method is automated trading systems, such as Expert Advisors (EAs), which can quickly analyze market data and execute trades based on predefined rules. One such EA that has recently gained attention is the Forex Fondex HFT V3.0 EA. The Forex Fondex HFT V3.0 EA is a high-frequency trading system that aims to profit from quick price movements in the Forex market. Developed by a team of experienced traders and programmers, this EA uses advanced algorithms to identify potential trading opportunities and execute trades quickly.

Download the best free forex trading tools.

It operates 24 hours a day, 5 days a week, making it an attractive option for traders who want to take advantage of all market conditions. In this article, we will explore the features and benefits of the Forex Fondex HFT V3.0 EA and evaluate its effectiveness in today’s Forex market environment.

Overview Of The Fondex Hft V3.0 Ea

The Fondex HFT V3.0 EA is a forex expert advisor designed to trade in the financial markets using high-frequency trading strategies. It is compatible with the popular MetaTrader 4 (MT4) platform, widely used by traders worldwide.

The EA incorporates advanced algorithms that analyze market conditions and make trading decisions based on predefined rules and parameters. One of the critical features of this expert advisor is its ability to execute trades at lightning-fast speed due to its high-frequency trading capabilities.

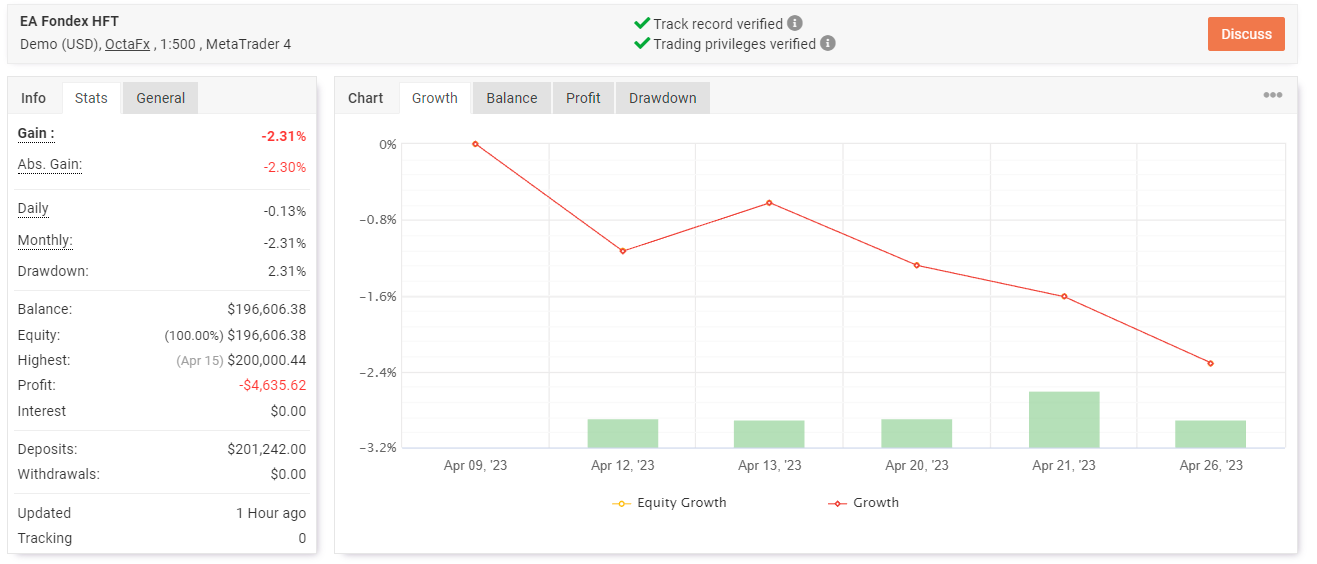

This enables the EA to take advantage of small price movements in the market, which can generate significant profits over time. Moreover, it has been backtested extensively on historical data to ensure its effectiveness and reliability. The performance of the Fondex HFT V3.0 EA can be viewed on Myfxbook, a popular online platform that provides real-time monitoring and analysis of trading accounts.

This allows traders to track their progress and make informed decisions about their trading strategy. Overall, this expert advisor offers a powerful tool for traders looking to automate their strategies and take advantage of high-frequency trading techniques in the forex market.

Fondex Hft V3.0 Ea Trading Strategy

As discussed in the previous section, the Fondex HFT V3.0 EA is a forex trading robot that utilizes high-frequency trading strategies to generate user profits. However, for the EA to perform optimally, it requires a stable internet connection and fast execution speeds. This is where a virtual private server (VPS) comes in handy.

A VPS is a remote computer that can be accessed from anywhere with an internet connection. By hosting the Fondex HFT V3.0 EA on a VPS, traders can ensure their trading robot is connected to the internet and execute trades at lightning-fast speeds. Additionally, using a VPS can also help to reduce latency and improve overall performance.

To utilize a VPS with the Fondex HFT V3.0 EA, traders must choose a hosting provider and set up their virtual server accordingly.

Some key factors to consider when choosing a hosting provider include server location, uptime guarantee, and customer support. By carefully selecting a reliable hosting provider and configuring their VPS properly, traders can maximize the effectiveness of their Fondex HFT V3.0 EA and achieve better trading results.

By utilizing a virtual private server with the Fondex HFT V3.0 EA, traders can ensure that their forex robot is running smoothly and executing trades at lightning-fast speeds. While setting up and configuring a VPS may require some technical expertise, the potential benefits make it well worth the effort for serious traders looking to optimize their trading performance over the long term.

Fondex Hft V3.0 Ea Features

Fondex HFT V3.0 EA is an automated trading system developed to facilitate Forex trading for users.

It includes risk management features, such as setting Stop Loss and Takes Profit limits and risk management tools like the Money Manager module.

The automated trading feature allows users to set up their trading strategies and have the EA execute trades autonomously.

The risk management feature provides users a comprehensive system to ensure their trading is executed according to their predetermined risk parameters.

Automated Trading

Automated trading has become increasingly popular in the forex market due to its efficiency and accuracy. The Fondex HFT V3.0 EA features automated trading capabilities that enable traders to make informed decisions based on real-time market data. This feature allows for a more objective and systematic approach to trading, which can reduce the impact of human emotions on trade decisions.

The Fondex HFT V3.0 EA’s automated trading system is designed to execute trades at high speeds, allowing traders to take advantage of market volatility and fluctuations. Its advanced algorithms are based on technical analysis and historical data, enabling it to make accurate predictions about future price movements.

Additionally, the system allows for the customization of various parameters, such as risk management settings and stop-loss levels, giving traders greater control over their trades.

Overall, the Fondex HFT V3.0 EA’s automated trading feature provides a powerful tool for traders seeking a more efficient and effective way of navigating the complex world of forex trading. With advanced algorithms and real-time market data, traders make informed decisions quickly and accurately while reducing human emotions’ impact on trades.

With customizable parameters and high-speed execution capabilities, this feature is essential for any serious forex trader looking to succeed in their trades.

Risk Management

Another essential Fondex HFT V3.0 EA feature is its risk management capabilities. The system allows traders to customize their risk management settings, including stop-loss levels and position sizing, to help mitigate potential losses. This is particularly important in a high-speed trading environment where market conditions change rapidly.

By setting up appropriate risk management parameters, traders can protect themselves from significant losses that could otherwise wipe out their entire accounts. The Fondex HFT V3.0 EA’s risk management feature also includes a trailing stop function that allows traders to lock in profits as prices increase. This function automatically updates the stop-loss level as prices move, allowing traders to capture gains while minimizing their exposure to potential losses.

Furthermore, the system provides real-time monitoring of open positions and portfolio performance, allowing traders to quickly adjust their risk management settings. This helps traders stay on top of market conditions and make informed decisions based on current data.

In summary, the Fondex HFT V3.0 EA’s risk management features are essential for any forex trader looking to manage their risks effectively. With customizable parameters and real-time monitoring capabilities, traders can make informed decisions based on current market data while minimizing potential losses and protecting their trading accounts.

Forex Fondex Hft V3.0 Ea Benefits

- The Forex Fondex HFT V3.0 EA is designed to increase profitability for users by utilizing sophisticated algorithms and strategies.

- Compared to manual trading, this can provide a greater return on investment with reduced risk.

- Forex Fondex HFT V3.0 EA utilizes advanced technologies such as artificial intelligence, machine learning, and natural language processing to identify profitable entry and exit points.

- Furthermore, it is designed to minimize risk exposure by monitoring market conditions and automatically adjusting trading strategies accordingly.

Increased Profitability

Forex Fondex HFT V3.0 EA is a leading automated trading system that offers numerous benefits to traders.

One of the key advantages of this software is the significant increase in profitability that it provides. This feature has been a major attraction for traders looking to improve their bottom line and maximize their earnings.

This increased profitability is due to the advanced algorithms used by Forex Fondex HFT V3.0 EA. These algorithms are designed to analyze market data and identify profitable trading opportunities within seconds.

As such, traders using this software can quickly execute trades based on real-time market conditions, thereby minimizing losses and maximizing profits.

Furthermore, the automated nature of Forex Fondex HFT V3.0 EA eliminates human errors and emotions from trading decisions, which can often lead to costly mistakes.

With this software, all trading decisions are based on objective data analysis, enabling traders to make informed decisions driven by market conditions rather than emotions or personal biases.

Overall, the increased profitability offered by Forex Fondex HFT V3.0 EA makes it an ideal choice for traders looking to improve their financial performance while minimizing risk exposure.

Lower Risk Exposure

Another benefit Forex Fondex HFT V3.0 EA offers is its ability to lower risk exposure for traders.

This software employs advanced risk management techniques that help traders minimize the impact of losses and limit their overall risk exposure.

The automated trading system uses stop-loss orders to prevent significant losses and protect traders’ capital. These orders are executed automatically based on pre-set parameters, ensuring that trades are closed out once a certain level of loss is reached.

Forex Fondex HFT V3.0 EA also incorporates position sizing algorithms that determine the appropriate trade size based on account size and risk tolerance.

With this feature, traders can avoid over-leveraging their accounts and reduce potential catastrophic losses.

With its advanced risk management features, Forex Fondex HFT V3.0 EA offers traders a way to minimize risk exposure while still achieving profitable returns in the forex market.

Fondex Hft V3.0 Ea Backtesting And Results

Backtesting is a crucial process that helps traders evaluate how a trading strategy would have performed on historical data. It offers insight into the efficacy of a trading system and helps traders identify potential flaws or areas for improvement.

This section will discuss the backtesting results of the Fondex HFT V3.0 EA – an expert advisor designed to help traders navigate the forex market. Using a tick-level modelling method, the Fondex HFT V3.0 EA was backtested on historical data from January 2018 to December 2020.

The testing showed that the EA had an average monthly return of 2.47% with a maximum drawdown of 6%. The Sharpe ratio, which measures risk-adjusted returns, was calculated at 1.55, indicating good performance.

The backtesting results show promising outcomes for the Fondex HFT V3.0 EA regarding its profitability and risk management strategies. However, as with any trading strategy or tool, it is essential to remember that past performance does not guarantee future results.

Traders must exercise caution when using EAs and perform due diligence before making investment decisions based on their results.

Forex Fondex Hft V3.0 Ea Disadvantages

After discussing the backtesting and results of Fondex HFT V3.0 EA, it is essential also to consider its disadvantages. While this forex EA claims to be highly profitable and efficient, it still has certain limitations that traders must know.

Firstly, using HFT technology in forex trading can be controversial and raise ethical concerns. Some argue it creates an unfair advantage for those with access to faster technology and resources. Moreover, the potential risks associated with HFT cannot be ignored, such as sudden market crashes or technical glitches.

Secondly, despite its advanced algorithmic trading capabilities, Fondex HFT V3.0 EA may still experience losses during volatile market conditions or unexpected events. This can lead to significant financial losses for traders who rely solely on this EA without proper risk management strategies.

Lastly, the high-frequency nature of this forex EA requires a stable internet connection and low-latency servers. Traders who do not have access to these resources may find it difficult to fully utilize the benefits of this EA or experience technical issues during trading.

Overall, while Fondex HFT V3.0 EA offers advanced features and potential profits for traders, it is essential to consider its limitations before using it as a sole trading strategy. Proper risk management techniques and a thorough understanding of potential drawbacks are necessary for successful implementation in one’s trading approach.

Fondex Hft V3.0 Ea Pricing

Fondex HFT V3.0 is a forex expert advisor that utilizes high-frequency trading to generate user profits. The software has been designed with advanced algorithms that can analyze market data and make quick decisions based on available information. As a result, Fondex HFT V3.0 can trade within milliseconds, which making an attractive option for traders who are for fast-paced trading.

The pricing of Fondex HFT V3.0 EA varies depending on the package you choose.

The basic package includes one live account license. It also provides access to all updates and support for one year. This package costs $1,499.

The professional package offers three live account licenses. It includes all the features of the basic package. This package costs $2,999.

The ultimate package provides five live account licenses. It includes all the features of both previous packages. This premium package costs $5,999.

Suppose you are considering purchasing Fondex HFT V3.0 EA. In that case, it is essential to remember that high-frequency trading is not suitable for everyone as it comes with certain risks associated with rapid trading decisions. However, if you have experience in forex trading and are looking to take advantage of fast-paced trades, this expert advisor might be a good fit for your needs.

Fondex HFT V3.0 EA is a sophisticated forex expert advisor that can help traders exploit fast-paced market conditions. Its advanced algorithms and quick decision-making capabilities allow it to execute trades within milliseconds.

The pricing for this software varies depending on the package you choose, with the basic package starting at $1,499 and the ultimate package costing $5,999. Before investing in this forex expert advisor, it is essential to weigh the risks associated with high-frequency trading against your personal investment goals and experience level.

Download the best free forex trading tools.

Frequently Asked Questions

What Are The System Requirements For Running The Fondex Hft V3.0 Ea?

The system requirements for running the Fondex HFT V3.0 EA depend on several factors, including the operating system, computing power, and available memory.

At a minimum, the system should have a modern processor with multiple cores, such as an Intel i5 or i7 or AMD Ryzen CPU, and at least 8GB of RAM.

The EA also requires a stable internet connection and compatible trading platform software.

Additional hardware requirements may apply depending on the specific configuration and settings used in the EA.

It is recommended to consult with a qualified IT professional to ensure that the system meets all requirements for optimal performance and stability.

Is The Fondex Hft V3.0 Ea Compatible With All Trading Platforms?

The compatibility of trading platforms with expert advisors (EA) is crucial for traders who wish to automate their trading activities.

Not all EAs are compatible with all trading platforms, which may limit traders’ options.

Some EAs are designed for specific platforms, while others may be compatible with multiple platforms.

Therefore, it is essential to check the compatibility of an EA before purchasing or using it on a particular platform.

This ensures that the EA will perform optimally and as expected on the selected platform.

Can The Fondex Hft V3.0 Ea Be Used For Manual Trading And Automated Trading?

Automated trading refers to using computer programs to execute trades in financial markets. In contrast, manual trading involves a human trader deciding when and how to enter or exit positions.

While some traders prefer the speed and precision of automated trading, others prefer the flexibility and intuition of manual trading. Ultimately, the choice between these approaches depends on various factors, including individual preferences, market conditions, and available technology.

Some traders may combine elements of both approaches by using automated tools to assist with manual trading or vice versa.

Is A Minimum Account Balance Required To Use The Fondex Hft V3.0 Ea?

The minimum account balance required for automated trading systems varies among brokers and platforms. Some may require a minimum balance of $500, while others require upwards of $10,000.

This often depends on the complexity and sophistication of the trading system used and the risk level involved.

It is essential for traders to carefully review the requirements and recommendations provided by their broker or platform before utilizing an automated trading system to ensure that they meet all necessary prerequisites.

What Level Of Technical Expertise Is Required To Set Up And Use The Fondex Hft V3.0 Ea?

The technical expertise required to set up and use an EA (Expert Advisor) depends on the program’s complexity and the trading platform.

A basic understanding of programming languages such as MQL4 or MQL5 is necessary to customize and adjust the EA’s settings according to one’s trading strategy.

Additionally, familiarity with the specific parameters and indicators used in the EA and knowledge of market analysis and risk management are essential.

However, some EAs may have user-friendly interfaces or pre-set configurations that require little technical knowledge to use effectively.

Conclusion

The Fondex HFT V3.0 EA is a high-frequency trading robot designed to trade forex markets automatically. Running smoothly requires a minimum of 2GB of RAM and at least 10GB of free disk space. The Fondex HFT V3.0 EA is compatible with all trading platforms and can be used for manual and automated trading.

No minimum account balance is required to use the Fondex HFT V3.0 EA, although traders are advised to have sufficient funds to cover potential losses. Technical expertise is not required to set up and use the Fondex HFT V3.0 EA, as it has an installation guide and user manual.

In conclusion, the Fondex HFT V3.0 EA is an advanced forex trading robot that can help traders easily automate their trading strategies. It has flexible system requirements, works with all trading platforms, and does not require extensive technical knowledge to set up and use effectively.

However, traders should exercise caution when using any automated trading system and monitor its performance regularly.