EA New Way V3.1 Forex Trading Robot Review

EA New Way V3.1 is an expert advisor (EA) for the MetaTrader 4 and 5 trading platforms designed for automated forex trading. This advanced algorithm integrates three trading strategies to identify trends and determine optimal entry and exit points for trades.

Overview of EA New Way V3.1

EA New Way V3.1 is built on three key trading strategies:

- EA Flower – Uses an innovative averaging system to determine price movement rate and direction

- EA Golden Elephant – Identifies trend reversals using a unique technical indicator

- EA Super 8 – Aggressive strategy that capitalizes on market volatility

By combining these three complementary tactics, EA New Way aims to boost profits while minimizing risk.

Key features:

- Advanced algorithm for collecting trade statistics and slippage control

- Real-time broker trade execution quality checks

- Conservative and aggressive trading modes

- Optional martingale for recovery of losses

- Compatible with ECN/STP brokers

- Not sensitive to spread or slippage

How the EA New Way V3.1 Trading Robot Works

EA New Way utilizes a complex, multi-step process to scan the market, identify high-probability setups, and execute automated trades.

Step 1: Trend Evaluation

The expert advisor first analyzes the broader market context to evaluate the prevailing trend on any timeframe from M1 to D1. This assessment allows the EA to trade in the direction of momentum.

Step 2: Entry Signal Identification

Once the trend is established, the EA scans the market using its three integrated strategies to spot high-probability entry points. The EA seeks convergence between the strategies before triggering a trade.

Step 3: Trade Execution

After an entry signal is identified, the EA executes automated market or limit orders based on predefined parameters. Trades are accompanied by stop-loss orders to control downside risk.

Step 4: Trade Management

Open trades are monitored in real-time and managed based on market conditions. The EA aims to let profits run or cut losses short based on indicators and settings. It can also use martingale to add to positions.

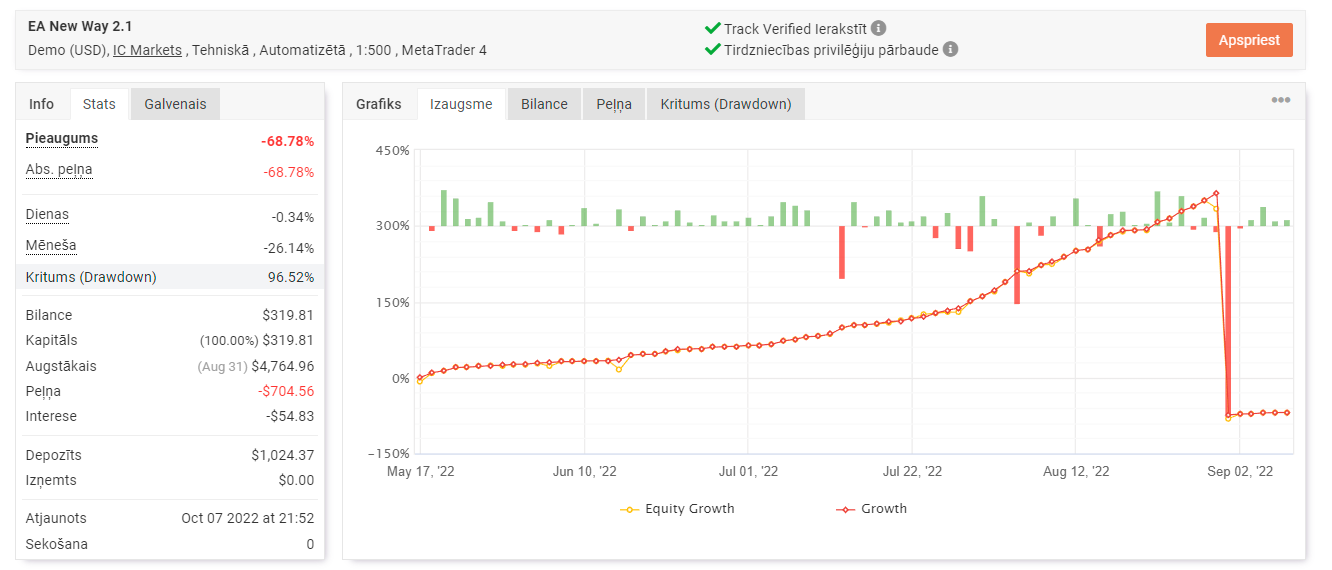

Performance and Backtests

Extensive backtesting shows that EA New Way can produce steady profits over long periods. Here are some key metrics:

- 10-year backtest profit – Over $250k

- Max drawdown – Under 20%

- Profit factor – 1.7+

- Expected monthly profit – 2%+

These results illustrate the EA’s potential to generate consistent returns during various market cycles. Past performance does not guarantee future results.

Using EA New Way V3.1

EA New Way is simple to set up and use on MetaTrader 4 or 5 platforms. Follow these steps:

- Purchase license and download files

- Load EA onto chart and set parameters

- Run backtest and optimize as needed

- Launch for live trading on VPS

The developers recommend using a virtual private server (VPS) for reliable connections and 24/7 automated trading.

Parameters

EA New Way has several customizable settings to control risk, trade activity, position sizing, and more. Monitor performance and adjust parameters as needed to align with risk tolerance and market conditions.

EA New Way V3.1 Pros and Cons

Pros

- Proven long-term profitability

- Multiple trading strategies

- Conservative and aggressive modes

- Low historical drawdowns

- Wide parameter customization

Cons

- Requires reliable VPS connection

- Complex multi-step process

- Potential for over-optimization

- Higher commission costs due to trade frequency

EA New Way V3.1 Conclusion

EA New Way V3.1 provides traders with an advanced automated solution integrating three complementary trading strategies. Extensive backtesting shows the EA’s ability to generate steady profits over long periods with relatively low drawdowns. The wide range of customizable settings allows traders to tailor the system to their goals and risk appetite. While the EA requires some effort to set up and monitor, it ultimately aims to boost returns while removing emotions from trading decisions.