Optimizing Forex Trading with AREMA MANTRA EA

AREMA MANTRA EA is an automated forex trading robot that originates from Indonesia and is gaining popularity among forex traders. This expert advisor (EA) claims to provide consistent profits of 80-110% per month. In this comprehensive review, we will analyze AREMA MANTRA EA’s features, performance statistics, pros and cons to determine if it is a worthwhile investment for forex traders.

How AREMA MANTRA EA Works

AREMA MANTRA EA is designed to automatically execute trades based on its built-in trading strategy across 28 currency pairs. It utilizes various technical indicators like moving averages and stochastic to identify potential trading opportunities.

Once installed on the MetaTrader 4 platform, the EA will analyze the markets and open long or short positions based on its strategy without any manual intervention. The number of maximum active trades and loss limits can be configured as per risk appetite.

Key Features[4]

- Fully automated trading with no manual intervention needed

- Trades across 28 currency pairs

- Customizable trading settings and risk management

- Suitable for both scalping and swing trading

- Utilizes combination of indicators like Moving Averages, Stochastic etc.

- Regular updates to stay profitable in changing markets

Performance Statistics and Backtests

As per the vendor’s website, AREMA MANTRA EA has been backtested across several time periods on EUR/USD with exceptionally high winning percentages:

| Timeframe | Win Rate | Profit |

|---|---|---|

| 2020-2021 | 96.31% | 16,059% |

| 2019-2020 | 95.24% | 7,816% |

| 2018-2019 | 97.66% | 12,215% |

These stellar backtest results showcase the potential profitability of the EA if traded correctly. However, past performance is not indicative of future results and real-world trading results may vary.

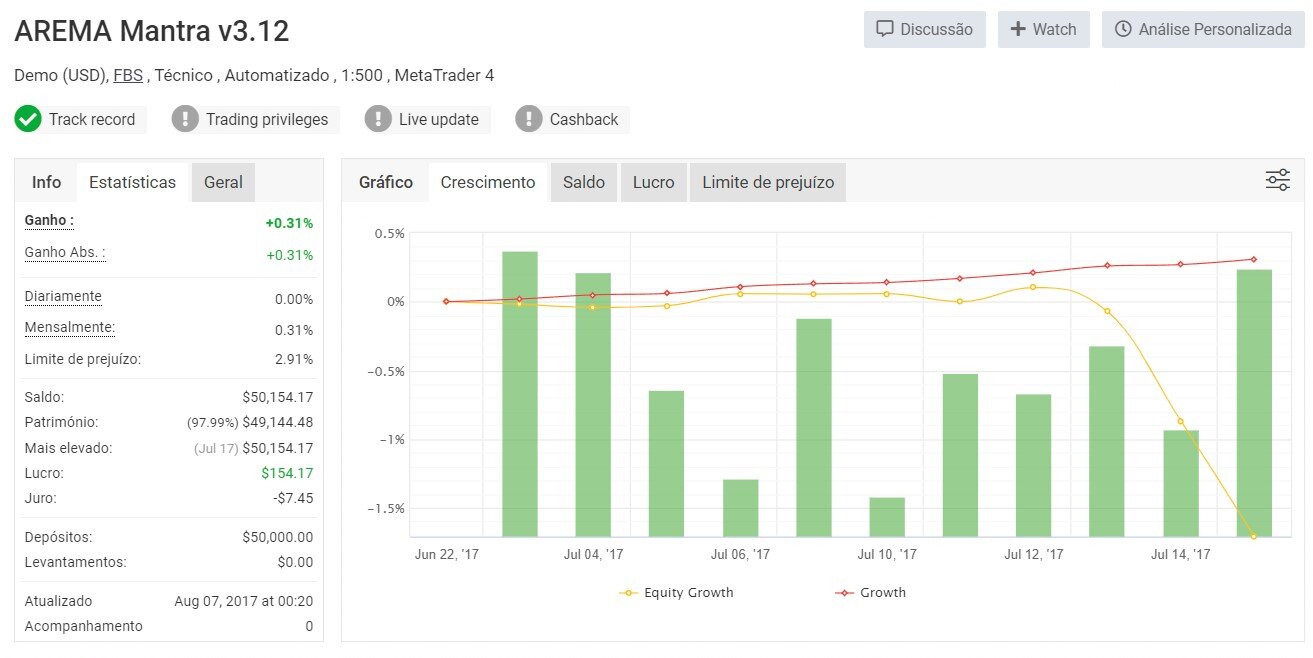

Real Account Trading History

The developer shows limited trading history from a real account on their website. For the period of Sep 2021 to Dec 2021, AREMA MANTRA EA delivered:

- 72% net profit

- Maximum drawdown of 18%

- Very high winning trades percentage

While the returns seem consistently high, a longer trading period would be required to gauge the EA’s long term profitability across different market conditions.

Pros of Using AREMA MANTRA EA

Profitable Backtest Results

The backtests spanning 3-4 years show incredible returns across EUR/USD. This indicates a robust and profitable trading strategy.

Customizable Settings

The EA allows traders to modify key parameters like trade allocation, max spreads, magic number as per their preferences and risk appetite. It also provides control over trading specific currency pairs.

Regular Updates

The developer frequently updates the EA to sustain performance even as market dynamics change. This ensures its trading strategy is optimized for current conditions.

Lucrative Money Management

AREMA MANTRA EA has inbuilt risk management features like martingale, recovery algorithms and stop loss limits to maximize profits while minimizing losses.

Cons of Using AREMA MANTRA EA

Unverified Live Results

Despite stellar backtests, AREMA MANTRA EA provides limited trading history from a live account. Long term real account performance remains unverified.

Overoptimization Risk

Tuning the EA excessively to historical data could lead to overoptimization and loss of profitability on unseen market conditions.

Potential Losses

Like any automated trading system, losses can exceed deposited capital especially if traded aggressively without stop losses. Risk is inherent despite advanced money management.

Requires Monitoring

While automated, the EA’s performance should be monitored periodically to ensure effective functioning and intervene if required. Server errors or platform crashes can interrupt trading.

Costs Involved

AREMA MANTRA EA is sold for $299 as a one-time fee without any subscription costs. This is reasonable compared to many other EAs. Additional costs include:

- VPS service for uninterrupted trading: $20-$30 per month

- Trading platform such as MT4: Free or bundled with broker account

- Forex broker account: Spreads, commissions and swap rates

Considering the high profit potential, these recurring costs seem affordable.

Verdict

Analyzing all aspects, AREMA MANTRA EA shows promise for being a profitable automated trading solution. The advantages of consistency, risk control and regular updates outweigh the disadvantages. For traders willing to take risks, it may deliver great results provided trading parameters are configured properly. As with any EA, losses can also occur so moderate risk is essential.

Overall, AREMA MANTRA EA passes the test as a wise investment for forex traders looking for hands-free income. It seems poised to provide high rewards despite short-term uncertainties and downswings. As more live performance data becomes available, we can better gauge its long-term profitability across different market regimes.