Advanced Swiss Scalper Review

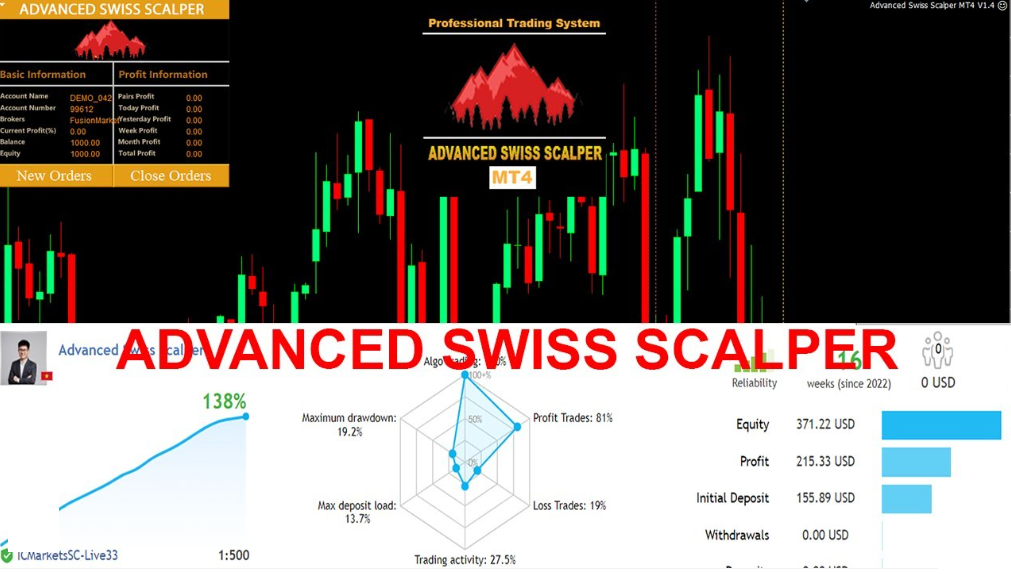

Advanced Swiss Scalper is a new automated trading system developed to provide traders with an efficient, accurate and reliable method of scalping the Forex markets. This article will discuss the features and opportunities this system provides its users in detail.

Download the best free forex trading tools

The advanced technology provided by the software allows it to analyze market data quickly and accurately, allowing for rapid decisions on when to enter or exit trades. In addition, it also offers integrated risk management tools designed to protect traders from excessive losses while providing them ample opportunity for profit. The user interface is easy-to-use yet powerful enough to meet even the most demanding trader’s needs. As such, Advanced Swiss Scalper offers a comprehensive suite of options that can be tailored to suit individual requirements.

What Is Advanced Swiss Scalper?

Advanced Swiss Scalper is an Expert Advisor (EA) for the MetaTrader 4 (MT4) trading platform. The EA has been designed to function as a scalping tool and make quick trades on the foreign exchange market with shallow risk. Advanced Swiss Scalper can be used on ECN accounts or those without commission fees, allowing users to configure the settings according to their needs.

The leading currency pair that Advanced Swiss Scalper works with is EUR/USD, which generally offers more consistent volatility than other pairs. It also employs sophisticated algorithms to generate stable returns while minimizing losses due to unpredictable market movements. Additionally, a manual guide provided by the developers of this EA explains how best to utilize its features and maximize profits.

This advanced Swiss Scalper provides traders with an excellent way to capitalize on short-term trends in the forex market with minimal risk exposure, allowing them to take advantage of numerous opportunities for profit throughout each trading day. Its user-friendly interface makes it easy for even novice traders to get started quickly and reap the rewards of successful scalping strategies.

How Does Advanced Swiss Scalper Work?

The advanced Swiss Scalper is a sophisticated trading strategy that utilizes an Expert advisor (EA) to create automated trades on the MetaTrader 4 platform. The EA uses Dukascopy real-time ticks and takes advantage of low spreads from brokers with low spread costs for optimal results.

A vital feature of this scalper strategy is its ability to adjust lot size to market conditions. This helps ensure maximum capital preservation while allowing traders to take full advantage of profitable opportunities. By using this method, traders can achieve greater accuracy and efficiency than manual trading alone.

The advanced Swiss Scalper is suitable for beginner and experienced traders, as it requires minimal setup or training to get started. Additionally, the EA automatically handles all aspects of the trade process, so there is no need for manual intervention once it has been configured correctly. With these benefits combined, it makes an ideal choice for those looking to maximize their potential profits quickly and efficiently.

What Is Scalping?

Scalping is a trading strategy traders use to exploit small market price movements. It involves opening and closing positions quickly, aiming for profits brokers offer. In scalping, trades are usually opened and closed within minutes or even seconds, depending on the market conditions.

To implement this strategy successfully, it’s essential to understand some key elements that can help maximize profits while minimizing risk per trade. These include 1. Knowing what assets you’re interested in trading; 2. Having an outlined plan for entry and exit points; 3. Setting up stop loss orders to minimize losses when prices move against your position; 4. Understanding how to choose the right broker who offers low spreads and fast execution times; 5. Being aware of news events that could affect your trades; 6—keeping track of your performance to identify improvement opportunities over time.

By having a well-defined scalp trading strategy and following these guidelines, traders can improve their chances of success when attempting advanced Swiss scalper strategies. With practice, knowledge, experience and perseverance, they can enjoy consistent returns while managing risk effectively.

Advantages Of Using Advanced Swiss Scalper

The advanced Swiss Scalper trading strategy is a powerful and effective tool for experienced traders. It requires real ticks in MT4 using low-spread brokers with low drawdowns, allowing the user to gain maximum profits from each trade. The strategy was backtested over multiple time frames and proven to be stable. It can be used on any M15 chart and needs minor tweaks, such as changing lot size or taking profit levels, making it incredibly versatile.

An additional benefit of the Advanced Swiss Scalper is that it works well even when market conditions are volatile. This means users do not have to worry about their trades being affected by sudden price movements or other unpredictable events. Furthermore, this system has been designed to minimize risk while maximizing profits, which all severe traders strive towards.

Using the Advanced Swiss Scalper allows traders to improve their skills and develop an edge in the markets they are most interested in trading. With its high win rate and consistent returns, many traders find that this strategy gives them an advantage over their competitors, who rely solely on manual analysis or technical indicators alone. Ultimately, this system offers a viable solution for those looking to become successful scalpers without spending countless hours studying charts or analyzing data sets.

What Types Of Assets Can You Trade With Advanced Swiss Scalper?

Advanced Swiss Scalper is an automated trading system that allows you to trade various assets with a high degree of accuracy. This scalping technique takes advantage of low spreads and fast executions offered by brokers, allowing traders to take profits quickly in the volatile currency markets. Its advanced vector machine learning algorithmic technology and Autolot feature provide intraday trades with precision entries.

The software can be used for various asset types, such as commodities, stocks, currencies (particularly the Swiss franc) and indices. The scalping strategy employed by Advanced Swiss Scalper enables it to identify trading breakouts and capitalize on them with minimal risk, making it suitable for both novice and experienced traders alike. Furthermore, this platform seeks out spread brokers with low spreads so that users can benefit from tight bid-ask spreads over time.

This innovative approach to trading offers numerous advantages compared to traditional methods; it enables efficient price movements and improves order execution capabilities due to its sophisticated algorithms, which allow for more accurate predictions. Moreover, its user-friendly interface makes it easy for anyone to use regardless of experience. It even provides comprehensive support services should any technical issues arise during operation.

Setting Up The Trading System

The advanced Swiss Scalper is a powerful trading system that can be used to profit in markets with high volatility. It has been designed to take advantage of the tight spreads, low latency and fast execution, which are standard features of brokers using MT4 platforms. The EA settings come as part of a free download package, allowing traders to set up their accounts for automated trades quickly.

Using tick data from Dukascopy, the advanced Swiss Scalper allows traders to access detailed market information on an intraday basis. This gives them greater insight into price movements and the ability to react faster than manual methods. An essential requirement when setting up this type of system is ECN (Electronic Communications Network) connectivity for accuracy and reliability.

Finally, news filter applications help to protect against unexpected dips or spikes in prices due to economic events such as interest rate changes or central bank announcements. Filtering out news-related trades can reduce losses and preserve profits over time.

Download the best free forex trading tools

Analyzing The Market

The advanced Swiss Scalper is one of the most effective methods for traders to profit in the Forex market. To maximize its potential, it is essential to understand the fundamentals of metatrader 4 (MT4), backtesting and currency pair analysis. Through MT4, traders can access various tools to analyze the forex market.

Backtesting helps traders determine which strategies would work best with their trading style and provide an accurate view of their strategy’s performance under different conditions. It also allows traders to uncover any inconsistencies or flaws in their trading system before investing capital.

Currency pairs play an essential role when using an advanced Swiss scalper as they help identify entry points, stop losses and take profit targets. By understanding how each currency pair behaves about others, traders are better equipped to make informed decisions while trading on the forex markets. With enough practice and dedication, traders can become experts at analyzing the forex market through this method and increase their chances of achieving profitability over time.

Choosing Entry And Exit Points

Choosing entry and exit points for an advanced Swiss scalper is critical to the trading system. It requires knowledge, skill and discipline to consistently identify when to open new orders on MetaTrader 4 (MT4) and determine where to place stop losses and take profits. To be successful at this, traders must:

- Analyze market conditions using technical indicators such as the Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI)

- Monitor channel breakouts on time frames below 15 minutes to establish high/low points with precision

- Scan candlestick patterns like engulfing bars or tweezers that signal reliable reversals

- Execute trades based on predetermined rules regarding position size and risk management

- Assess long-term trends in currency pairs while being mindful of sudden price movements due to news releases

- Utilize short-term strategies such as scalping, fading or momentum trading depending on current market conditions

Therefore, selecting entry and exit points with accuracy is essential for any advanced Swiss Scalper hoping to achieve success in their trading endeavours.

Managing Risk

Having established the critical elements of choosing entry and exit points, it is essential to consider how we manage risk. To begin with, the Martingale strategy is a famous risk management tool that has been used in trading for centuries. This strategy involves increasing the size of one’s position after each loss until, eventually, a gain is made, thus recovering any losses incurred. When live trading markets using this approach, it is essential to understand breakout patterns and monitor every tick based on actual market movements rather than relying solely on technical indicators. Furthermore, when using a real account for scalping purposes, monitoring should be done continuously to stay abreast of changes in market conditions so as not to incur too much risk or miss potential opportunities.

The aim of any scalping system should ultimately be designed to reduce transaction costs while taking advantage of small price movements throughout a session. Scalpers who are successful at their craft have developed strategies that allow them to detect and capitalize on such fluctuations over short-term periods quickly; however, they must also be aware of the risks associated with rapid decision-making and ensure that all transactions are monitored closely to protect against future losses. By carefully evaluating market trends and understanding trendlines before entering into trades, scalpers can reduce their chances of being caught off guard by sudden shifts in market prices due to news events or other unforeseen circumstances.

Setting Stop Losses And Take Profits

Scalping, also known as advanced Swiss scalper ea settings, is popular among currency traders. It involves entering and exiting the market quickly with small profits over short time frames while attempting to minimize losses. This requires quick decision-making skills and an understanding of how the EA works to make profitable trades.

Accurate operation monitoring is essential for successful scalpers to keep up with breakouts from ranging markets or other key features of their EA. Scalpers typically look to maximize profits by making multiple trades within a day, often using leverage to do so. In addition, having a tight stop-loss setup will help reduce risk when trading using this strategy.

Advanced Swiss Scalpers must be aware of the risks associated with this type of trading, such as slippage, spreads and volatility which can all affect profitability. By incorporating these elements into their EA settings, traders can better manage their risk and optimize their returns on investments while looking to maximize their gains in the long term.

Optimizing For Profitability

The advanced Swiss Scalper EA, an automated trading tool for the MT4 Forex platform, is a robust and reliable trading strategy. The robot allows traders to purchase the Scalper to automate their trades without manually monitoring or analyzing markets in real time. This makes it possible for traders to maximize profitability with minimal effort.

This scalping system uses algorithms and technical indicators to detect market reversals before they occur, enabling it to enter and exit positions immediately. With its ability to identify opportunities quickly, this robot can help traders make consistent profits while minimizing risk. It also offers customizable parameters so users can tailor the robot’s performance according to their preferences and goals.

The advanced Swiss Scalper EA is designed for all types of traders, whether experienced or novice, looking for an effective way to increase their returns on investment through automated trading. Its user-friendly interface ensures that anyone can easily understand how the software works, allowing them to benefit from its superior capabilities immediately after installation.

Using Automated Trading Tools

Automated trading tools, such as the advanced Swiss Scalper EA MT4 robot for Eurusd, are becoming increasingly popular in Forex markets. Automated trading robots are designed to help traders make decisions faster and more accurately than manual methods. Here we will discuss how to purchase a Swiss Scalper EA MT4 robot and obtain instructions on setting it up correctly:

- Purchase an Advanced Swiss Scalper EA MT4 Robot from one of the best online FOREX brokers.

- Download the Manual Guide, which provides all the instructions to set up and configure your robot for optimal performance.

- Use breakout strategies in your manual guide to get better results with your new robot.

Using these simple steps, you can quickly set up your Advanced Swiss Scalper EA MT4 robot to begin making profitable trades in the Forex market without any additional learning curve or effort. With this automated trading tool, you can take advantage of all the benefits of using robots, like increased speed and accuracy when executing orders and improved consistency in achieving desired outcomes even during volatile market conditions.

Frequently Asked Questions

How Much Capital Do I Need To Get Started With Advanced Swiss Scalper?

The capital needed to start scalping depends on the individual’s risk tolerance and trading style. It is recommended that traders start small, with a smaller portfolio size, as this will help ensure they are comfortable with their strategy before committing more significant sums of money. Furthermore, it allows for greater control over losses and improved learning opportunities due to reduced financial pressures. Many experienced traders suggest investing only 2-4% of a total account balance in any trade when utilizing advanced Swiss scalper strategies.

Do I Need Any Prior Trading Experience To Use Advanced Swiss Scalper?

When engaging in scalping, prior trading experience is typically beneficial. Scalping requires making quick decisions based on market conditions and trends. This type of trading requires knowledge related to technical indicators and chart patterns. Without some background or familiarity with these concepts, it may be challenging to utilize Advanced Swiss Scalper successfully. Additionally, having experience placing orders rapidly will increase the chances of success utilizing this particular strategy as scalpers aim to close positions quickly.

Is There A Minimum Trading Period When Using Advanced Swiss Scalper?

A minimum period must be observed for the strategy to succeed when trading. This is especially true when using advanced strategies such as scalping. Therefore, it should not be surprising that Advanced Swiss Scalper also requires a minimum trading period to ensure optimal results. While the exact length of this period may vary, traders can generally expect to trade over multiple weeks or even months before achieving desired performance levels with this specific strategy.

Is Advanced Swiss Scalper Available On Mobile Devices?

Mobile trading is becoming increasingly popular due to its convenience and the ability to monitor markets on the go. Advanced Swiss Scalper is a scalping software that can be used for forex trading. It features high accuracy, low-risk trades, and fast execution times. This article will discuss whether or not users can access this platform from their mobile devices.

What Kind Of Customer Support Does Advanced Swiss Scalper Offer?

Customer support is an integral part of trading software. Advanced Swiss Scalper offers customer support by providing 24/7 assistance, a comprehensive help centre with FAQs and tutorials, email support, and live chat options. The company also offers personalized assistance to customers through one-on-one sessions with experienced traders who can provide tailored advice on using the platform effectively. All these features are designed to ensure that users have access to help when needed, allowing them to make informed decisions about their trades.

Conclusion

Advanced Swiss Scalper is an advanced trading platform that offers a range of features to its users. With the right amount of capital, no minimum trading period and access to mobile devices, it provides traders with an excellent opportunity to take advantage of the markets.

Furthermore, customer support is available should they need assistance or wish to ask any questions regarding their trades. It has become popular among experienced and novice traders due to its user-friendly interface and reliable performance. Advanced Swiss Scalper is an effective tool for those looking to profit through scalping strategies.