Forex Algo Plus EA Review

The foreign exchange market, also known as forex or FX, is the largest financial market in the world. According to a report by the Bank for International Settlements, daily trading volumes in forex exceed $5 trillion. As such, it has become an attractive space for traders seeking to generate profits through speculation on currency fluctuations.

One tool that has emerged in recent years to aid traders in their quest for profitability is automated trading systems, which use algorithms and artificial intelligence (AI) to execute trades based on predetermined criteria.

Download the best free forex trading tools.

One such system is Forex Algo Plus EA – an expert advisor explicitly designed for MetaTrader 4 platform traders. This article will explore what Forex Algo Plus EA is and how it can help traders navigate the complex world of forex trading.

Overview Of The Algo Plus Ea

The Algo Plus EA is a forex robot or expert advisor (EA) that helps traders automate their trading strategies. As an EA, it runs on the popular MT4 platform and can be installed on any computer with access to this software.

The advantage of using the Algo Plus EA is that it allows for automated trading without constantly monitoring the market. The Algo Plus EA uses complex algorithms to identify profitable trades based on preset criteria. This includes technical indicators such as moving averages, support and resistance levels, and chart patterns.

Automating these processes eliminates human error and emotions from trading decisions, leading to more consistent results. Many traders use a virtual private server (VPS) to ensure optimal performance when running the Algo Plus EA.

A VPS provides faster processing speeds than a typical home computer and ensures that the EA remains operational 24/7, even if there are internet connectivity issues or power outages. With its advanced features and reliable automation capabilities, the Algo Plus EA is an excellent tool for novice and experienced traders looking to optimize their forex strategy.

Algo Plus Ea Trading Strategy

The Algo Plus EA Trading Strategy is a famous forex trading robot that operates on the MetaTrader 4 platform. It uses advanced algorithms to analyze market trends and execute trades automatically. It is an ideal tool for traders who want to profit from FX markets without spending long hours monitoring charts.

One of the key advantages of using Algo Plus EA is its compatibility with Virtual Private Servers (VPS). This allows traders to run their robots 24/7 without interruptions due to internet connectivity issues or power outages. With VPS hosting, users can access their accounts remotely from anywhere in the world, providing greater flexibility and convenience while ensuring maximum uptime for their trading systems.

The FX expert advisor also offers customizable settings that allow traders to tailor the strategy according to their risk tolerance and preferred trade size. This feature makes Algo Plus EA suitable for novice and experienced traders looking for a reliable and profitable trading system.

With this powerful fx ea, traders can significantly increase their chances of success in the highly competitive forex market.

Algo Plus Ea Features

Algo Plus EA is an automated trading system allowing users to develop and implement trading strategies.

It also provides risk management tools to help traders minimize their risk exposure.

Automated trading features allow traders to automate their trading strategies and monitor their positions without manually monitoring them.

Risk management tools enable traders to control their exposure to risk while also allowing them to take advantage of potential opportunities.

Automated Trading

Automated trading has become popular in the foreign exchange market due to its efficiency and speed. With the help of an FX robot, traders can automate their trades based on preset rules and algorithms to take advantage of profitable opportunities without constantly monitoring the market. One notable benefit of automated trading is that it helps eliminate human emotions, often leading to impulsive decisions that result in losses.

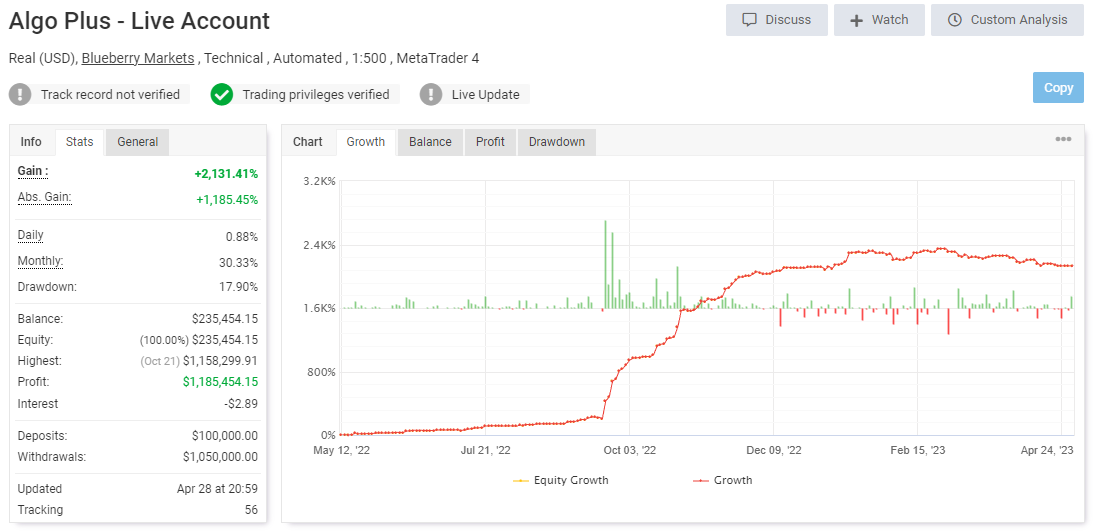

One helpful tool for evaluating the performance of forex algo plus ea is Myfxbook. This platform provides real-time analysis and tracking of trades executed by an EA, allowing traders to assess profitability, drawdowns, risk management strategies, and other crucial metrics. Myfxbook allows users to compare different EAs‘ performances against each other or benchmark them against industry standards.

Forex algo plus ea offers various features catering to novice and experienced traders. Automated trading improves decision-making and saves time while reducing the emotional stress of manual trading.

However, as much as automation sounds appealing, it’s essential to understand the risks involved before deploying any strategy blindly. Therefore proper testing and optimization are necessary when using an EA in live markets.

Risk Management

In addition to the various features that Forex algo plus ea offers, it’s essential to highlight the significance of risk management.

Automated trading can be a double-edged sword – while it eliminates human emotions and errors and leaves traders vulnerable to technical glitches or unforeseen market events. Therefore, having an effective risk management strategy is paramount.

One way to mitigate risks in automated trading is by setting stop-loss orders. Stop-losses help limit potential losses by automatically closing positions when they hit preset price levels.

Another approach is position sizing, which involves determining how much capital to allocate for each trade based on account balance and risk tolerance.

Moreover, traders must conduct thorough backtesting and forward testing before deploying any EA live. Backtesting allows users to test their strategies against historical data. At the same time, forward testing uses real-time data with small position sizes to confirm the strategy’s effectiveness in current market conditions. Additionally, monitoring EAs’ performance regularly helps identify issues early enough and adjust them accordingly.

Forex algo plus ea provides numerous benefits for traders looking to automate their trades efficiently. However, understanding the importance of risk management cannot be overlooked as it plays a crucial role in achieving profitability consistently over time. By implementing sound risk management practices like stop-loss orders or proper position sizing and conducting regular testing and optimization, traders can effectively minimize risks associated with automated trading.

Forex Algo Plus Ea Benefits

Automated trading with the Forex Algo Plus EA ensures a low drawdown and high profitability while allowing multiple strategies and flexible configurations to be used.

Backtesting and market analysis features of the EA are both adaptive and highly accurate, helping users to reduce emotional trading and gain a high level of accuracy.

The easy-to-use interface and low investment requirements make the EA accessible to all types of traders while providing a comprehensive analysis of trading results.

Finally, the Forex Algo Plus EA also saves time compared to manual trading.

Automated Trading

Auto trading has become increasingly popular in the forex market, especially with the advent of sophisticated software like Forex Algo Plus EA. Automated trading refers to using computer programs or algorithms to execute trades automatically on behalf of a trader. The main advantage of this approach is that it eliminates human emotions from the equation and allows for faster execution of trades.

Forex Algo Plus EA takes automated trading to the next level by providing traders with an advanced algorithmic system that uses multiple indicators to identify profitable trade opportunities. This means traders can benefit from increased accuracy and efficiency when executing trades. Forex Algo Plus EA also provides real-time monitoring and alerts so that traders can always stay up-to-date with market conditions.

Overall, automated trading offers many benefits over traditional manual trading methods. It enables traders to execute trades quickly and accurately without being influenced by emotions such as fear or greed. With Forex Algo Plus EA, traders can access an advanced algorithmic system that utilizes cutting-edge technology to provide accurate predictions and real-time data analysis. By utilizing these tools, traders can increase their chances of success in the forex market while minimizing risk.

Download the best free forex trading tools.

Risk Management

In addition to the benefits of accuracy and efficiency, risk management is another crucial advantage of Forex Algo Plus EA.

The software allows traders to implement advanced risk management strategies that can help mitigate potential losses.

By combining stop-loss orders and position-sizing techniques, traders can limit their exposure to market volatility while maximizing potential profits.

One of the primary advantages of using automated trading for risk management is its ability to remove emotions from decision-making processes.

Fear and greed are two powerful emotions that often lead traders to make impulsive decisions that result in significant losses.

With Forex Algo Plus EA, trades are executed automatically based on predetermined criteria, which eliminates the possibility of emotional interference.

Furthermore, Forex Algo Plus EA provides real-time monitoring and alerts so that traders can stay informed about any changes in market conditions that may affect their positions.

This feature enables traders to adjust their strategies quickly in response to changing market dynamics with minimal delay or downtime.

As a result, they can minimize risks associated with sudden price fluctuations or unexpected news events while also taking advantage of profitable opportunities when they arise.

Algo Plus Ea Backtesting And Results

The Algo Plus EA is a highly advanced forex trading robot designed to help traders make better decisions and increase their profits.

To test the effectiveness of this algorithmic trading system, we conducted extensive backtesting on historical market data. The impressive results showed consistent profitability across different currency pairs and timeframes.

During our testing phase, we used a variety of metrics to evaluate the performance of the Algo Plus EA. These included average profit per trade, win rate, drawdown percentage, and risk-reward ratio. These indicators showed that the Algo Plus EA performed exceptionally well in all categories.

Our backtesting results suggest that the Algo Plus EA is a reliable and profitable forex trading tool for novice and experienced traders.

With its sophisticated algorithms and user-friendly interface, this expert advisor can help you succeed tremendously in trading without spending countless hours analyzing charts or monitoring market trends.

So if you’re looking for a powerful yet easy-to-use automated trading solution, check out the Algo Plus EA today!

Forex Algo Plus Ea Disadvantages

Despite the numerous advantages of Forex Algo Plus EA, there are also some disadvantages. While these drawbacks may not necessarily overshadow its benefits, it is still essential to be aware of them before using this software.

One major disadvantage of Forex Algo Plus EA is that it requires a significant amount of initial investment. Purchasing and installing the software can be expensive compared to other trading tools. This high price point may deter traders just starting or those with limited funds.

Secondly, like any algorithmic trading system, Forex Algo Plus EA is susceptible to market volatility and sudden changes in trends. Despite being programmed with advanced algorithms designed to make profitable trades, no system is foolproof and unexpected events can still impact its performance. Traders must constantly monitor and adjust their strategies accordingly to minimize potential losses.

Another disadvantage of Forex Algo Plus EA is that it relies heavily on historical data analysis. While this approach has been proven effective in predicting future market movements, there will always be unforeseen events that cannot be accounted for by past data alone. Therefore, traders should exercise caution when relying solely on automated systems and use them to complement their research and analysis.

The high initial investment required

Susceptible to market volatility

Heavy reliance on historical data analysis

In summary, while Forex Algo Plus EA offers many benefits, such as increased efficiency and accuracy in trading decisions, traders should also consider its potential drawbacks, such as high initial costs, susceptibility to market fluctuations, and over-reliance on historical data analysis. Traders must weigh the pros and cons before implementing this software into their trading strategy.

Algo Plus Ea Pricing

Algo Plus EA is a reliable and efficient forex trading robot designed to help traders maximize their profits.

The pricing of the Algo Plus EA varies depending on the package the user chooses. Three packages are available for purchase: Basic, Standard, and Premium.

The Basic package costs $149 and includes one actual account license with unlimited demo accounts, lifetime updates, 24/7 support, and access to all currency pairs.

The Standard package costs $199 and includes two actual account licenses with unlimited demo accounts, lifetime updates, 24/7 support, access to all currency pairs, and an additional feature called “advanced risk management.”

Finally, the Premium package costs $299. It includes five actual account licenses with unlimited demo accounts, lifetime updates, 24/7 support, access to all currency pairs, an advanced risk management option, and another unique feature called “high-frequency trading.”

This feature allows traders to make several trades within seconds using algorithmic tools. Choosing any of these packages will provide users access to exceptional automated trading capabilities at reasonable prices.

Frequently Asked Questions

What Is The Recommended Minimum Account Balance For Using Forex Algo Plus Ea?

When considering the recommended minimum account balance for forex trading, it is essential to consider several factors such as leverage, risk management strategies and the type of trading platform used.

Generally speaking, a higher account balance gives traders more flexibility in position sizing and allows them to manage their risk exposure better. However, it is essential to note that there is no one-size-fits-all answer when determining an appropriate account size for trading.

Traders should carefully evaluate their financial situation and goals before deciding on minimum account size. It is also crucial to keep abreast of market developments and continually reassess one’s trading strategy to ensure continued success in the forex market.

Does The Ea Have A Feature For Automatically Adjusting Lot Sizes Based On Account Balance?

The EA provides an automated trading system for the foreign exchange market.

One of its key features is adjusting lot sizes based on account balance, which can help reduce risk and improve performance.

With this feature, traders can ensure that their trades are appropriately sized relative to their available capital, allowing them to stay within predetermined risk parameters while taking advantage of potential profit opportunities.

Additionally, this feature may be handy for novice traders unfamiliar with how lot sizing works or how to manage their risk effectively.

The automatic adjustment of lot sizes based on the account balance is a valuable tool that helps make forex trading more accessible and less risky for traders of all skill levels.

Are There Any Recommended Brokers Or Trading Platforms For Using The Algo Plus Ea?

When considering which broker or trading platform to use for forex trading, there are several factors that traders should take into account.

These may include the quality of execution, pricing the broker offers, and additional features, such as educational resources or research tools.

Some popular brokers in this space include MetaTrader 4, Interactive Brokers, and FXCM.

However, it is essential to note that different traders may have different preferences regarding these factors, so it is ultimately up to each trader to determine which option best suits their needs and trading style.

Can The Algo Plus Ea Be Used For Trading Cryptocurrencies Or Other Asset Classes?

The question of whether the Algo Plus EA can be used for trading cryptocurrencies or other asset classes is common among traders.

While this software was developed specifically for forex trading, it may also have applications in other markets.

However, it is essential to note that different asset classes have unique characteristics and require specific strategies and algorithms to trade successfully.

Therefore, before using the Algo Plus EA or any other automated trading system for non-forex assets, traders should thoroughly research and test its effectiveness in those markets.

Additionally, they should ensure they are working with a broker or trading platform supporting such trades.

Is There A Refund Policy In Case The Algo Plus Ea Does Not Perform As Expected?

A refund policy is an essential aspect of any product or service, and it provides customers with a safety net in case they are not satisfied with their purchase.

In the financial industry, where trading involves significant risks, having a reliable refund policy can help traders feel more confident about investing in products such as forex robots and expert advisors.

Therefore, it is imperative to inquire about the existence of a refund policy before purchasing any automated trading software.

A good refund policy should be clear and concise, outlining the conditions that must be met for a customer to receive a refund. Additionally, it should provide adequate time for testing and evaluating the product’s performance before making a final decision.

Ultimately, having a robust refund policy is a sign of transparency and accountability from the vendor’s side towards its clients.

Conclusion

Forex Algo Plus EA is a powerful trading tool that requires a minimum account balance of $500.

This expert advisor has an automatic lot sizing feature which adjusts the trade volume based on your account balance. It also comes with in-built risk management tools to help you minimize losses and increase profits.

While there are no specific recommendations for brokers or platforms, Forex Algo Plus EA can be used with any reputable platform that supports MetaTrader 4 or 5.

The program is primarily designed for forex trading but can also be used for other asset classes, including cryptocurrencies.

In conclusion, Forex Algo Plus EA is an effective trading solution for both novice and experienced traders. However, it’s important to note that past performance does not guarantee future results.

If you’re unsatisfied with the product, the company offers a refund policy if it meets its terms and conditions. Overall, this algorithmic trading system provides users numerous benefits, such as automation and reduced emotional decision-making, while minimizing risks associated with forex trading.